An impressive start to the year for nickel as it hits 10-year high

Nickel has gained almost 6% year-to-date, chiefly driven by a continuous inventory drawdown and the tightness in the class 1 market

Macro tailwinds, hot inflations remain a support the whole complex

The industrial metals complex continues to rally at the start of 2022 amid broadening inflationary pressure, and those macro tailwinds have not yet turned into headwinds.

The pandemic has caused an imbalance in market supply and demand, and market dislocations geographically. We entered the new year with a deficit in market balances, although some are structural. Meanwhile, exchange warehouses, the market’s last resort for consumers, have been running with even lower stocks.

In 2022, the market is expected to see a divergence between US and China policies. With an emphasis on stability, China is set to become more supportive of growth this year after unprecedented restrictions in 2021 within the property sector, among others. Meanwhile, the market is also contemplating an interest rate cut as we approach Chinese New Year.

Energy transition sector remains a sweet spot

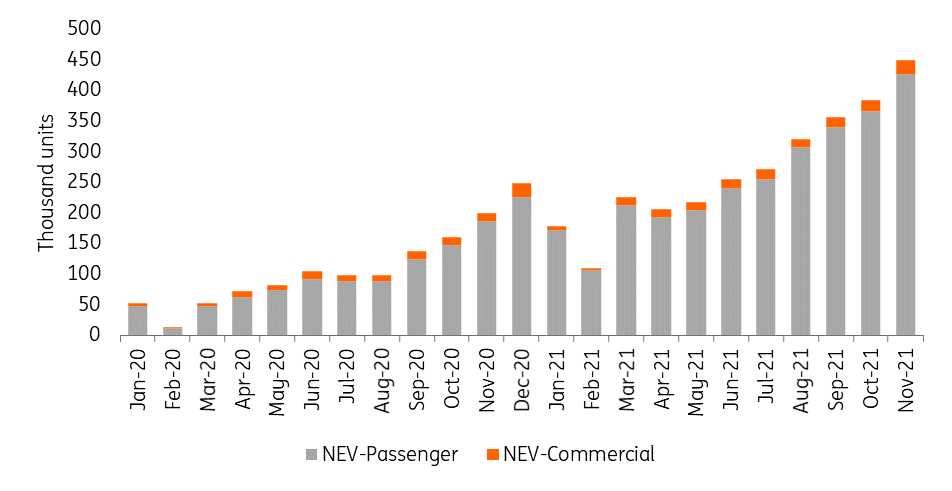

Despite last year's economic slowdown, there has been double- and even triple-digit growth in energy-transition related areas. On Wednesday, the China Passenger Car Association (CPCA) released its latest data for December on new energy vehicles (NEV), with retail sales growing 129% Year-on-Year. Total NEV sales in 2021 grew by 169%. Such strong growth has bumped up demand for batteries.

China New Energy Vehicle Sales

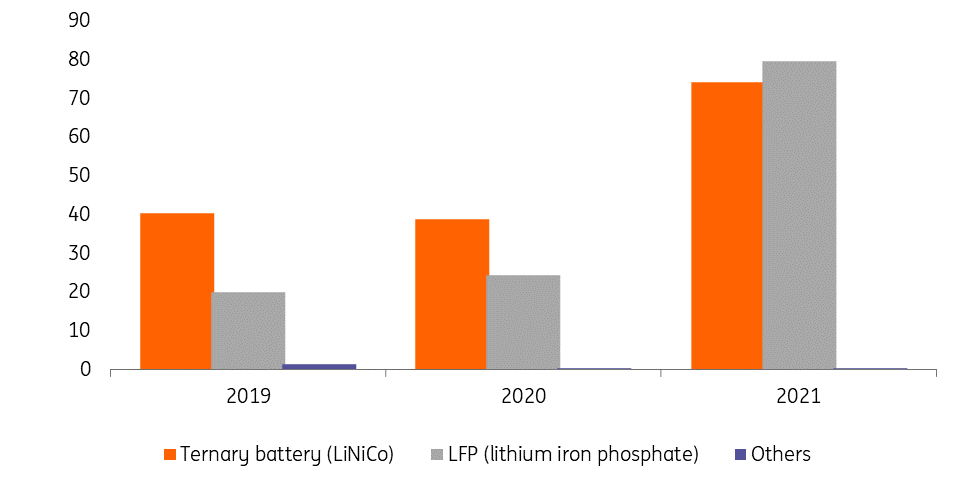

Total vehicle battery installations have grown by 143% Year-on-Year, with ternary battery installations surging by 91%, according to the latest data from the Battery Union. The data also points to phenomenal growth in lithium iron phosphate (LFP) battery installations which have grown by more than 227% Year-on-Year. This has provided a boost to a number of energy transition-related metals and chemicals, including copper, nickel, and lithium carbonate.

A point worth noting here is that the growth in LFP does not come at the cost of the ternary battery. They tend to grow in parallel – at least for now.

China automotive battery installations (GWh)

While LFP batteries have a larger market share than ternary batteries and are becoming the dominant choice for Chinese EV companies, this has not prevented the latter from recording impressive growth.

Supply angst of suitable material drives down exchange stocks

We entered the new year with an optimistic view of nickel, albeit with some caution (A matter of class in the nickel market). The exchange-traded nickel stocks, despite only accounting for around a quarter of global salable nickel, is running with decade-low stocks and continues to decline this year.

We suspect that the tightness in the class 1 market has prompted battery/precursor makers to unload nickel briquette (the main LME nickel type and one of the feedstocks to produce sulfate) out of the exchange sheds to secure their supply. This view is corroborated by a strong increase in Chinese refined nickel imports. The dwindling stocks in LME makes traders wary of building significant short positions in case of a squeeze.

The supply disruptions had not stopped when we were discussing this in early December 2021. Boliden halted operations at its Harjavalta smelter around mid-December due to a slag explosion. The smelter has a total capacity of around 66ktpa, and there haven't been any reports of operations restarting any time soon.

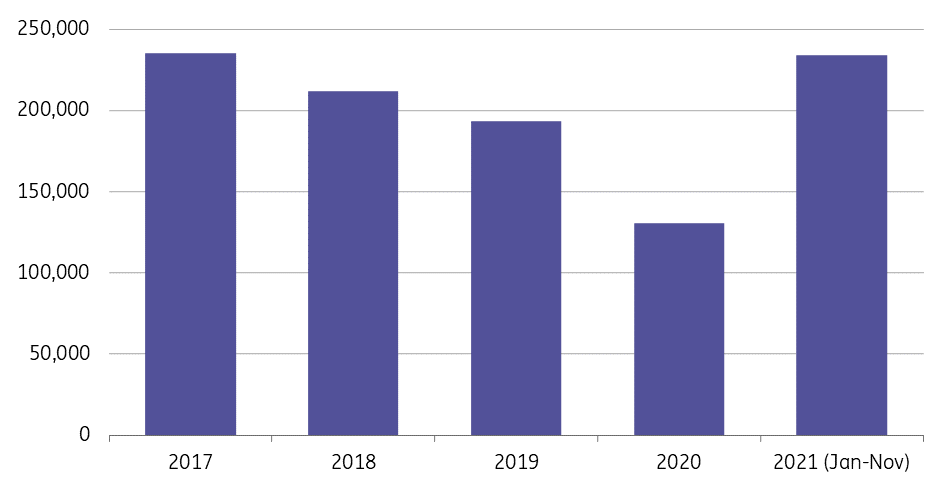

China refined nickel imports

During the first eleven months of 2021, China's refined nickel imports grew by 97% YoY.

A tough job timing the new supply

A key problem lies in the supply growth of feedstocks to produce nickel sulfate, one of the key ingredients in making ternary batteries going into NEVs or consumers electronics.

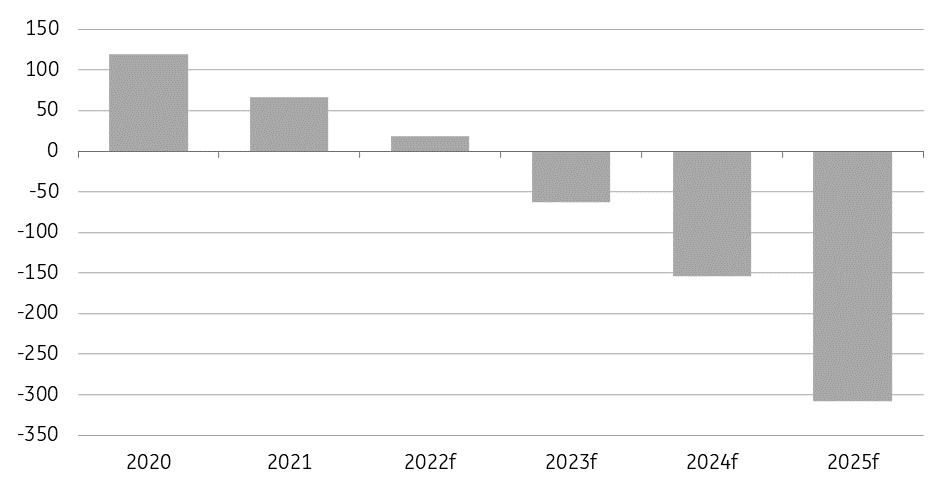

According to BNEF, this specific market is shifting toward a large deficit driven by strong demand for batteries as the world speeds up electrifications. For 2022, there is a forecast of an 18kt surplus of nickel sulfate globally, but this is against the backdrop of around 500kt demand a year.

The other option is to get the feedstocks from those MHP/matte conversion projects, but this often comes with delays. Among the projects we are tracking, we expect five to come online this year, bringing a total 178kt (Ni), but the majority are pencilled in to start in the summer.

What is worth noting is that the nickel pig iron (NPI) discount reemerged this week to a level last seen back in the first quarter of 2021. This, in theory, should incentivise the conversion of some NPI/FeNi into matte to meet the sulfate demand. And current nickel prices should exceed the incentive prices of these HPAL projects. While it has been difficult to time these projects, if they come to market earlier than expected, that would help ease the tightness in the class 1 market later this year.

Nickel sulfate market balance

Class 2 market remains lacklustre in the short term

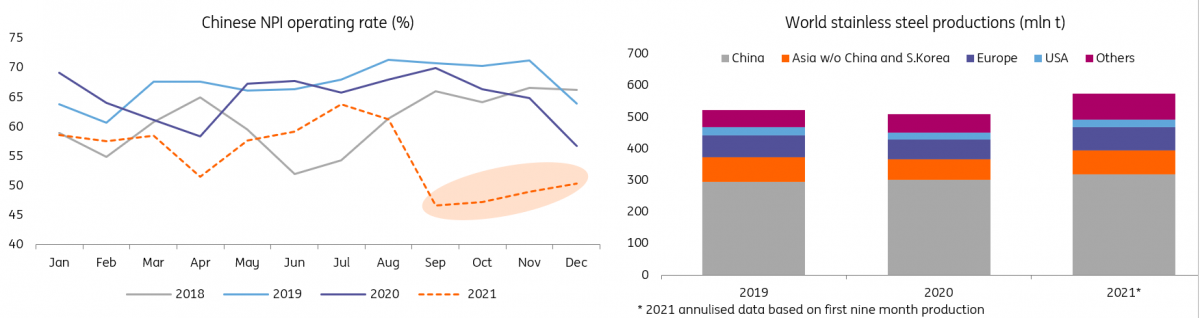

Rising cost pressures as a result of high nickel ore prices following the Indonesia ban, combined with the energy crunch last quarter, has taken its toll on Chinese NPI productions. According to Mysteel, Chinese NPI productions fell 7% between November and December (-19% YoY), as some failed to come out of the power crunch during October/November. Reduced NPI supply and strong demand for the material from the nation's stainless steel sector pushed prices to a decade high in late October/early November before collapsing in December amid curtailments from the sector.

This year, NPI prices have rebounded about 7% from the lows seen last December, with elevated nickel ore prices and weak supply during the Philippines monsoon season offering some support. Reports of mills replenishing stock have also helped.

As nickel's primary end-use, stainless steel productions had a strong year driven by Indonesia (due to new projects coming online) and China. Despite strong growth from industry in Indonesia from a low base, Chinese stainless steel production still accounts for around 55% of the global total. Last year, Chinese crude stainless production grew by 6.8% Year-on-Year. Production of the nickel-rich 300-series gained an increasing share in the total, with productions rising by 9.5%, accounting for 50% of the total. The latest data from the International Stainless Steel Forum (ISSF) also showed that global stainless steel productions grew by 16.9% Year-on-Year during the first nine months of 2021.

However, some Chinese mills are running maintenance during the first two months of this year, weighing on the overall demand for NPI, their preferred feedstock. In the short term, the Chinese class 2 market is lacklustre, as weak supply (NPI/FeNi) and soft demand from the stainless steel sector is failing to provide impetus to the parabolic run in the exchange-traded nickel.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article