Asia week ahead: Central banks frenzy

Asian central bank meetings dominate the agenda next week, and while all four are likely to pass without any policy changes, we'll be looking for clues if Asia’s aggressive duo in 2018 – Indonesia and the Philippines – continue to defy easing over currency stability

Four central bank meetings, but only two matter

Asian central banks in Indonesia, Philippines, Taiwan, and Thailand all have monetary policy meetings next week.

We think the market is interested in what Indonesia and the Philippines central bank's will do and look for any signs of easing after their aggressive policy hikes in 2018. The inflation argument for easing is getting stronger in both countries, and the argument for currency stability doesn’t seem to hold much ground anymore in an increasingly dovish G3 central bank environment. But the key resistance to currency appreciation in these countries is the wide current account deficit. We think the central banks will look over the inflation data and remain on hold next week.

In Taiwan, the central bank has been on hold since the last rate cut to 1.375% in June 2016. We don’t think it will do anything this year despite falling exports dragging GDP growth lower in the recent quarter. The trend is likely to continue ahead while inflation is almost non-existent. And given that the Bank of Thailand tightened policy in December, it has been flagging a stable policy ahead even though economic data has shown increased downside growth risk. But look out for February export figures from Taiwan and Thailand next week.

Malaysia’s central bank likely to get ahead of the curve

Malaysia's consumer price data for February will be interesting to watch after the deflation surprise in January, which we believe was largely a transitory phenomenon due to administrative cut in fuel prices. Factors underlying our forecast of 0.5% year-on-year inflation, which is a reversal from -0.7% in January, are the Lunar New Year-related rise in the food component and narrowing negatives in the fuel-related transport component.

We don’t think inflation will be a policy problem for the central bank in 2019, as risks remain tilted toward growth. Nor are there any strong arguments for central bank policy easing just yet, but a pre-emptive move to support growth won’t hurt when there is room. We see the central bank moving to cut rates at the next meeting in early May 2019 - a shift from our previous forecast of no change in 2019.

Singapore NODX data will help shape central bank

In Singapore, the non-oil domestic exports is the critical data release for next week, signalling the possible course the central bank could take at the next semi-annual meeting in April. 2019 started with weak export and manufacturing performance, and both indicators posted sharp year-on-year declines in January. The Lunar New Year effect is likely to have sustained the weakness in February and if so; quarterly GDP growth is poised to slow further in 1Q19 from 1.9% YoY in 4Q18 - which was already the slowest in two years.

Having tightened policy twice in 2018, a stable Monetary Authority of Singapore policy in April seems to be the safest forecast for now. But we're not ruling out the central bank joining the potential easing bandwagon led by G3 central banks just yet.

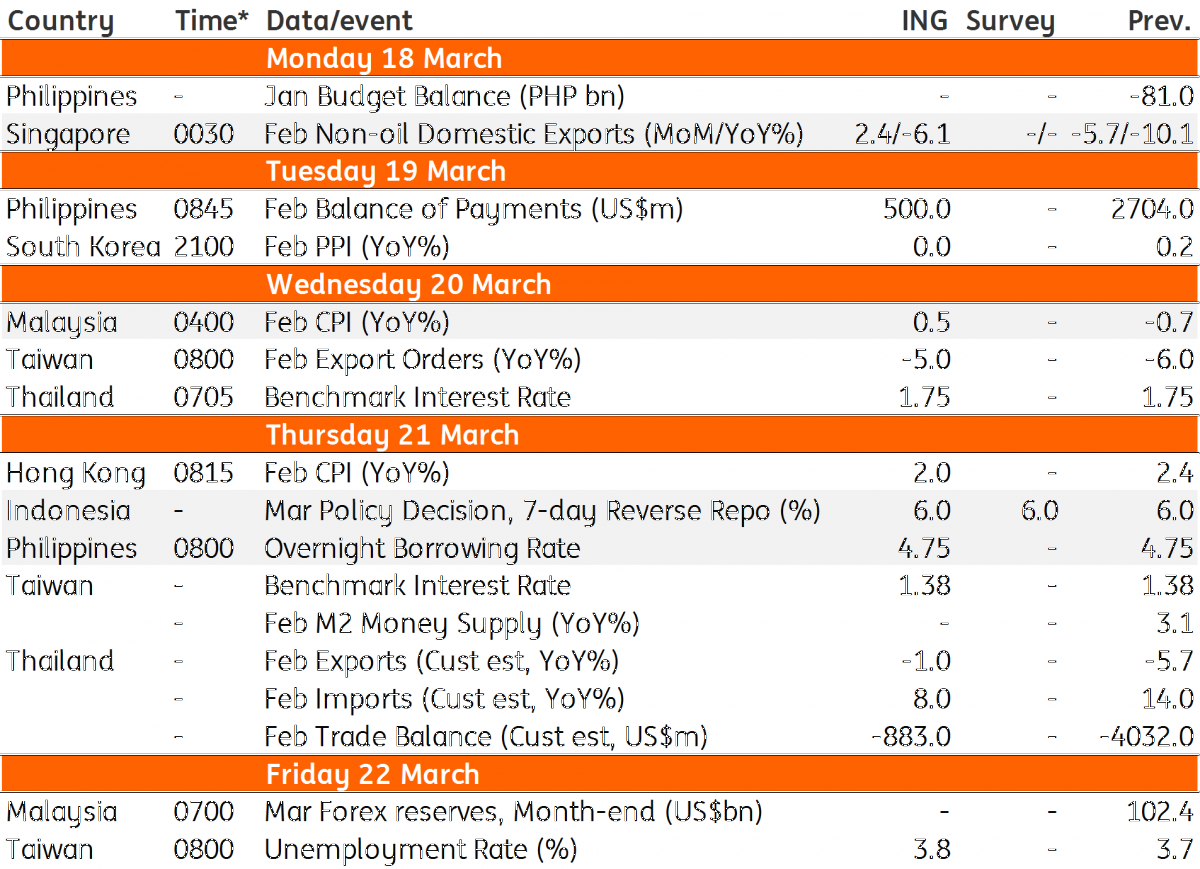

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Asia week aheadDownload

Download article

14 March 2019

Our view on next week’s key events This bundle contains 3 Articles