FXFX Talking

Asia FX Talking: Hard to find value just yet

Asian FX has held up quite well this year, with only modest losses for Indonesia, India and the Philippines. However, it's still too early to call the 'all-clear' on trade and the bloc can easily come under renewed pressure. We stick to the view that Chinese authorities want to hold the line in USD/CNY and won't trigger competitive devaluations in the region

Main ING Asia FX Forecasts

| USD/CNY | USD/KRW | USD/INR | ||||

| 1M | 7.31 | ↑ | 1475 | ↑ | 87.00 | ↓ |

| 3M | 7.32 | ↑ | 1500 | ↑ | 88.00 | ↑ |

| 6M | 7.33 | ↑ | 1450 | ↑ | 88.00 | ↑ |

| 12M | 7.39 | ↑ | 1425 | ↑ | 89.00 | ↑ |

USD/CNY: PBOC continues to hold the line as depreciation pressure mounts

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/CNY

7.2936

|

Neutral | 7.31 | 7.32 | 7.33 | 7.39 |

- The Lunar New Year limited trading days for the USD/CNY, but the CNY generally strengthened after Trump’s inauguration, with the USDCNY moving as low as 7.24 after highs of 7.33.

- Tariff developments were a major catalyst over the past month. China was the first country hit by tariffs but the scale has been manageable for markets for now. The PBOC reiterated its intention to maintain currency stability, assuaging fears of intentional devaluation.

- The Two Sessions in early March and upcoming China-US trade talks will be catalysts for the CNY in the near term. We hold our baseline call for a 7.00-7.40 2025 fluctuation band, with upside to 7.50 in a CNY bear scenario.

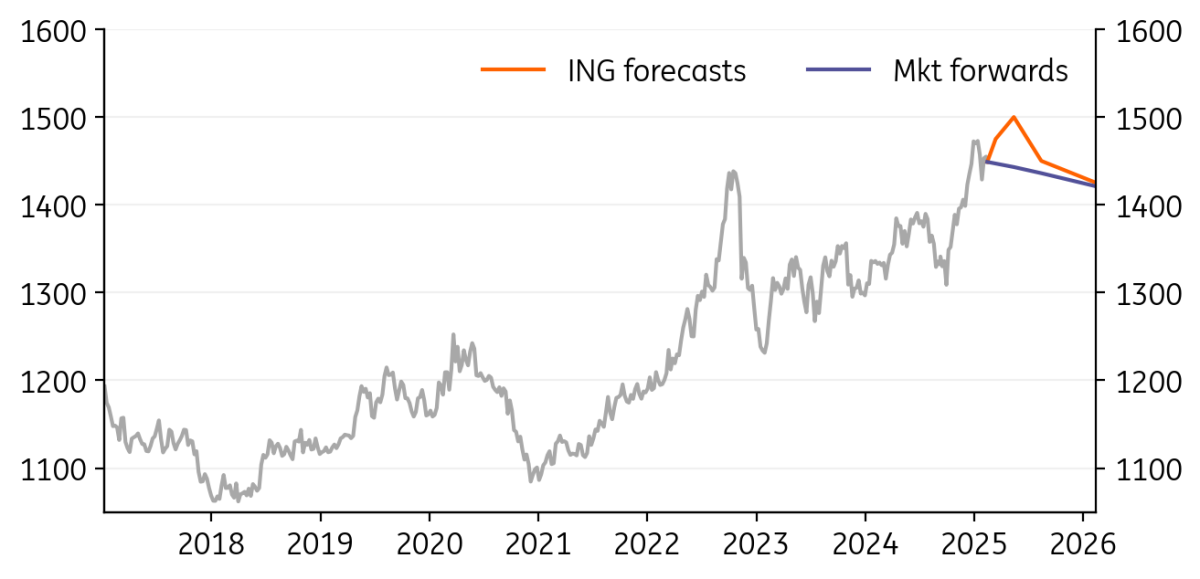

USD/KRW: Uncertainty over politics continue to pressure on KRW

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/KRW

1448.80

|

Mildly Bullish | 1475.00 | 1500.00 | 1450.00 | 1425.00 |

- The KRW is moving in sync with global dollar trends and Trump’s tariff announcement, and we expect significant volatility in the coming months.

- The excessive weakness of the KRW, triggered by domestic political uncertainty and the plane crash, prevented the BoK from cutting policy rates in January despite clear signs of slowing growth. But it is expected to resume easing in February, focusing on concerns about weak growth.

- Faster rate cuts by the BoK than the Fed, rising tariff concerns, and sluggish growth are likely to push up the KRW above 1.475 in the near term.

USD/INR: More downside pressure on INR in the near term

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/INR

86.88

|

Neutral | 87.00 | 88.00 | 88.00 | 89.00 |

- USD/INR continued to break higher last month and rose by about 0.3% in the month as the RBI allowed for more flexibility in the currency pair.

- The RBI embarked on the rate cut cycle and cut the Repo rate by 25bp last month, in line with our expectations. The RBI also lowered its GDP growth target for FY26. Growth moderation and overvaluation of REER as well as equity markets should mean INR trades with downside bias in the near term.

- The new RBI governor reiterated that the RBI aims to intervene to “maintain orderliness and stability, and without targeting any specific level or band”. We think that, given the strain RBI FX intervention had on domestic liquidity, interventions should slow and be used only to smooth out volatility.

USD/IDR: Weaker IDR given higher sensitivity to rate differential

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/IDR

16355.00

|

Neutral | 16500.00 | 16000.00 | 15500.00 | 15200.00 |

- IDR was the weakest Asian currency last month as the lower rate differential vs USD rates continued to exert downward pressure on the rate-sensitive IDR.

- Bank of Indonesia cut rates unexpectedly to support growth despite IDR being a currency that is overly sensitive to rate differentials and where FX considerations have a higher weight in the monetary policy reaction function compared to other countries. These moves suggested that BI might be getting more open to currency weakness to support growth

- USD strength is likely to be the dominant factor impacting the IDR in the near term. While Indonesia is relatively less exposed to US tariff risk, escalation of tariff talks is likely to keep Asian currencies under pressure.

USD/PHP: BSP hints at lesser rate cuts in 2025

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/PHP

58.00

|

Mildly Bullish | 59.00 | 58.00 | 57.50 | 56.00 |

- PHP continued to be one of the strong performers in Asia last month, appreciating by 0.9% in the month after hitting lows of 59.0. We expect the currency pair to trade in the 58-59 range in the near term.

- The three-month campaign period, ahead of the mid-term elections in May 2025, has kicked off. Domestically, President Bongbong Marcos’ 2025 budgeted spending sparked debates around misallocation and a lack of transparency. The political drama between the two political families could de-incentivise foreign inflows in the near term.

- We expect BSP to cut rates by another 25bp this week, in line with consensus. However, despite 4Q GDP growth coming in below expectations, the BSP hinted at lower rate cuts in 2025 than before given the uncertainty around Trump tariffs and the impact on inflation.

USD/SGD: SGD NEER to drift lower in 2025 driven by slower growth and inflation

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/SGD

1.3489

|

Mildly Bullish | 1.37 | 1.36 | 1.37 | 1.35 |

- SGD appreciated by 1% over the month, in line with other Asian currencies that are more external demand-driven as the markets shrugged off tariff announcements by the US administration

- Singapore’s central bank, MAS, eased monetary policy for the first time in almost five years by reducing the slope of the S$NEER policy band “slightly”, driven by a faster-than-expected fall in core inflation below 2% on a sustainable basis and as growth concerns from trade policy uncertainty took centre stage.

- The robust growth and inflation picture that the economy witnessed in 2024 has turned sharply and we expect GDP growth to slow down in the second half of this year, driven by slower global and export growth. We expect the trading range of SGD NEER to drift lower in 2025 driven by slower growth and inflation.

USD/TWD: Equity inflows helped soften depreciation pressure

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/TWD

32.78

|

Neutral | 32.80 | 32.70 | 32.50 | 32.70 |

- The USD/TWD pair was very stable over the past month, moving within a small range of 32.7-33.1. The TWD has generally tracked closely with the broader USD trend.

- Domestic drivers of the TWD were neutral over the last month. US-Taiwan yield spreads were little changed on the month, and equity market flows were mixed but showed a slight net outflow over the past month. Increased USD-denominated life insurance sales may be contributing to TWD depreciation pressure.

- Year-to-date, the TWD has been middle of the pack for Asian currencies. We expect the CBC to keep rates unchanged at next month’s meeting.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download articleThis article is part of the following bundle

14 February 2025

FX Talking: Silver Linings Playbook This bundle contains 6 Articles