Asia week ahead: Will Thailand tighten?

Central bank meetings and trade data dominate the calendar next week. But the key question is whether Thailand’s central bank tightens policy again

An interesting Thai central bank meeting

Central banks in Japan, Taiwan, Indonesia, and Thailand hold their monetary policy meetings. While the first three are widely expected to leave policies unchanged, the odds of the Thai central bank seem to be balanced between staying on hold and a 25 basis point hike next week.

Thailand’s economy doesn't need higher interest rates, but the central bank may want to create some policy cushion for the economy if growth takes a further hit. Still, we believe the Bank of Thailand has missed the boat. Growth has already started to slow down and inflation has dipped below 1% - not really the right time to change policy.

Elsewhere, consolidation of the Indonesian rupiah in November after a heavy sell-off earlier in the year gives some stability to the central bank after a total of 175bp rate hikes since May this year. And there are no real economic grounds for Japan and Taiwan's central bank to change policies just yet, maybe not until we're in the new year.

Thailand: Balance of risks tilted towards growth

And lots of trade data

November trade releases from Japan, Indonesia, Singapore, and Thailand will be in focus for any trade war impact. The impact is becoming apparent, slowly but surely, as we've seen from weak November exports from northeast Asia including China, Korea, and Taiwan.

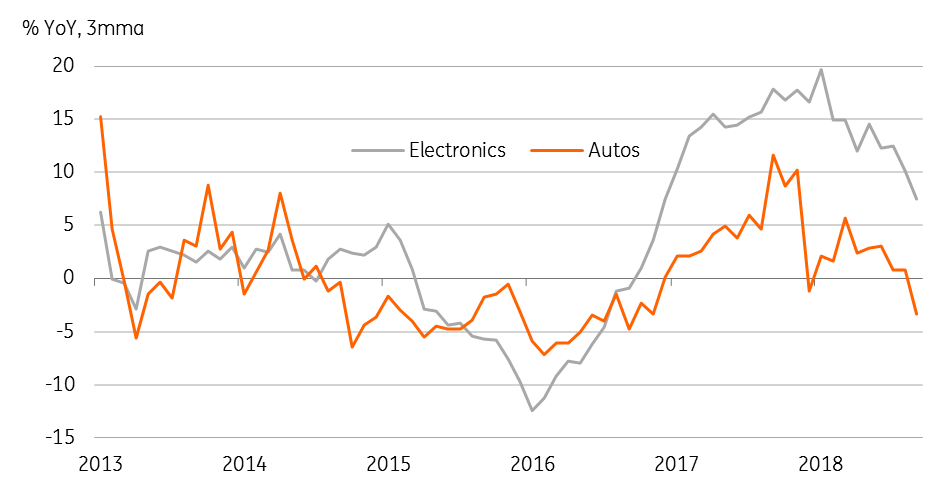

Besides the US-China trade war, a potential downturn in global electronics foreshadowed by the recent sell-off in electronic stocks also weighs on regional exports. Electronic exports from Korea are still growing on an annual basis, but those from Japan, Singapore, and Thailand have either been flat or declining. Not only electronics, but weak automobile demand has been an added drag on Japan’s and Thailand’s exports.

Indonesia’s persistent trade deficit remains the main negative for the rupiah. However, if materialised, the expectation of some narrowing of deficit to $1.6bn in November from $1.8bn in October should be some relief for the central bank.

Asia: Electronics and automobile exports are weakening

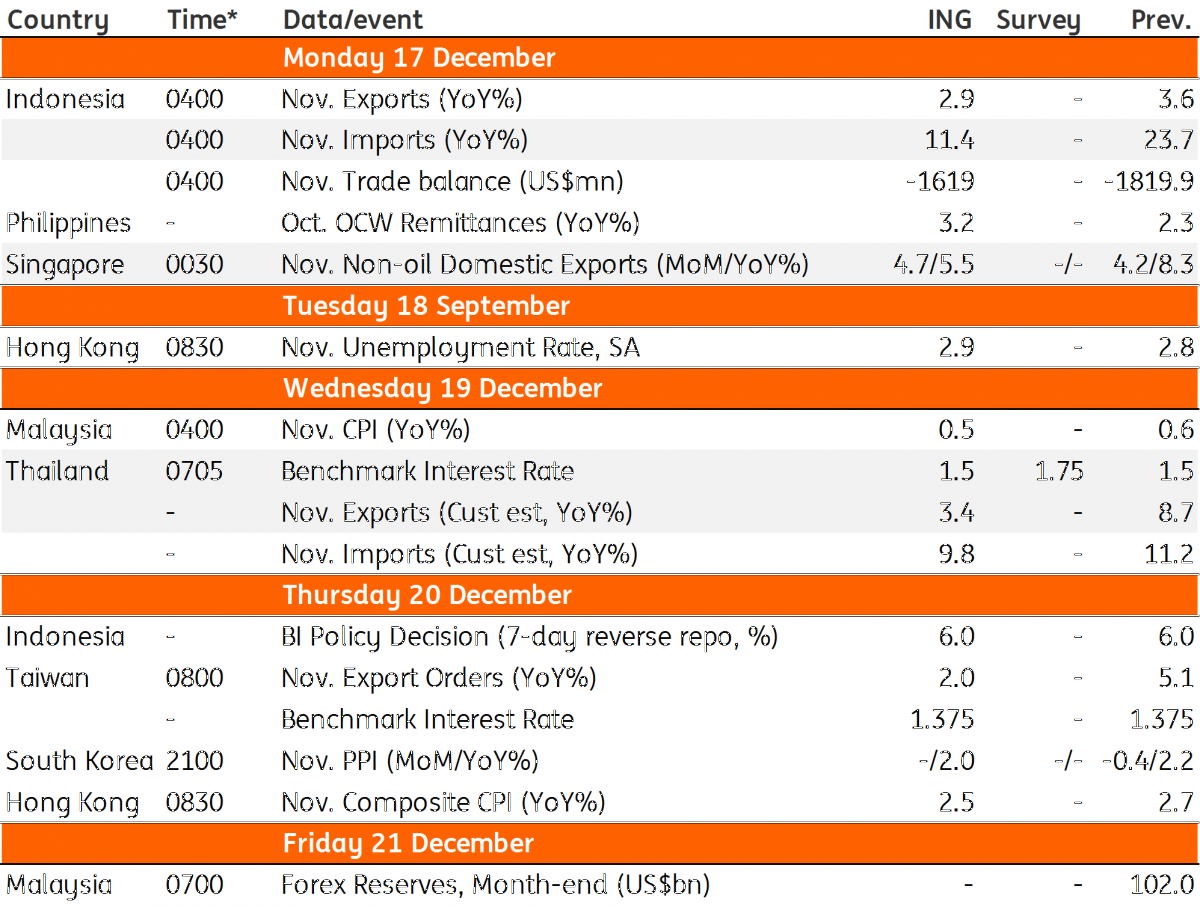

Asia Economic Calendar

Tags

Asia week aheadDownload

Download article

14 December 2018

Our view on next week’s key events This bundle contains 3 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).