FXFX Talking

Asia FX: Preparing for the 2023 recovery story

The Asian currency complex has taken advantage of the recent softness in the dollar and has enjoyed some strong gains. It looks fair to say that the Asian FX recovery into 2023 will not be a straight line, but the direction of travel seems clear

Source: Shutterstock

Main ING Asia FX forecasts

| USD/CNY | USD/KRW | USD/INR | ||||

| 1M | 6.97 | → | 1300.00 | → | 82.50 | → |

| 3M | 6.90 | ↓ | 1320.00 | ↑ | 81.50 | ↓ |

| 6M | 6.77 | ↓ | 1270.00 | ↓ | 81.00 | ↓ |

| 12M | 6.72 | ↓ | 1250.00 | ↓ | 80.00 | ↓ |

USD/CNY: Volatility to rise

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/CNY

6.98

|

Neutral | 6.97 | 6.90 | 6.77 | 6.72 |

- Although China is relaxing its zero-Covid strategy, residents may remain cautious about congregating in crowded spaces (restaurants, markets, etc). The initial positive impacts on retail sales may be overestimated. External demand weakness should be more obvious in 1Q23, which would put pressure on the production sector of the economy.

- The People's Bank of China may not cut the policy rate further in 2023. The re-lending programme quota for SMEs and real estate, however, could increase.

- Combining slow growth, no rate cuts, but possibly more relaxed Covid measures, the yuan is likely to remain volatile.

Source: Refinitiv, ING

USD/KRW: Credit crunch calms down

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/KRW

1304.00

|

Neutral | 1300.00 | 1320.00 | 1270.00 | 1250.00 |

- The KRW has outperformed most other Asian currencies over the last quarter, helped by the domestic credit crunch calming down. The trade deficit has widened due to sluggish exports, but the current account remains in surplus.

- The Bank of Korea (BoK) raised its policy rate a further 25bp in November with inflation running at 5% year-on-year. We expect the BoK to pay more attention to growth next year as inflation falls, and so an additional 25bp increase in February will probably be the final move in this rate hike cycle.

- Liquidity issues are expected to cause some further noise and there are plenty of risks as we approach the year-end.

Source: Refinitiv, ING

USD/INR: It all looks good apart from the currency

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/INR

82.75

|

Neutral | 82.50 | 81.50 | 81.00 | 80.00 |

- The INR has not benefited from the bounce that we have seen in other Asia Pacific (APAC) currencies, and quarter-to-date is down 1.17%, with only the IDR performing worse.

- This is not the fault of the Reserve Bank of India, which has continued to tighten, raising rates a further 35bp at the December meeting, nor is it a reflection of a competitiveness loss from runaway inflation, as inflation continues to drop and is expected to fall further.

- India’s recent GDP data also came in above expectations and is expected to perform well in 2023. The recent slide in the INR seems mainly a reflection of equity outflows, with the NIFTY index turning down in December.

Source: Refinitiv, ING

USD/IDR: Trade support for IDR fades

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

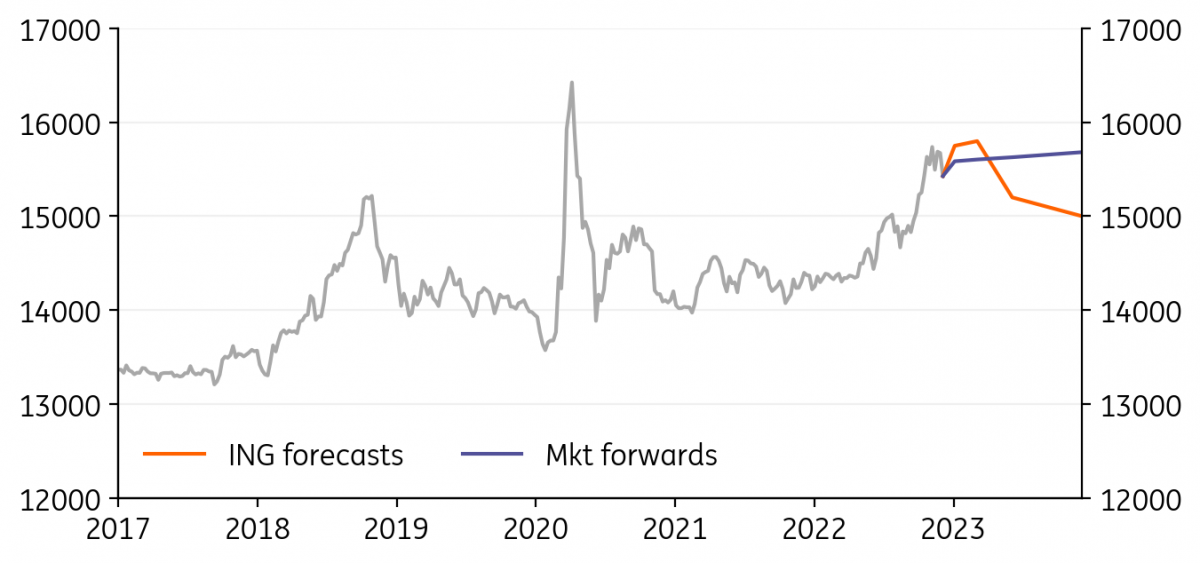

USD/IDR

15650.00

|

Neutral | 15750.00 | 15800.00 | 15200.00 | 15000.00 |

- The IDR is up just over 0.4% over the last month, but along with the INR props up the bottom of the APAC FX table. The sizable trade surplus that supported the currency in early 2022 narrowed recently suggesting that this key support has faded. Foreign bond holdings also dipped in November.

- Bank Indonesia (BI) has been active in raising its policy rate to help support the IDR. BI hiked rates by another 25bp in November after successive 50bp rate increases.

- We expect the IDR to face depreciation pressure in the near term as moderating commodity prices could lead to a further narrowing of the trade surplus and less support for the currency.

Source: Refinitiv, ING

USD/PHP: Peso up on remittance support

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/PHP

55.90

|

Mildly Bullish | 57.50 | 58.00 | 56.00 | 55.50 |

- The Philippine peso got a boost from the influx of overseas Filipino remittances ahead of the holiday season. A slight narrowing of the trade deficit also helped ease pressure on the currency as global commodity prices moderated.

- Aggressive rate hikes by the central bank also helped shore up the peso. Bangko Sentral ng Pilipinas (BSP) carried out a jumbo (75bp) rate hike in November, “matching” the US Fed’s previous move.

- The peso could be supported further by remittances in the near term but could then slip again as the import season resumes and remittances fizzle out after the holidays.

USD/SGD: SGD steadies as MAS fights inflation

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/SGD

1.356

|

Neutral | 1.36 | 1.35 | 1.34 | 1.32 |

- The SGD has steadied over the past month on improved sentiment and hopes for a sustained reopening of China. Meanwhile, despite elevated inflation, growth momentum has remained fairly solid with retail sales supported by tourist arrivals.

- The Monetary Authority of Singapore (MAS) has been aggressively tightening with four separate actions carried out this year.

- With the SGD trading in the top half of its NEER band and 3m SIBOR indicating a tightening bias, we look for the SGD to remain firm over the coming quarters.

USD/TWD: Approaching a pause

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/TWD

30.72

|

Mildly Bearish | 30.60 | 30.20 | 29.60 | 29.40 |

- Taiwan’s central bank will hike again in December, but it might pause in 1Q23 as inflation pressures abate. The economy is going to weaken as global orders for semiconductors continue to shrink, even if mainland China’s economy improves slightly.

- Even though mainland China intends to ease its Covid measures in the coming months, it is unlikely that there will be more tourists from mainland China going to Taiwan for leisure trips and Taiwan’s retail sales will remain soft.

- The expected pause of policy rate hikes could put temporary downward pressure on the TWD in January 2023.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

FXDownload

Download articleThis article is part of the following bundle

13 December 2022

FX Talking: Winter wonderland This bundle contains 5 Articles

↑ / → / ↓ indicates our forecast for the currency pair is above/in line with/below the corresponding market forward or NDF outright

Source (all charts and tables): Refinitiv, ING forecast