Asia week ahead: Busy week for central banks

In the coming week, several central banks will meet to discuss policy with inflation in the spotlight

The week ahead: Central bank super Thursday

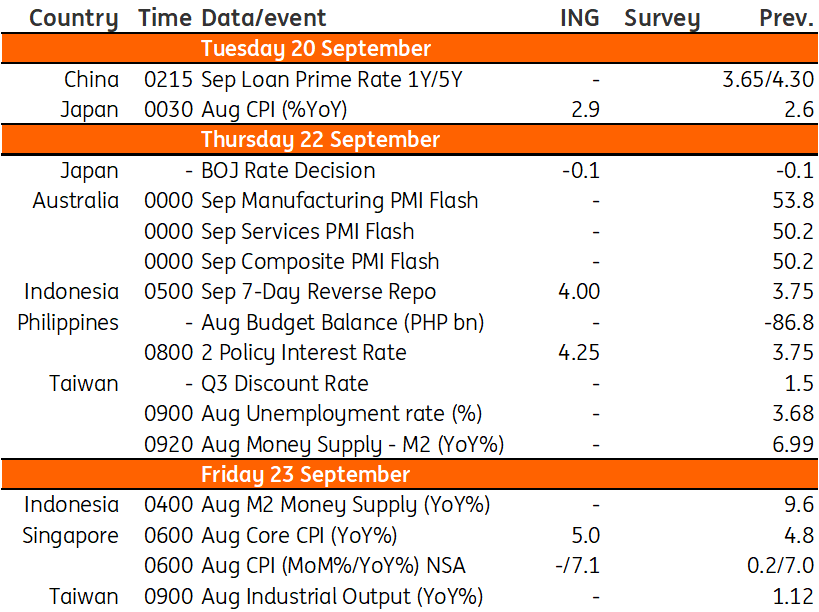

It’s a busy week for central banks next week. The Bank of Japan (BoJ) will meet to possibly discuss currency intervention measures, while the Reserve Bank of Australia (RBA) releases minutes from its meeting in September. Meanwhile, the central banks of the Philippines and Indonesia will meet on Thursday to discuss rate hikes in order to slow above-target inflation.

The BoJ meeting

The BoJ will meet on 22 September and this meeting will likely be the highlight of the week. Given recent warnings about FX movements, markets will be looking for clues as to how the BoJ will respond to volatile currency movements and how it will justify its ultra-low policy to support the country’s economy.

RBA meeting minutes

The RBA will release its minutes from the September meeting. The meeting should have provided more clarity on the pace of tightening from here on, given the recent speech from Governor Philip Lowe that seemed to suggest some slowdown was imminent.

Philippines and Indonesia policy meetings

Bangko Sentral ng Pilipinas (BSP) meets on Thursday to determine policy. We expect BSP to hike by 50bp in a bid to slow inflation which has moved past the target. The central bank will likely retain its hawkish tone and signal additional rate hikes for the rest of the year with inflation still expected to breach the BSP’s inflation target for the year.

Bank Indonesia (BI) surprised markets with a rate hike at its August meeting and we can’t rule out another surprise next week. We expect BI to hike 50bp when it meets on Thursday. Headline inflation has just recently moved past the central bank’s target and we can expect this trend to continue after its fuel price hike. BI Governor Perry Warjiyo, however, did rule out “jumbo-sized” rate hikes, possibly referring to the 75bp rate hikes carried out by the Fed.

Inflation out from Japan and Singapore

August inflation is set for release on Friday and we expect inflation to heat up to 7.2% year-on-year driven by both demand and supply-side factors. More importantly, core inflation, the measure of price gains more closely monitored by the Monetary Authority of Singapore (MAS), could move past 5% YoY and prod further tightening by the central bank in October.

Meanwhile, we expect the August CPI inflation in Japan to rise further to near 3% YoY given the low base last year. The monthly gain should slow as import prices and producer prices fell recently mainly due to the decline in global energy prices.

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

15 September 2022

Our view on next week’s key events This bundle contains 3 Articles