Asia week ahead: Bank of Korea policy standoff

The Korean central bank policy meeting will be a non-event. China’s August PMI will reflect the first full month of the trade war impact, while India looks poised to post a GDP slowdown

China: PMI to reflect full-month of trade war impact

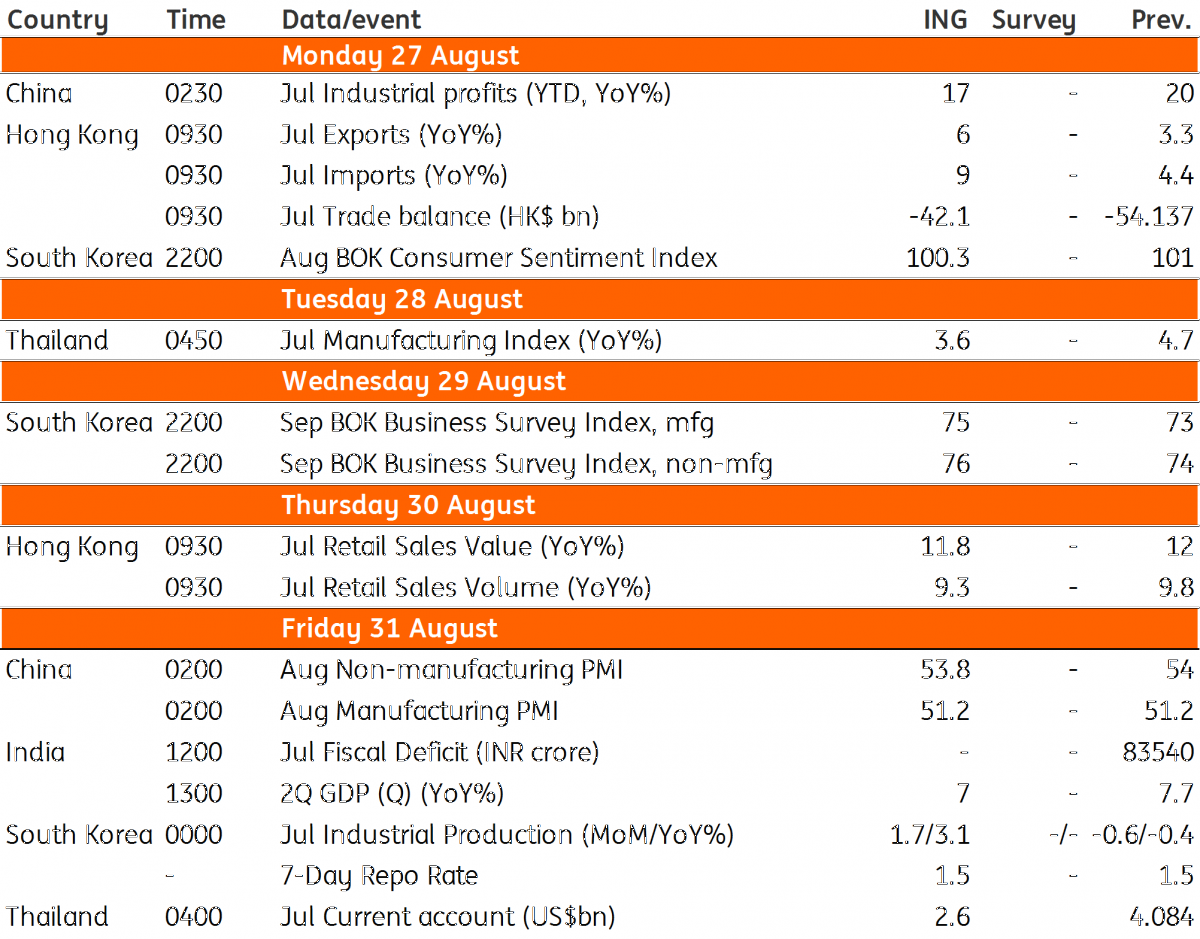

The ongoing trade war with the US has put China’s high-frequency activity data under an intense spotlight. Next week's data includes industrial profits for July and the manufacturing and non-manufacturing Purchasing Managers Indexes (PMIs) for August.

The manufacturing PMI for August will reflect the first full month of the US-China trade war impact. The consensus is centred on our 51.2 forecast, unchanged from July, but the risk is tilted on the downside rather than upside.

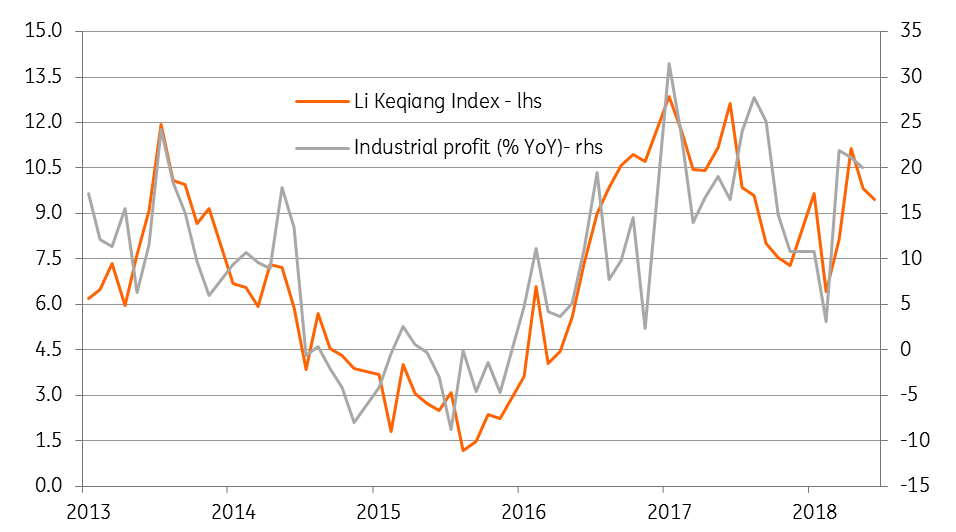

Consistent with the Chinese stock market sell-off underway since the start of the year, industrial profit growth has slowed to 17.2% year-on-year in the first half of the year from 22% a year ago. This closely tracks the Li Keqiang index (the composite index of year-on-year activity growth, including growth in outstanding bank lending- Premier Li’s preferred gauge of the economy) which shows the slowdown continued in July (see figure).

Li Keqiang Index points to slower profits growth

Korea: A big week ahead, though nothing exciting

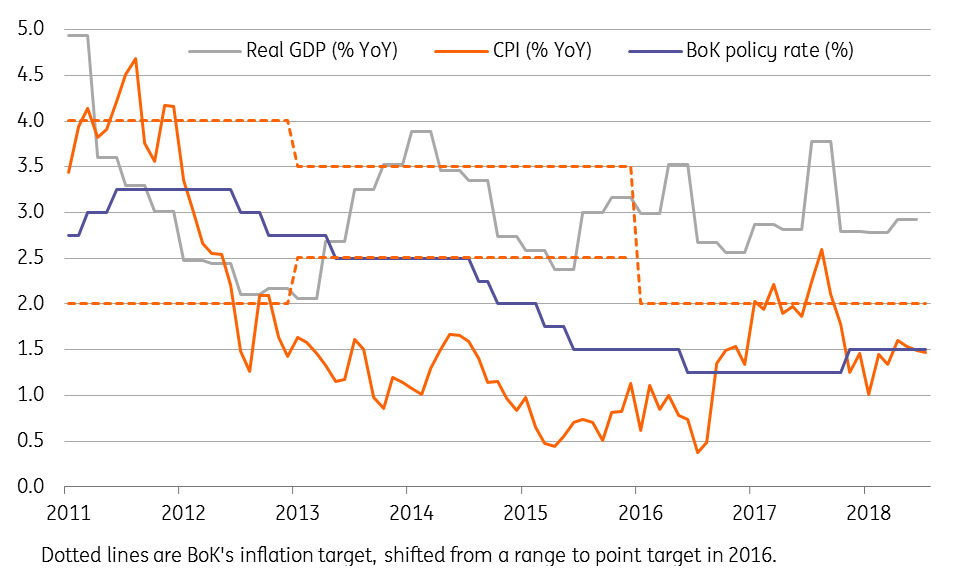

After the usual end-of-month Korean activity data, the central bank (Bank of Korea) will hold its monetary policy meeting on Friday, 31 August. We aren’t forecasting the BoK to change policy next week. Korea’s GDP growth has been stuck under 3% for the last three quarters, and new job creation dipped to an eight-year low in July. A further escalation of the US-China trade tension also reduces the potential for any export-led growth recovery in the period ahead. We expect these risks to manifest in the activity data in coming months. With below-target inflation right now, the argument for the BoK to maintain its accommodative policy stance for the rest of the year remains strong (see figure).

Among the slew of activity releases next week, the forward-looking BoK Consumer and Business confidence indexes and July industrial production data for July will be under scrutiny for clues about the economy’s performance in the current quarter.

No pressure on BoK to change policy

India: A slowdown in GDP growth

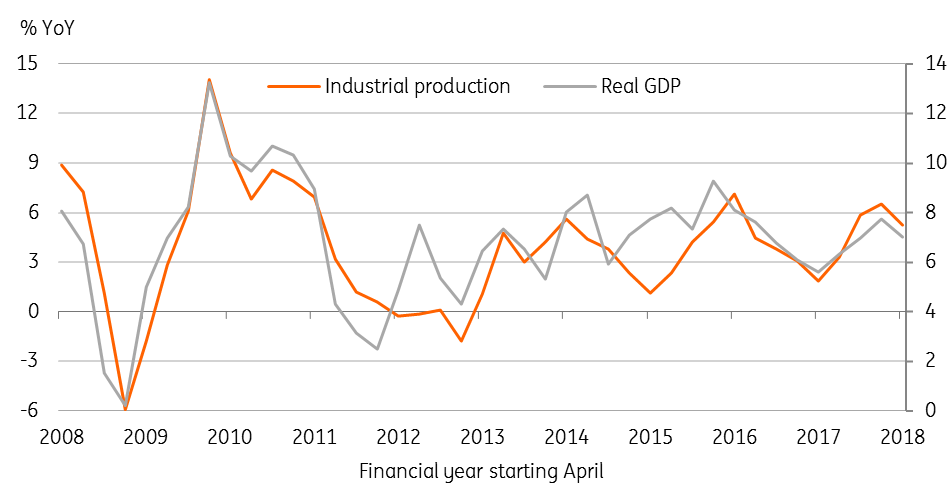

India’s GDP data for 1Q FY2018-19 (April-Jun quarter of 2018) is due. Underlying our projected slowdown in GDP growth is a slowdown in manufacturing (see figure). Export growth accelerated in the last quarter, though exports account for a small share of GDP (average 13% in the last five years). With an oil-led surge in imports and widening trade deficit, net exports have acted as a drag on GDP growth. We forecast a GDP slowdown to 7% YoY in 1Q from 7.7% in the previous quarter, not a good start to the year, the rest of which will remain exposed to greater global economic uncertainty and rising domestic political risk.

Manufacturing leads GDP slowdown

Asia Economic Calendar

Download

Download article

22 August 2018

Our view on next week’s key events This bundle contains 3 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).