Asia week ahead: Bank of Japan’s first meeting with new governor

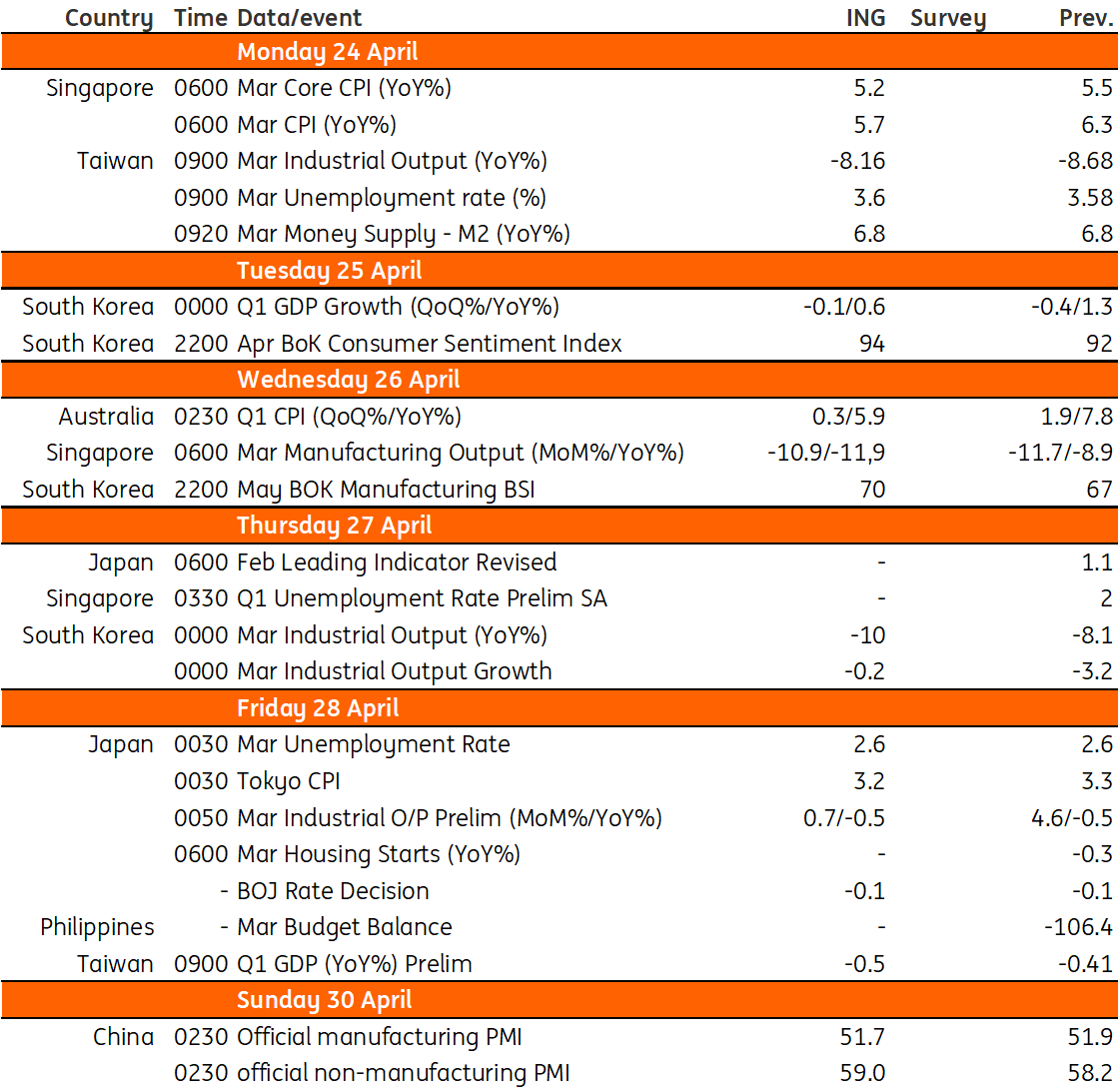

Next week’s data calendar features activity figures from Korea, inflation from Japan, Singapore and Australia, job and growth data from Taiwan plus PMI data from China. Japan's central bank will also meet for the first time under new governor Kazuo Ueda

Inflationary pressures expected to ease in Australia

March inflation will probably fall substantially on base effects alone, as last March witnessed a 1.1%MoM increase following Russia’s invasion of Ukraine and the resulting spike in energy and agriculture prices. But we may also have some additional help from volatile food prices, which rose 1.0%MoM in February, but will probably ease back to something closer to 0.3 to 0.4% in March. Some additional decline in alcohol and tobacco prices may provide a further push down, and offset slightly higher gasoline prices for the month, resulting in a total CPI index increase of 0.3%MoM, and 5.9%YoY, down from 6.8% in February. This should be enough to at least put the Reserve Bank of Australia on hold at the April meeting. And may be enough to draw a line under this entire rate tightening cycle.

Weak semiconductor demand could hinder Korea’s economy

We expect 1Q23 GDP to post a mild contraction of -0.1%QoQ sa (vs -0.4% in 4Q22) mainly due to sluggish exports and investment. Weak global demand for semiconductors is a major reason behind this development. However, private consumption and construction are expected to hold up relatively well despite higher borrowing costs and a sharp decline in real estate, while inventory also to contribute positively to growth.

We believe March industrial production will contract again as we expect that chipmakers cut production further in March to unload inventory. Meanwhile, the increase in auto sector activity should partially offset the overall decline.

Meanwhile, sentiment survey data is expected to improve as the Bank of Korea maintained its policy rates and the market rates have fallen gently. Also, China’s reopening and financial market jitters triggered by banking sector calmed down, which probably helped to boost consumer and business sentiment.

Ueda’s first meeting as BoJ governor

The Bank of Japan (BoJ) will hold its monetary policy meeting on 27th and 28th, the first time under Governor Kazuo Ueda, amid speculation about the timing of the monetary policy adjustment. We believe that the BoJ will opt to keep all settings untouched shortly after the banking sector jitters in the US and Europe. Yet, it is still worth watching how the new Governor will shape his views on monetary policy and macroeconomic conditions. Also, the BoJ will release its latest macro-outlook report on that day. They key takeaway will be the inflation forecasts and whether the BoJ sees inflation undershooting its 2% target in near future, which will give us more hints to the BoJ’s reaction to the CPI in coming meetings.

Other than that, Tokyo CPI inflation is expected to cool down further in April while the labour market conditions are expected to remain solid mainly led by service sector. March industrial production is expected to slow on back of the weak global demand on IT products.

Gloomy economic outlook for Taiwan

Taiwan will release its first quarter GDP report next Friday, and we expect a mild contraction of 0.5%YoY from 0.41%YoY contraction in 4Q22. This would mean that Taiwan will fall into a recession by 1Q. The dip in semiconductor demand has hurt economy in terms of production and exports. We will wait to see negative impact on industrial production in March and we expect another contraction of around 8%YoY in March after an 8.7% contraction in February. The unemployment rate should therefore edge up to 3.6% in March from 3.58% in February. All these point to a gloomy outlook for Taiwan. However, there is a low base effect by the second quarter, which should help GDP growth turn positive again. This technical rebound may not imply improvements in global demand for semiconductors as the US economy is slowing.

Upcoming PMI data from China

China will release official manufacturing and non-manufacturing PMIs on 29th April (Sunday). We expect services should grow faster than manufacturing activities as there was a short holiday in April, and tourism-related activities increased. Meanwhile, manufacturing activities could grow slightly slower in April due to the short month.

Inflation to trend lower in Singapore

Singapore reports March inflation next week and we expect both headline and core inflation to moderate from the previous month. Headline inflation could settle at 5.7%YoY from 6.3% while core inflation could dip to 5.2% from 5.5%. Slowing inflation could be one of the reasons why the Monetary Authority of Singapore (MAS) opted to retain policy settings last week after growth disappointed. We can expect inflation to grind lower in the coming months but given that it remains well-above the central bank’s target, the MAS may be limited in its ability to ease settings to help support sagging growth momentum.

Key events in Asia next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

20 April 2023

Our view on next week’s key events This bundle contains 3 Articles