Asia week ahead: Australian and Indian central bank meetings

As two central bank meetings are likely to pass as non-events, the markets will be left to ponder a flood of economic activity data from around the region

Central bank meetings

The Reserve Bank of Australia (RBA) reviews policy next week, Tuesday, 1 December. The central bank is missing important data though on which to base its policy decision – the country’s 3Q20 GDP figure which will be out just a day later than the policy meeting. Whatever the 3Q GDP outcome (ING forecasts +2.5% quarter-on-quarter vs. -7% in 2Q), it’s still history and doesn't reflect current trends. And, having cut the Cash Rate by 15 basis points to 0.10% at the November meeting, it’s hard to see the RBA moving the policy rate again in less than a month. Reinforcing this view further is the latest labour report for October with a 179,000-strong surge in employment, hinting at a faster economic recovery in the current quarter.

The Reserve Bank of India (RBI) meets on Friday, 4 December. The persistently weak growth and accelerating inflation dynamics have put this central bank in a jam, in our view. As covered in this space a week ago, India’s 3Q GDP data out this Friday (27 November) will underscore the need for more policy support (ING’s 3Q GDP forecast is -12% YoY). But the counter-argument is still-high CPI inflation. Inflation has stayed above the RBI’s 6% policy limit in all but one month in the year through October (7.6% in October). As these divergent growth-inflation trends are likely to be stretched well into 2021, stable RBI rate policy throughout the next year seems to be the safest wager for now.

Busy data pipeline

A typical market focus around the turn of the month is the Purchasing Manager Indices. China’s PMIs are more market-sensitive than most other countries’. So, we will have November China PMI releases on Monday setting the tone for regional and global markets.

We think the recent pattern of services outperforming manufacturing activity in China was intact in November as weak global demand due to the second Covid-19 outbreak weighed on exports. Korea's November trade figures, the first in the region for this month, will bring more information about global demand, especially the electronics cycle, given some signs of tapering in the electronics upcycle lately.

Meanwhile, Korea and Japan’s October manufacturing data will shape expectations for their GDP performance in the fourth quarter. And the October retail sales from Hong Kong and Singapore, together with a raft of November CPI inflation releases elsewhere, will inform about the private consumption recovery. The downside risk to regional economies has increased, however, with the recent surge in Covid-19 cases around the globe.

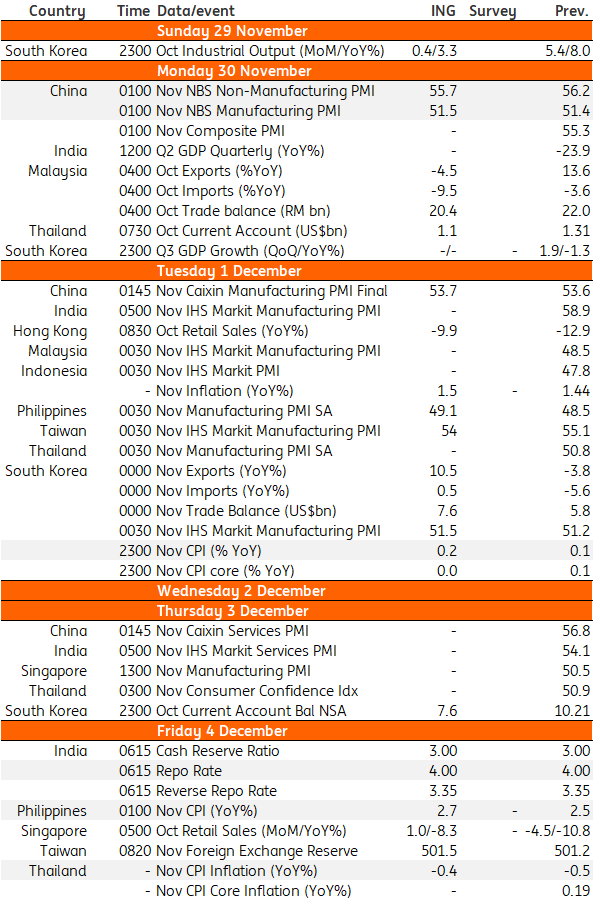

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

26 November 2020

Our view on next week’s key events This bundle contains 3 Articles