Asia week ahead: Bank Indonesia to pause tightening

Manufacturing, trade, inflation and GDP releases dominate the Asian economic calendar in the coming week, though an Indonesian central bank policy meeting is likely to capture the most attention

Bank Indonesia to pause tightening

The Indonesian central bank, Bank Indonesia (BI), announces the outcome of its monetary policy meeting on Tuesday (23 October). We believe it’s time for BI to pause the tightening started in May this year, and subsequently intensified amidst the emerging market currency contagion that saw the Indonesia rupiah (IDR) plunge in value. As part of its currency stabilisation drive, BI lifted the policy rate by a total 150 basis points to 5.75% through to September.

With well-behaved inflation, dipping below 3% year-on-year in September for the first time in over two years, monetary policy remains geared towards stabilising the Indonesian rupiah. And the USD/IDR appears to have traded tightly around 15,200 this month after an early October spike. Recent economic reports-, such as the trade balance swinging back to surplus in September and a lower-than-expected government budget deficit this year, are contributing to improve investor sentiment towards the currency. We believe this has taken pressure off the central bank to hike rates at the forthcoming policy meeting.

| 5.75% |

BI policy rateNo change expected |

Fine-tuning of GDP growth estimates

September manufacturing data releases from Taiwan and Singapore will help to fine-tune estimates of GDP growth for these economies, while Korea will report actual GDP data for the third quarter.

Underlying our estimate of 2.1% year-on-year growth in Korea’s GDP in 3Q, which is close to the low end of analysts’ estimates ranging from 2% to 2.7% in the latest Bloomberg poll, is a sustained slowdown in export growth. September’s 8.2% YoY fall in exports was the worst showing in over two years although partly coming off a high base, as growth peaked at 35% in the same month a year ago. As it left monetary policy on hold this week, the Bank of Korea also downgraded its outlook for growth this year and next, the second downgrade this year.

We don’t think it’s just Korea. Asia’s other export-reliant economies Taiwan and Singapore are also exposed to a growth slowdown amid lingering US-China trade tensions. Singapore’s weaker-than-expected non-oil domestic exports in September are likely to have depressed manufacturing, raising the risk of a downward revision to the 3Q advance GDP growth estimate of 2.6%, which in itself was a sharp slowdown from 4.1% growth in 2Q.

And being on the frontline of the US-China trade conflict, Taiwan’s exports have already started to take a beating, keeping both manufacturing and GDP growth in the low single-digits. Look out for Taiwan’s export orders data for September; orders' growth has been firm but it failed to translate into actual shipments.

Asian export performance in last two quarters

Sustained low inflation in most of Asia

Of the two countries to report September inflation data in the coming week, Malaysia and Singapore, we consider Malaysia’s to be the more closely-watched report. This is not because of any alarming outcome but because of the re-introduction of the Sales and Services Tax (SST) from 1 September. Replacing the Goods and Services Tax (GST), which was scrapped in June this year, we anticipate the SST impact on consumer prices to be benign, keeping inflation well under 1%. With persistently low inflation through most of 2019, the central bank (BNM) will be under no pressure to change policy next year.

Similar to Malaysia, Singapore continues to enjoy the lowest inflation among the Asian economies. We expect headline inflation to tick up to 0.8% YoY in September from 0.7% in the previous month but no change in the core inflation rate from 1.9%. The central bank’s (MAS) semi-annual Macroeconomic Policy review will provide insight into its thinking behind the recent tightening via a slight increase in the slope of the SGD-NEER policy band.

Apart from India and the Philippines, inflation in most other Asian countries has been subdued. This is despite higher global oil prices and weaker Asian currencies this year.

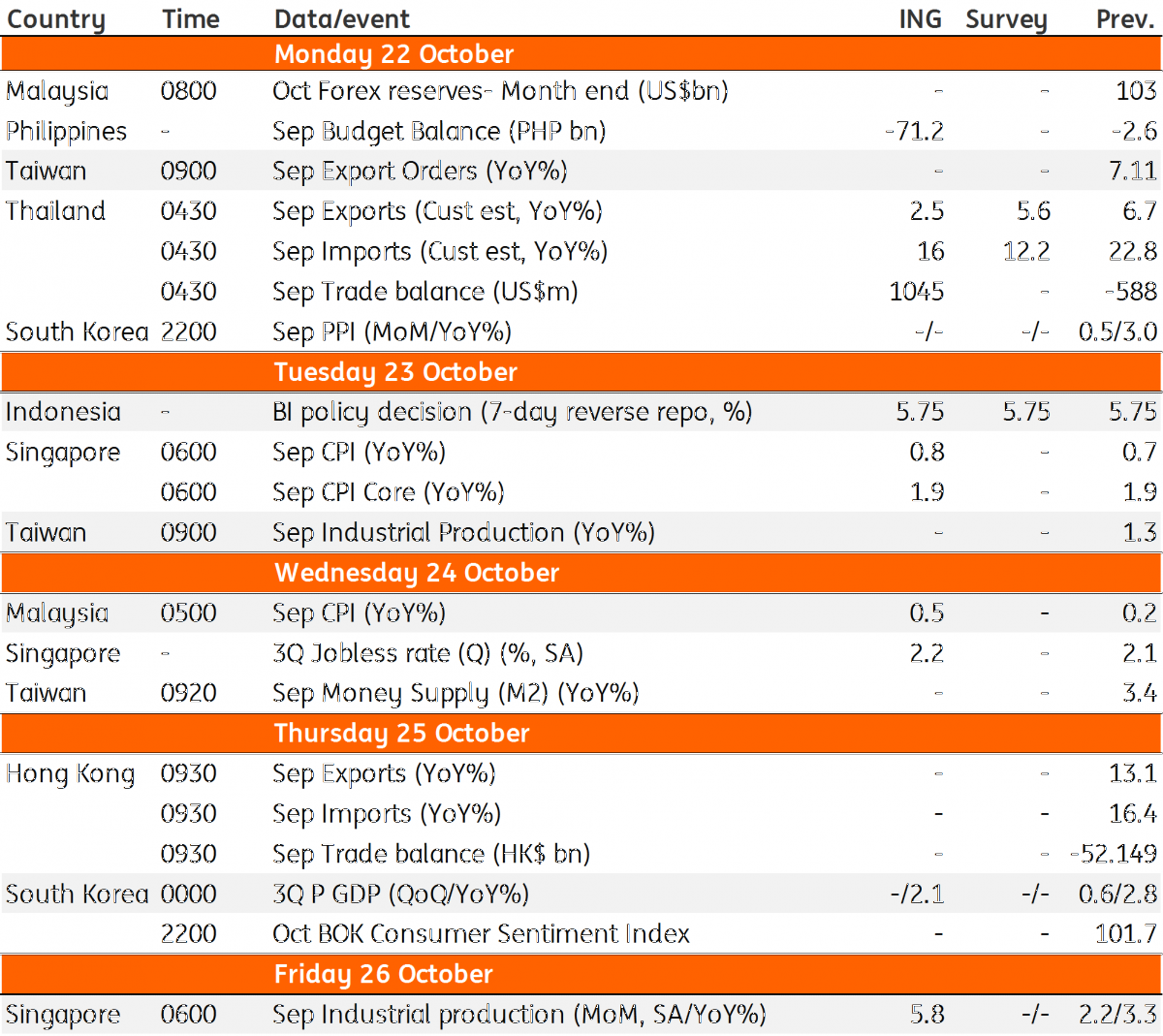

Asia Economic Calendar

Download

Download article19 October 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).