FX

Asia FX: Chinese tailwind to keep Asian FX in demand

The reopening of China has provided a tailwind to Asian currencies, which are anywhere between 1% and 5% stronger against the dollar year-to-date. Expect these trends to continue – especially were the Japanese yen to receive some fresh support from less dovish Bank of Japan policy. The peak in local tightening cycles should not prove too much of a problem

Source: Shutterstock

Main ING Asia FX forecasts

| USD/CNY | USD/KRW | USD/INR | ||||

| 1M | 6.72 | → | 1220.00 | ↓ | 82.00 | → |

| 3M | 6.50 | ↓ | 1200.00 | ↓ | 81.00 | → |

| 6M | 6.40 | ↓ | 1180.00 | ↓ | 80.00 | → |

| 12M | 6.50 | ↓ | 1200.00 | ↓ | 82.00 | → |

USD/CNY: Strong economic recovery expected in the second half of 2023

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/CNY

6.773

|

Neutral | 6.72 | 6.50 | 6.40 | 6.50 |

- After the strong bounce in January around the Lunar New Year holidays, the recovery may moderate a little in February. But as job availability increases, consumption should accelerate in the second quarter and could surpass pre-pandemic levels.

- Market expectations for a continuation of the economic recovery are likely to increase demand for the yuan.

- Furthermore, with the economy now in recovery mode, there is no need for the People's Bank of China to cut interest rates or the Required Reserve Ratio. Instead, the central bank could focus on re-lending programmes to support the technology sector and green finance.

Source: Refinitiv, ING

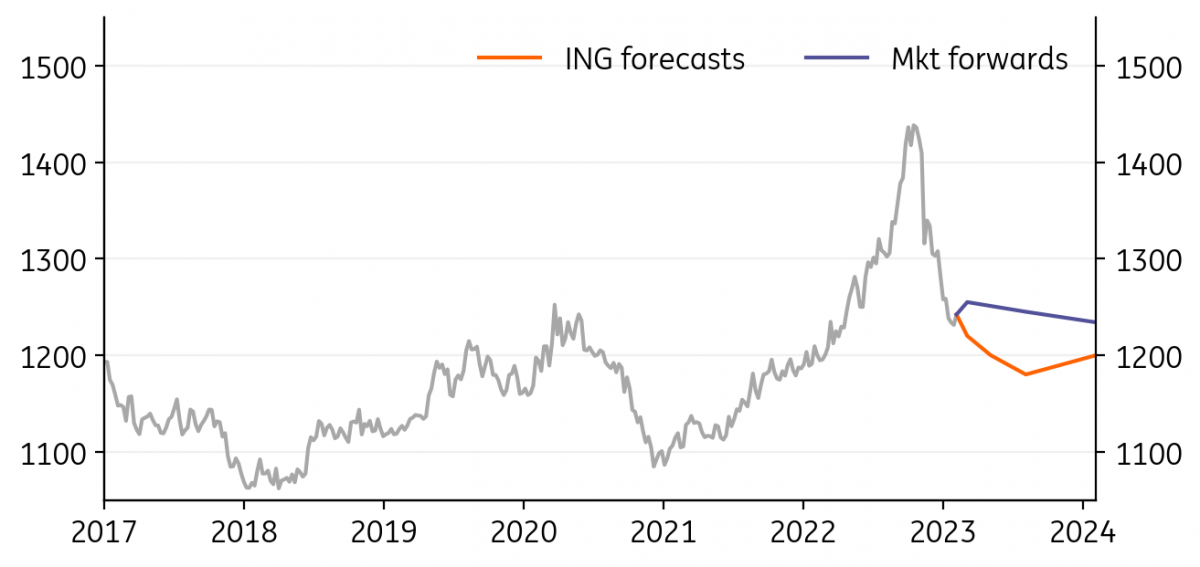

USD/KRW: KRW to strengthen despite chip slump

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/KRW

1254.70

|

Mildly Bearish | 1220.00 | 1200.00 | 1180.00 | 1200.00 |

- The Korean won has gained the most ground of all APAC currencies over the last three months as the USD’s trend has reversed. China’s reopening and a possible policy change by the BoJ could encourage further KRW appreciation.

- However, Korea’s chipmakers are experiencing slowing demand and there is a growing possibility that the current account balance may record a deficit during the first quarter of 2023.

- We expect the Bank of Korea to enter an easing cycle in the second half of the year, echoing our expectations for Federal Reserve rate cuts. We think the KRW will eventually break 1200 and touch 1180 later this year.

Source: Refinitiv, ING

USD/INR: RBI done, or close

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/INR

82.621

|

Neutral | 82.00 | 81.00 | 80.00 | 82.00 |

- The Indian rupee has had a reasonable start to the year, moving from about 82.70 to below 81.00 before drifting back up to around 82.00 currently.

- With inflation dropping back into the Reserve Bank of India’s target range, and below policy rates, central bank tightening is now probably complete, or at least, close to complete.

- The latest budget contained aggressive growth-promoting capital expenditure measures, though the deficit is expected to shrink to below 6% after this year’s 6.4% target. The slightly tighter fiscal stance could help offset the end to monetary tightening to leave the currency relatively steady.

Source: Refinitiv, ING

USD/IDR: IDR gains on foreign inflows, rally stalled by dovish BI

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/IDR

15055.00

|

Neutral | 14920.00 | 14625.00 | 14450.00 | 14725.00 |

- The Indonesian rupiah strengthened sharply in January benefiting from the return of foreign funds into the local bond market. Economic data was also supportive after trade data showed another month of surplus.

- Bank Indonesia (BI) hiked policy rates by 25bp to help slow still-elevated core inflation. However, Governor Perry Warjiyo hinted that the current rate hike cycle was ending, which may help to cap further IDR appreciation.

- China’s recovery and support for Indonesia’s commodity exports could help support the IDR this year.

Source: Refinitiv, ING

USD/PHP: Trade shortfall could limit further PHP gains

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/PHP

54.39

|

Neutral | 54.10 | 52.50 | 53.00 | 53.50 |

- The Philippine peso has tracked the regional appreciation against the US dollar with an uninspiring middle-of-the-road performance. Foreign investor inflows into the local equity and bond market have helped.

- BSP Governor Felipe Medalla initially indicated that he would hike by 25-50bp at his next meeting. Though more recent commentary has hinted at a potential end to rate hikes in the first quarter, curbing the PHP’s recent gains.

- Further gains in the PHP could be tempered by concerns about the current account deficit as the trade shortfall remains substantial.

Source: Refinitiv, ING

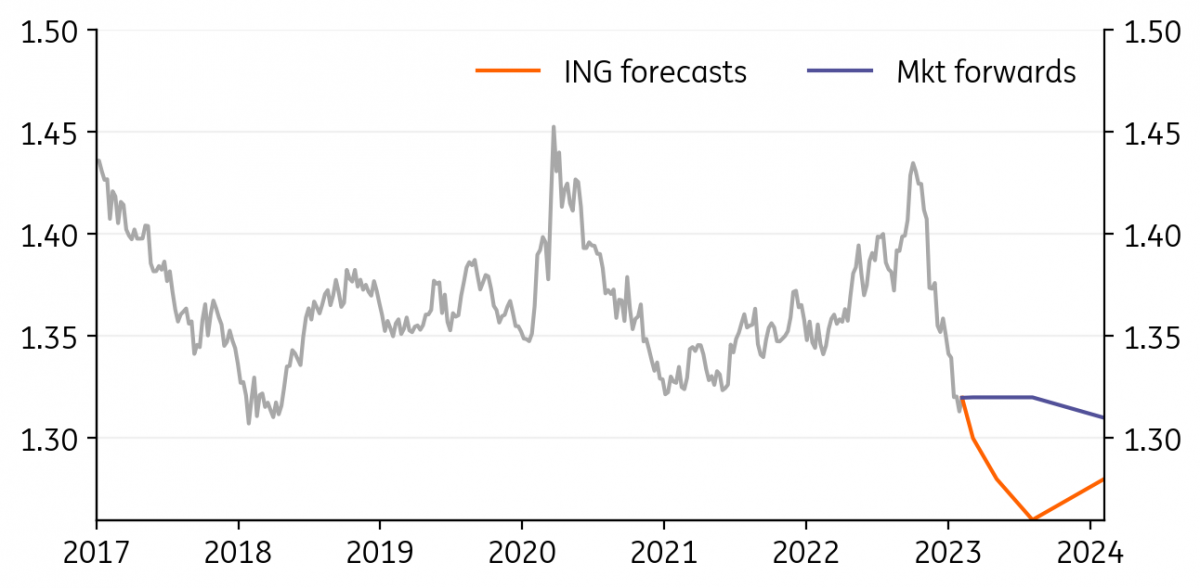

USD/SGD: SGD still on appreciating NEER path

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/SGD

1.3235

|

Neutral | 1.30 | 1.28 | 1.26 | 1.28 |

- Singapore's dollar has had a solid start to the year, continuing the appreciation that has taken it from 1.44 at the end of September last year to just over 1.30 now.

- The Monetary Authority of Singapore (MAS) expects inflation to remain elevated in 2023, which seems an easy call given that there is no let-up in rental inflation and government support measures are offsetting most of the monetary tightening the MAS is undertaking.

- The plateauing observed in the 3m Sibor rate may simply reflect the weakness of the US dollar, rather than any shift to a slower appreciating path for the nominal effective exchange rate.

Source: Refinitiv, ING

USD/TWD: Semiconductors could bring mild recession in the first half of 2023

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/TWD

30.004

|

Neutral | 29.95 | 29.20 | 28.00 | 29.00 |

- With weakening export markets in the US and Europe, and Mainland China still to recover fully, global semiconductor demand has dropped significantly. As a result, Taiwan’s overall economy has entered a downward cycle since December.

- A mild recession seems to be inevitable in the first half of 2023. But recovery should come quickly if the hiking cycle in the US ends and Taiwan’s central bank follows suit.

- A stronger Taiwan dollar would mainly stem from market expectations of a recovery in semiconductor demand from Mainland China in the first half of the year and global semiconductor demand in the second half.

Source: Refinitiv, ING

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download articleThis article is part of the following bundle

6 February 2023

FX Talking: Soft landing, hard landing, no landing? This bundle contains 5 Articles

↑ / → / ↓ indicates our forecast for the currency pair is above/in line with/below the corresponding market forward or NDF outright

Source (all charts and tables): Refinitiv, ING forecast