Asia FX Outlook 2023: Better positioned

This year has been tough for Asian currencies – hit by surging energy prices, the strong dollar, and in some cases central banks being a little slow to react. Their course in 2023 will again be determined by the dollar trend and also diverse local stories. We see 3-5% gains in Asian FX against the dollar in 2023, with the Korean won outperforming

Local and international factors are still uncertain

For all the effort that goes into forecasting Asian exchange rates, the last year has shown that apart from some short-lived deviations, dollar strength was the principal driving factor and EUR/USD provided perhaps the best clue as to both direction and magnitude.

Within this period, there were times when other drivers took over – energy dependence was pivotal during the period immediately following the Russian invasion of Ukraine with the Indian rupee (INR) and Thai baht (THB) suffering badly while the Indonesian rupiah (IDR), Malaysian ringgit (MYR), and Australian dollar (AUD) outperformed. Then the differing inflation experiences, coupled with how much the respective central banks leaned against it, also held sway for a time. This saw the more interventionist economies (IDR, INR, PHP [Philippine peso]) which absorbed price pressures through fiscal buffers doing better at times compared to more market-oriented economies – such as the Korean won (KRW) – though this usually didn’t last. Then there were occasions when the more managed benchmark exchange rates of the region – chiefly the Chinese yuan (CNY) – would “reset” in response to local economic conditions and drag "satellite" currencies in north Asia along with it.

In the end, though, perfect foresight of where EUR/USD was going would probably have been a better indicator than a full understanding of any of these other factors, and looking forward to 2023 we see few reasons why this should be much different over the coming 12 months.

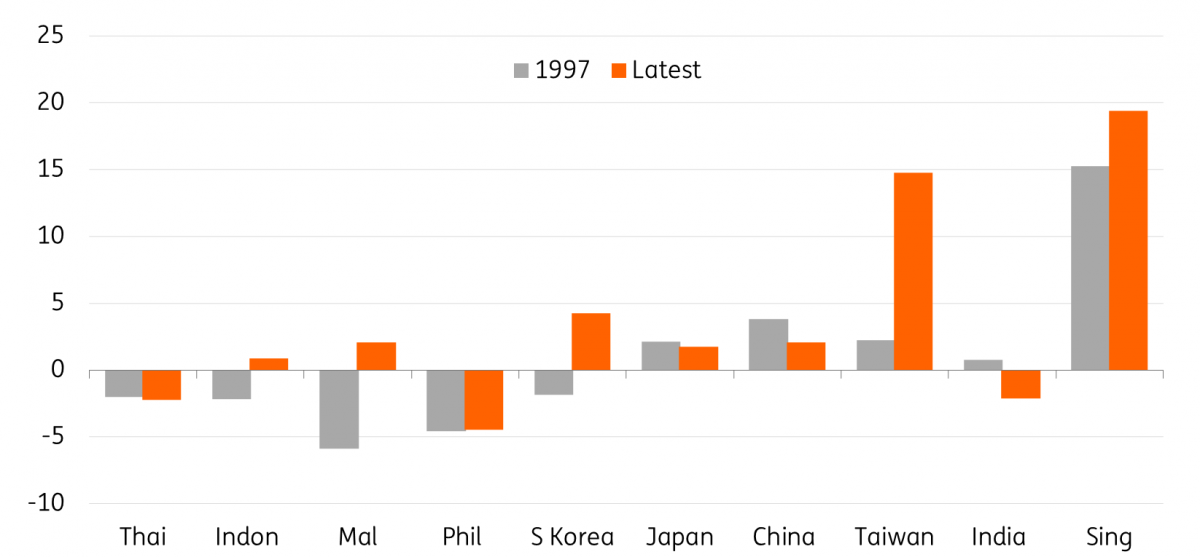

Asian Current a/c (% GDP)

Our house view for EUR/USD still sees some near-term dollar strength, and for this reason, we anticipate there still being some more mileage in the weaker Asian FX story. But both the scale and duration of this residual USD-driven leg remain the subject of much debate. Any further aggressive USD appreciation could see the current account surplus economies of the region outperforming their peers (see chart). External balances across the region have been damaged by this year’s energy price spikes, although compared to the Asian Financial crisis in 1997, the region as a whole is still in a much healthier position with respect to external balances, FX reserves, and import cover (see also here).

At some point though, and possibly after some further Asian FX weakness, a number of factors will start to swing in the opposite direction. Local factors include:

- While still somewhat subdued, China’s economy will be in better shape in 2023 than it was in 2022. There are some tentative indications of a more nuanced approach to zero-Covid, and this may be amended further following the two sessions in March.

- The property development sector will still likely be a shambles, but its drag on the economy will be trending towards zero or small positives from the substantial negative in 2022.

- Either of the factors above may free up more fiscal resources at the local government level to push growth along.

- Across the rest of Asia, without a renewed energy price spike, local inflation rates should begin to moderate, allowing for some easing of policy rates and recovery of demand.

Inflation already looks to be peaking in some economies and this trend is likely to spread. And while it may mean that policy rates can begin to be cut, the currency-relevant fact will be that negative real policy rates will shrink, and that could allow for some further currency strength.

However, when the turn comes, how much further it has gone before this occurs, and how rapidly it reverses course, will be determined by a wide range of local and international factors, and remains the subject of considerable speculation.

USD/CNY: Liquidity to remain ample

| Spot | Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | |

|---|---|---|---|---|---|---|---|

| USD/CNY | 7.05 | Neutral | 7.22 | 7.35 | 7.25 | 7.18 | 7.13 |

- Capital flows: Even though the yuan has been weak against the dollar, we have not seen net capital outflows reflected in the data. There are several possible reasons for this. More global asset indices include China's onshore assets in their portfolios. This can smooth out volatility as the Chinese market often has low correlations with other markets. Another more likely factor is that offshore Chinese entities could be remitting dollars to their onshore counterparts and then converting them to yuan. There has also been a higher trade surplus every month so far this year. All of this adds up to a strange pattern of weak yuan mapping with net capital inflows. This pattern could continue until the People's Bank of China (PBoC) believes that there is no more risk of quick and massive capital outflows.

- Macro backdrop: The Chinese economy has not been doing well in 2022 due to Covid measures, the real estate crisis, and recently, the slowdown in export demand from the US and Europe. Our GDP forecast for 2022 is only 3.3%. We believe that the Chinese government is gauging the risk to the healthcare system from re-opening by holding big events like the Beijing Marathon and Shanghai Expo. We may see some slightly more flexibility on Covid measures, but we believe that any important official announcement of Covid measures is more likely during the Two Sessions in March 2023. On real estate, more funding for local governments' 2023 budgets will be available by the end of 2022 via special bond sales. This should help local governments finish uncompleted homes faster. As such, there should be more construction activity in the first half of 2023 compared to the second half of 2022. But the risk of recession in the US and Europe will weigh on Chinese exporters and manufacturers, and therefore the jobs market. Due to the weakness of the economy, there is no inflation pressure and slight PPI deflation pressure in 2022. It is unlikely that high inflation will occur in China in 2023 given the weak economic prospects. With a low base effect and some improvements domestically, our GDP forecast for 2023 is 5.3%.

- PBoC and rates: The PBoC has not changed policy interest rates since August 2022, and the time before that was in January 2022. We believe that conventional monetary policy tools, that is, policy interest rates and required reserve ratio adjustments (RRR), are not efficient to tackle existing economic conditions from Covid measures and the real estate crisis. The PBoC has turned to lending to domestic development banks that in turn lend to local governments. This gives some breathing room on fiscal pressures. And this is more efficient as there is no lag time to get funding compared to commercial loan and bond channels. It is possible that the current practice will continue until some uncompleted homes are finished and Covid measures become more flexible. Consequently, we do not expect any change in policy interest rates in 2023.

USD/INR: Real rates turn less negative

| Spot | Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | |

|---|---|---|---|---|---|---|---|

| USD/INR | 81.10 | Neutral | 83.00 | 84.00 | 83.00 | 82.00 | 82.00 |

- Capital flows: One of the factors providing support to the INR during the past year has been the expectation that Indian Government Securities (G-Secs) would be included in one or more of the global bond indices. That expectation got knocked back in early October this year, mainly on disagreements between JP Morgan and India’s Finance Ministry on settlement issues (India wants bond trades settled locally, not at Euroclear) and taxation (India is unwilling to treat foreign bond investors differently to local investors for the purposes of capital gains). There is still some scope for inclusion in 2023, but it doesn’t sound as if India’s government is all that willing to make concessions. There may be more scope for equities to draw in capital in the second half of fiscal 2023, as the dry spell in IPOs is thought likely to end with around INR10.5tr reported of approved capital raising and a further INR7tr awaiting approval.

- Macro backdrop: The Indian economy has not been immune to the global headwinds following Russia’s invasion of Ukraine and is particularly exposed to high energy prices given its large net importer position. Despite taking advantage of some cheaper Russian crude supplies and absorbing some price pressures through margins at state-owned petroleum companies and reduced import excise duties, inflation has still risen above 7%, and this has taken its toll on the growth outlook, with third-quarter 2022 GDP coming in slower than expected, and putting previous expectations of a 7% growth rate for 2022 out of reach. We now look for growth of 6.3% in the calendar year 2022. This is still one of the highest rates of growth in Asia, and there is scope for some firming of the growth environment next year if there are no further price shocks.

- RBI and rates: After abandoning its awkward dance of trying to support both growth and leaning against rising prices in early April this year, the Reserve Bank of India (RBI) has taken a steadfast and convincing stance against inflation, taking the repo rate from its low of 4.0% up to 5.9% currently. We look for a further 25bp of rate increases in December, and perhaps another 25bp in February, taking rates to 6.4%. But by then, we may well see inflation coming off its highs, which could leave the real (adjusted for actual inflation) policy rate close to zero, rather than its current strong negative rate. This could mark the peak for the RBI, as inflation should fall further from this point, enabling real policy rates to float back into positive space.

USD/IDR: Bank Indonesia to step up rate hikes

| Spot | Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | |

|---|---|---|---|---|---|---|---|

| USD/IDR | 15540.00 | Neutral | 15850.00 | 15950.00 | 15800.00 | 15700.00 | 15600.00 |

- Trade balance support could fade: The IDR was well supported by inflows related to trade for the most part of 2022. Exports managed to easily outpace imports this year as the export sector benefited from the surge in global commodity prices. Trade surpluses hit a record high in April ($7.5bn) but have since narrowed with the latest surplus down to $4.9bn. Slowing global trade and a dip in coal prices point to a further narrowing of the trade surplus which would impact Indonesia’s current account balance. Bank Indonesia (BI) expects the current account to settle between 0.4-1.2% of GDP for 2022 but revert to a deficit in 2023. This suggests that key support for the IDR in 2022 will not be around next year resulting in sustained pressure on the currency.

- Macro backdrop: Indonesia has strung together six quarters of positive growth, rebounding quickly from the pandemic-induced recession in 2021. Growth got a boost from exports, which in turn helped support the recovery of the manufacturing sector. Meanwhile, relatively subdued inflation in the first half of 2022 helped support domestic consumption with retail sales benefiting from increased mobility. Inflation, however, has finally picked up in recent months and is likely to accelerate further after the government increased the price of subsidised fuel. The recent weakness experienced by the IDR has also contributed to higher inflation, a trend that should extend to 2023. Accelerating inflation is likely to cap consumption growth in the coming quarters while expectations for slower global trade suggest that exports will be subdued going into 2023. With the projected slowdown in the second half of 2022, we expect full-year growth to settle at 5.2% year-on-year in 2022 while 2023 growth could slip to 4.4%.

- Central bank to stay hawkish: Bank Indonesia was a latecomer in terms of rate hikes in 2022 as inflation stayed relatively subdued for the first half of the year. Faster inflation by the second half of the year prodded the previously reluctant central bank to finally increase policy rates in a surprise move in August. BI has since been actively tightening, increasing rates by 75bp so far, and will likely need to continue tightening to support the IDR well into 2023. BI Governor Perry Warjiyo previously highlighted his preference for a stable currency, and we expect BI to hike rates by at least 100bp to help steady the IDR.

USD/KRW: Second half of 2023 to be better for Korea and the won

| Spot | Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | |

|---|---|---|---|---|---|---|---|

| USD/KRW | 1320.00 | Mildly Bearish | 1350.00 | 1400.00 | 1350.00 | 1300.00 | 1250.00 |

- Capital flows: Foreigners have been net sellers of the Korea Composite Stock Price Index (KOSPI) until recently, but we see foreign investors coming back to the Korean equity market, as the sharp outflows have stagnated over the past few months. We believe that the KOSPI will benefit from an asset allocation perspective as the China-US conflict intensifies, and thus decoupling with the Chinese market is expected to some extent. On the bond side, Korea has been added to the watch list for World Government Bond Index (WGBI) inclusion and it is possible to join the WGBI next year at the earliest. This is a positive factor providing support for the Korean won and Korean authorities appear to believe inclusion is very promising. Several new initiatives including the exemption of the withholding tax, reforms to improve accessibility to the KRW market, and Korean treasury bond (KTB) trading via ICSD (International Central Securities Depositories) were proposed to improve the structure and accessibility of its capital market for investors.

- Macro backdrop: The Korean economy is heavily dependent on exports and is a net energy importer. The trade deficit will continue for some time as semiconductor exports continue to struggle while energy prices remain high. We expect the current account to be in a surplus, but weak trade performance will weigh on the currency markets.

- BoK and rates: The Bank of Korea (BoK) has been one of the fastest-moving central banks in the race to raise rates since last year and is expected to become one of the fastest-moving to cut rates next year. We expect a 25bp hike in November, and perhaps another 25bp in January, taking rates to 3.50%. But the BoK is likely to go into a wait-and-see mode afterwards, as inflation is expected to slow to below 4% and fall further. To lighten the burden for businesses and households, the BoK will likely enter into an easing mode from the second half of next year.

USD/PHP: How much longer can BSP hold the line?

| Spot | Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | |

|---|---|---|---|---|---|---|---|

| USD/PHP | 57.20 | Neutral | 58.75 | 59.00 | 58.50 | 58.00 | 57.50 |

- Current account woes to persist: The Philippines is highly dependent on imported food and energy items and has traditionally run trade deficits. Elevated global commodity prices bloated the import bill resulting in a record-wide trade shortfall. Contributing to the stark widening of the trade deficit was the economic reopening after mobility restrictions were finally relaxed in the first half of the year. Resurgent domestic demand also resulted in increased capital and consumer goods imports which were enough to push the current account into a deficit. The trade balance and current account are likely to remain in deficit in 2023, especially if commodity prices stay elevated. The central bank expects the current account deficit to widen to roughly $19bn in 2022 and $20bn in 2023, suggesting that pressure on the PHP will persist next year.

- Macro backdrop: The Philippines posted solid growth numbers in the first half of 2022 after the national government relaxed mobility restrictions after improvements in Covid-19 containment. The reopening of the economy helped along by election-related spending powered strong growth for the first half of the year (7.7%). The second half of the year, however, presents a much more challenging landscape, which also marks a change in leadership after Ferdinand Marcos Jr. won the presidential election in May. Surging inflation on top of rising borrowing costs is likely to translate to a significant slowdown in growth for the second half of 2022 and the whole of 2023. We expect inflation to hit 5.6% year-on-year in 2022 and stay elevated at 5.0% in 2023, which would translate to 5.9% YoY growth in 2022 and 4.4% in 2023.

- Busy year for BSP: It has been a busy year for the Bangko Sentral ng Pilipinas (BSP). The central bank faced a quick acceleration in price pressures as well as a change in leadership after the presidential election. Given the country’s dependence on imported energy and food, price pressures rose quickly to drive inflation well-past target (currently at 7.7% YoY). Several deadly typhoons also pushed up food prices after the storms caused significant crop damage. The BSP responded with several rate increases, even resorting to an off-cycle decision in July as well as a pre-announced rate increase which will take the policy rate to 5% by November. BSP Governor Felipe Medalla, who assumed his post in July, vowed to match any move by the Federal Reserve in the coming months and maintain a 100bp differential with the Fed funds target rate. We expect BSP to take the policy rate to 5.5% by year-end with at least an additional 50bp worth of rate hikes in 2023 should the Fed continue to raise rates.

USD/SGD: MAS waits for recent tightening to take hold

| Spot | Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | |

|---|---|---|---|---|---|---|---|

| USD/SGD | 1.37 | Neutral | 1.39 | 1.40 | 1.38 | 1.375 | 1.37 |

- Growth outlook: Singapore has managed to post decent growth in 2022 despite the increasingly challenging global backdrop. Relatively robust trade activity in the first part of 2022 has helped support growth momentum although we have noted a slight deceleration of late. Meanwhile, retail sales recorded a steady pace of expansion despite the sharp uptick in prices. One possible development that could be supporting retail sales is the sustained influx of foreign visitors which may be driving the consistent growth of sales for department stores and recreational goods. Retail sales growth could help offset the projected slowdown in global trade somewhat and we expect Singapore growth to settle at 3.5% YoY in 2023.

- GST to add to inflation pressure in 2023: Surging global commodity prices and robust domestic demand resulted in faster price increases for Singapore with core inflation rising 5.3% YoY as of September. The Monetary Authority of Singapore (MAS) now expects headline inflation to settle at 6% YoY for 2022 and between 5.5-6.5% in 2023 given current developments and the scheduled increase in the Goods and Services Tax (GST) from 7% to 8% next year. Risks to the inflation outlook remain skewed to the upside, especially if commodity prices stay elevated in 2023. A prolonged period of high commodity prices should eventually evolve into additional second-round effects that would fan both headline and core inflation.

- MAS tightens aggressively: The MAS has been busy over the past few months, surprising market participants by tightening unexpectedly in October 2021, the first of five separate moves to tighten monetary policy. Given surging core inflation, MAS needed to tighten policy aggressively with two of the moves carried outside of scheduled meetings. The MAS is likely to remain hawkish given expectations that core inflation will average 3.5-4.5% YoY in 2023 and stay elevated until the second half of next year. We believe, however, that the MAS would be less aggressive in tightening should it need to act as it monitors the impact of its aggressive tightening moves.

USD/TWD: Wider differentials weigh on TWD

| Spot | Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | |

|---|---|---|---|---|---|---|---|

| USD/TWD | 31.00 | Neutral | 32.40 | 33.00 | 32.00 | 31.70 | 31.40 |

- Capital flows: The weakness of the New Taiwan dollar (TWD) in 2022 mainly comes from net capital outflows of foreign investments in Taiwan’s equity market. The net outflows year-to-date amounted to $48.2bn as of 7 November. This is a lot compared to historical data of the next biggest outflows at $15.6bn in 2021, which was itself bigger than the outflows of $15.5bn in 2008. Capital outflows from the equity market have led to a fall in foreign exchange reserves of $5.62bn. Offloading of Taiwan equities should continue in 2023 as semiconductor sales should fall further as a result of the expected recession in the US and Europe and weak demand in China.

- Macro backdrop: Taiwan enjoyed strong semiconductor sales in the first half of 2022, but after this the economy turned sour when Covid hit, and then weakened further when weak demand in China led to a fall in semiconductor sales. Adding to this pressure is softer demand for smart devices in 2022. As the Taiwan economy specialises in semiconductor manufacturing and sales, it is prone to external economic conditions. Taiwan did experience some higher-than-normal inflation of around 3.5% YoY in the first half of 2022. But this was then followed by softer inflation pressure in the second half of 2022 as the economy slowed. For 2023, we believe that semiconductor sales will continue to fall as a recession in the US and Europe is likely in the first half of 2023, and China’s consumption demand will remain weak due to Covid measures and the ongoing real estate crisis.

- Taiwan's central bank and rates: As Taiwan has not encountered as high inflation as the US, Taiwan’s central bank has raised interest rates at a much slower incremental pace than the Fed. As of November 2022, Taiwan’s central bank had raised rates by just 0.5 percentage points in 2022, which is much smaller than the Fed’s 3.75 percentage points. This is one of the reasons why TWD has fallen over 15% so far in 2022. If the Fed pauses its hiking in 2023, the interest rate differential should stop widening.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 November 2022

FX Outlook 2023: The dollar’s high wire act This bundle contains 6 Articles