Asia week ahead: A big week in China and India

The Asian calendar is packed with economic releases from China and India, which will make for an exciting week ahead. State legislative assembly elections in India and the central bank meeting in the Philippines should add to the fun

China: Will exports continue to downplay the trade war impact?

Since the outbreak of the trade war, China’s economic data has been under the spotlight for any noticeable impact as the protectionist sentiment increases.

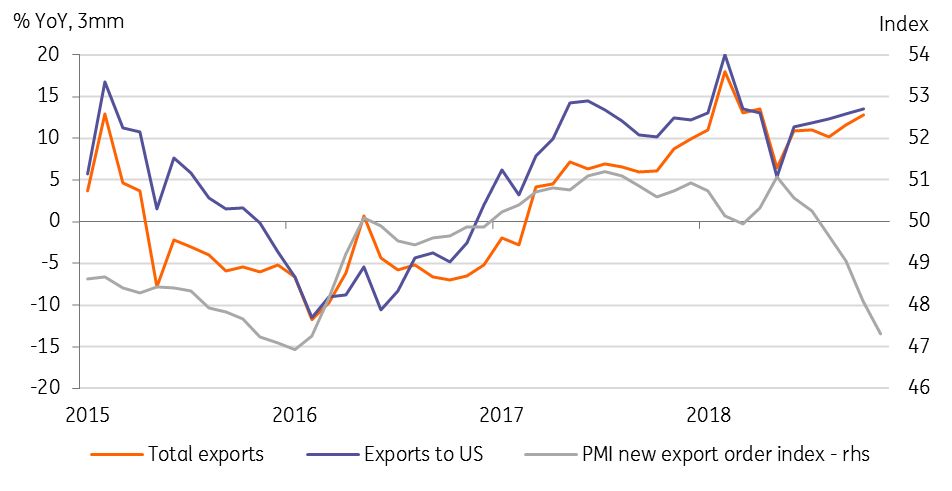

Next week, we'll get all the activity data for November starting with trade data over the weekend. The tariffs on more than half of China’s exports to the US went into effect in September, and so while overseas orders for Chinese goods have been shrinking since June, there has been no let-up in export shipments which have maintained their double-digit pace of growth throughout October, as the graph below shows.

The strength seen in recent months could be front-loading before higher tariffs strike at the beginning of 2019 as the consensus estimates 10% annual export growth, which will put monthly exports at an all-time high of $237 billion. Hopes remained pinned on the latest trade truce talks giving way to the so-called 'real deal' after the 90-day negotiation period ends. But all markets need now is more clarity on what exactly transpired at the Trump-Xi meeting at G-20 summit last week.

The rest of the China data including inflation, retail sales, fixed asset investment, industrial production, and bank lending should tell us about the effectiveness of domestic policies which have been trying to cushion the economy from the effect of the trade war.

Strong Chinese exports despite falling orders

Indian politics send the rupee in a tailspin, again?

The Indian market is braced for a spike in political uncertainty - at least that’s how we read this week’s spike in the rupee above the 71 level against the dollar, though higher oil prices might have helped.

Rajasthan, a key Indian state and a stronghold of Prime Minister Modi’s Bhartiya Janata Party (BJP), goes to the polls tomorrow (7 December). The results of this and four other state assembly elections (Chattisgarh, Madhya Pradesh, Mizoram – held by Congress, and Telangana held by a local party) will start flooding in from 11 December, the day vote counting for all these states begins. It’s widely expected to be a close race between the BJP and Congress - the main opposition party. The outcome will be a gauge for the general elections scheduled for May 2019, seems to be difficult to predict, especially in Rajasthan and Madhya Pradesh.

For now, the safe bet is that investors will stay clear of this market until political anxiety disappears, which is unlikely before mid-2019. The consolidation of the USD/INR exchange rate over the last month below the 70 level was short-lived, and the pair bounced back above 71 this week. Our year-end forecast of 71.5 remains on track, or rather subject to more upside risk. As things stand now, we remain confident about our view of the USD/INR re-testing the 73 level as political risk intensifies.

The politics will obviously overshadow economics as most of India’s monthly economic data comes through next week. Another forecast downgrade by the central bank this week has pushed back the inflation risk, at least for now and the coming quarters, which leaves exports and industrial production releases as guides to the country's GDP growth.

The longest rupee appreciation streak in two years has come to an end

Will the Philippines central bank pause policy tightening?

The Philippines’ central bank, meets next week but a surprisingly steep drop in inflation in November than expected, to 6.0% from 6.7% in the previous month vs a consensus of 6.3% was a relief for the Bank, and has prepared the stage for the central bank to leave the policy on hold.

However, the central bank meeting is unlikely to pass as a complete non-event as markets will be focused on the central bank’s assessment of inflation-growth risks for 2019, while the balance of risks remains tilted toward inflation considering current elevated inflation expectations and the second-round effects of the administrative hikes in transport and fuel.

Even so, we believe inflation has peaked, and so has the central rate hike cycle, which could even make the central bank ease the policy as early as the second quarter of 2019.

| 175bp |

BSP rate hikes since May 18Policy rate at 4.75% |

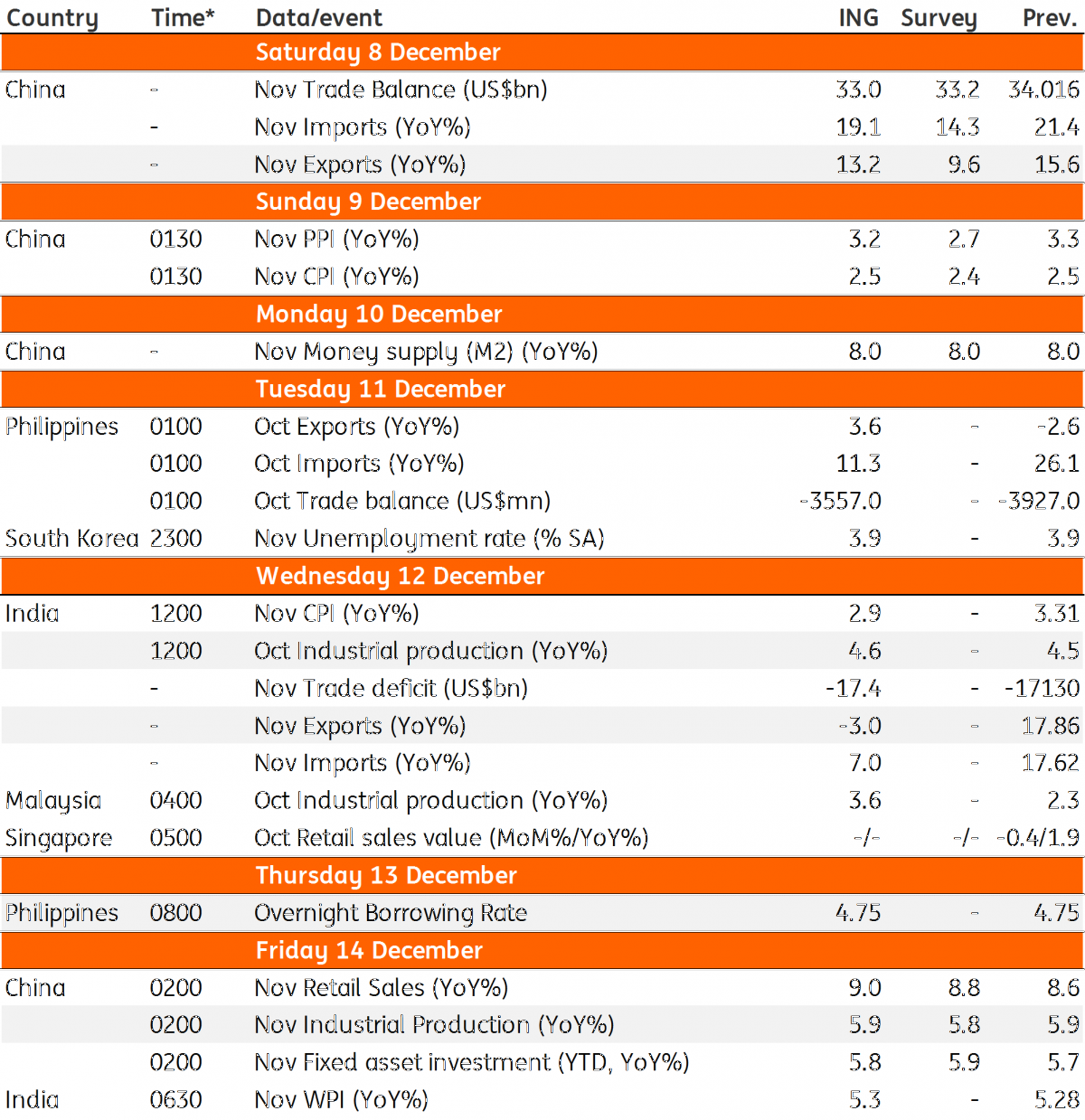

Asia Economic Calendar

Tags

AsiaDownload

Download article

6 December 2018

Our view on next week’s key events This bundle contains 3 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).