FXFX Talking

Asia FX Talking: China to continue resisting a weaker renminbi

Asian currencies have largely taken a back seat to events in the US and Europe. Some softer US interest rates might offer some room for a reversal in this year’s USD/Asia rally, but conditions are far from ripe for a substantial Asian FX recovery. We expect only limited USD/CNY upside and Chinese authorities to avoid seeking a competitive devaluation

Main ING Asia FX Forecasts

| USD/CNY | USD/KRW | USD/INR | ||||

| 1M | 7.25 | ↑ | 1340 | ↓ | 83.50 | ↓ |

| 3M | 7.19 | ↑ | 1300 | ↓ | 83.50 | ↓ |

| 6M | 7.13 | ↑ | 1320 | ↓ | 83.00 | ↓ |

| 12M | 7.00 | ↑ | 1280 | ↓ | 82.50 | ↓ |

USD/CNY: Near-term weakness ahead of monetary policy moves

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/CNY

7.2557

|

Neutral | 7.25 | 7.19 | 7.13 | 7.00 |

- USD/CNY has trended weaker over the past month, in line with our expectations. The reprieve from depreciation pressure amid a few dovish US developments proved to be short-lived.

- The People’s Bank of China has held back on rate cuts so far this year to help stabilise the renminbi. However, with more global central banks easing now, and weak domestic credit and confidence data, the odds of a rate cut in the next few months are rising.

- Yield spreads will likely remain the main catalyst for FX moves. Though both the US and China are expected to cut rates, yield spreads should favour strengthening in USD/CNY in the second half of the year.

Source: Refinitiv, ING forecasts

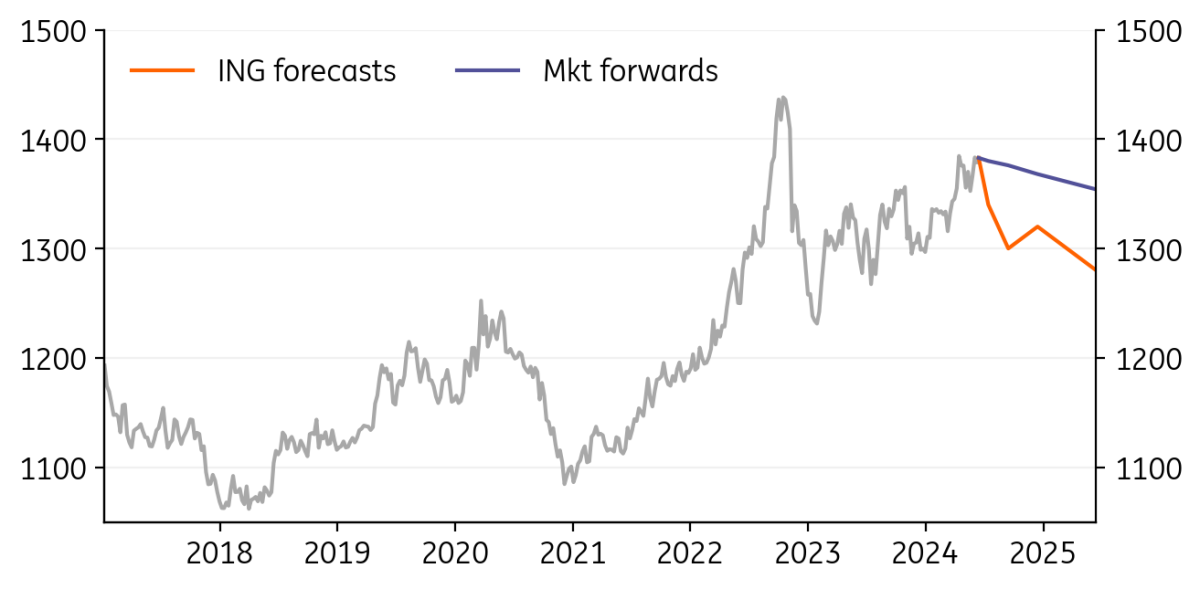

USD/KRW: KRW is likely to trade at a lower level

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/KRW

1383.00

|

Mildly Bearish | 1340.00 | 1300.00 | 1320.00 | 1280.00 |

- The Korean won has traded in a range between 1340-1380 for the past month, as market appetite for risk assets has lacked direction.

- Thanks to robust AI chip demand, exports and manufacturing grew strongly, while inflation eased to 2.7%. The Bank of Korea is expected to cut rates by 25bp in 4Q24 once inflation cools down to 1-2%.

- We continue to believe that a short window of appreciation will open at the end of 2Q24 for about one quarter as US data slows. But rising uncertainty about US politics and policies should limit further appreciation of the KRW.

Source: Refinitiv, ING forecasts

USD/INR: Election results add volatility

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/INR

83.54

|

Neutral | 83.50 | 83.50 | 83.00 | 82.50 |

- The loss of a parliamentary majority by Prime Minister Narendra Modi’s BJP party initially caused the rupee to come under significant weakening pressure.

- Since then, support by the BJP’s main allies, and the likelihood that there will be no change in leadership at the Ministry of Finance means that markets have calmed down.

- The Reserve Bank of India left rates unchanged in June but note that they do not have to wait for the Fed before easing. The last MPC meeting was close, with two members voting for a cut.

Source: Refinitiv, ING forecasts

USD/IDR: IDR initially steadies after BI hike but slides on trade data

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/IDR

16400.00

|

Mildly Bearish | 16250.00 | 16050.00 | 15800.00 | 15500.00 |

- The Indonesian rupiah managed to steady for most of May after Bank Indonesia’s surprise rate hike to 6.25% on 24 April. However, the IDR began to slide again after trade data showed the surplus narrowing.

- Bank Indonesia opted to leave rates unchanged at its May meeting although sustained pressure on the IDR forced it to retain a hawkish tone.

- The IDR could remain pressured in the near term which could force BI to consider hiking again to push the differential with the Fed funds rate to 100 bp.

Source: Refinitiv, ING forecasts

USD/PHP: PHP slid on dovish speak from BSP

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/PHP

58.65

|

Neutral | 58.60 | 58.00 | 57.60 | 56.00 |

- The Philippine peso came under pressure after Bangko Sentral ng Pilipinas Governor Eli Remolona indicated he was open to cutting policy rates ahead of the Fed.

- The PHP slid further after data supported early BSP easing with GDP disappointing and inflation cooling faster than forecast. Remolona reiterated his openness to cutting by August.

- The PHP will likely lag regional peers as BSP keeps up the dovish talk with a rate cut by August now a possibility.

Source: Refinitiv, ING forecasts

USD/SGD: SGD moves sideways for the period

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/SGD

1.353

|

Neutral | 1.35 | 1.34 | 1.32 | 1.31 |

- High frequency economic data has been mostly disappointing suggesting that current growth is still modest. Still elevated inflation and contracting non-oil domestic exports and industrial production have weighed on overall sentiment.

- The persistence of inflation should keep the Monetary Authority of Singapore on hold in the near term with any adjustments only likely at the last meeting of the year in October.

- The Singapore dollar nominal effective exchange rate should continue its modest appreciation path until that meeting, taking direction from regional peers such as the CNY near-term.

Source: Refinitiv, ING forecasts

USD/TWD: Net inflows drove appreciation

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/TWD

32.37

|

Neutral | 32.35 | 32.15 | 31.50 | 30.70 |

- USD/TWD traded within a band of 32.1-32.5 over the past month, with the Taiwan dollar remaining in an overall strengthening trend over the past two months.

- Capital flows switched from net outflows to inflows May, supporting the TWD. President Lai Ching-te’s inauguration avoided major friction and focused on maintaining the status quo, attracting net inflows toward the end of May. The TAIEX stock exchange hit a new record high.

- As the TWD has been one of the weaker Asian currencies year-to-date, in a potential dollar weakening window, the TWD could have more room for a rebound.

Source: Refinitiv, ING forecasts

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download articleThis article is part of the following bundle

17 June 2024

FX Talking: Politics vs Policy This bundle contains 6 Articles