Asia week ahead: Spotlight on China

China’s Two Sessions will inform on the macro policy directive for 2018. Philippines inflation and a Malaysian central bank policy meeting are also highlights

China aims for qualitative growth

An annual rite of spring, China’s Two Sessions -- the Chinese People’s Political Consultative Conference (CPPCC) and the National People’s Congress (NPC) -- will be held on 3rd and 5th of March. Unlike last year’s GDP target of “around 6.5% growth for 2017”, Premier Li’s annual report to the NPC may not include a GDP growth target. Instead, the report is likely to focus on achieving qualitative growth through macro-prudential measures, corporate and financial sector reforms, greater technological advances in manufacturing and related investments, tighter environmental protection measures, rural developments, and Belt and Road projects.

The Two Sessions may also discuss taxation reform, especially central and local government splits of tax revenue. Although this may not yield a concrete result, we anticipate higher budget spending in 2018 directed toward President Xi’s objective of narrowing the urban-rural divide. As such, a higher budget deficit than the government’s 3% of GDP line in the sand in recent years shouldn’t come as a complete surprise. We also expect the authorities to announce a new central bank (PBoC) governor as Mr. Zhou is moving to another role. The new governor will be someone who shares Xi’s gradual reform approach on interest rate and exchange rate liberalisation.

China’s National Statistics Office releases economic data for February, including foreign reserves, trade, and consumer and producer price inflation. The combined January-February activity growth will be a good guide to GDP growth in the current quarter.

Philippines central bank calms markets before CPI data

Consumer price inflation for February will be closely watched in the Philippines. The release of January CPI data showing a bigger-than-expected spike to 4% year-on-year from 3.3% in the previous month unsettled the markets a month ago. The central bank (BSP) forecasts February inflation in a 4-4.8% range but it has attempted to calm the markets this time by signalling steady monetary policy in the near-term. We do not rule out a pre-emptive rate hike as early as March to stabilise inflation expectations.

| 4-4.8% |

BSP's inflation forecast for FebruaryYear-on-year |

Malaysian central bank keeps policy on hold

Malaysia's central bank (BNM) holds its monetary policy meeting on 7-Mar. BNM raised its policy rate by 25 basis points at the last meeting on 25-Jan, describing the move as a normalisation, not tightening, of monetary policy. Steady strong growth and slowing inflation support a baseline of a gradual policy normalisation. We do not expect a move at the forthcoming meeting, but retain our call of a 25bp hike in the third quarter of 2018.

| 3.25% |

BNM policy rate |

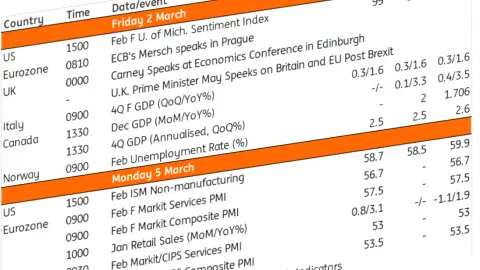

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 March 2018

Our view on next week’s key events This bundle contains 3 Articles