America’s growing bioenergy market needs clearer monitoring and more innovation

Bioenergy is a crucial pathway to net-zero emissions by 2050. The bioenergy market in the US has been growing and diversifying, with strong growth potential seen in carbon capture and storage (CCS), renewable diesel, and renewable natural gas. Addressing the environmental impact of bioenergy needs clear monitoring and more innovative solutions

Bioenergy, a form of renewable energy derived from organic materials (or biomass), will play a pivotal role in helping the world achieve net-zero emissions by 2050. With a wide range of application options in sectors such as transport, heating, and electricity, bioenergy is forecast to account for 19% of total energy supply in 2050 and will contribute to 13% of the emissions reduction between 2020 and 2030 under the International Energy Agency's (IEA) Net-Zero Emissions (NZE) scenario.

Emissions reductions by mitigation measure in the Net-Zero Emissions scenario, 2020-50

In the US, the development of bioenergy has been accelerating and expanding. In the transport sector, the US is home to the world’s largest biofuels market, and the demand for biofuels in North America is expected to grow more than any other region through 2026 under the IEA’s baseline scenario. Growth will continue to be led by a diversification of biofuels supply beyond conventional ethanol, as advanced biofuels like renewable diesel and renewable natural gas (RNG) keep gaining momentum. Sustainable aviation fuels (SAFs) are another point of growth; these will be covered in a later article.

Biofuel demand growth by region in the baseline scenario, 2021-2026

But the deployment of and investment in bioenergy is rising in other sectors as well, led by mounting action from corporates and investors across sectors to decarbonise their businesses and portfolios. So, let's take a look at the growth prospects of various bioenergy applications in the US, as well as the challenges they face.

Examples of bioenergy-related corporate climate strategies:

- Oil and gas: ExxonMobil identifies biofuels as one of its core solutions for its net-zero ambition. The company announced in early 2022 that it would acquire a 49.9% stake in Biojet AS, a Norwegian biofuels company, to receive up to three million barrels of biofuels per year. ExxonMobil is also investing $125m in California-based Global Clean Energy to purchase up to five million barrels per year of renewable diesel.

- Petrochemicals: Dow sees the creation of a circular economy through recycling and using bio-based materials as a focus area to accelerate sustainability. The company is expanding an agreement with Fuenix Ecogy Group to ramp up circular plastics production. It has also signed agreements with Gunvor Petroleum Rotterdam and Texas-based New Hope Energy to purify pyrolysis oil feedstocks derived from plastic waste.

- Power: Southern Company last year took ownership of the Meadow Branch Landfill Methane Recovery Facility, the renewable natural gas facility located in Tennessee, to strengthen its RNG capacity as part of the company’s strategy to achieve net-zero emissions by 2050.

Biofuels: Federal policies will have a net positive effect on US production this year

The main federal policy to support the US biofuels market is the renewable fuel standard (RFS), which requires refiners to blend certain volumes of biofuels in gasoline each year. The RFS benefited biofuels production – especially that of fuel ethanol – in the past, although in recent years the RFS has become more susceptible to policy uncertainty.

The Environmental Protection Agency (EPA), which is in charge of setting RFS mandates, last December proposed to retroactively lower biofuel mandates for 2020 and 2021 but set 2022 requirements slightly above pre-pandemic levels. This will put pressure on refiners to blend more biofuel into their gasoline production this year, resulting in a net positive impact on the biofuels industry.

In addition, the EPA has proposed the rejection of all outstanding small refinery exemption (SREs) waivers pending for the 2016-20 compliance years. SREs give small refiners that process less than 75,000 barrels per day (bpd) of oil and can demonstrate economic hardship caused by the RFS an exemption from complying with the rules. If implemented, this decision would substantially raise the demand for biofuel credits.

A federal policy that will specifically boost the production of ethanol is the Biden administration's plan to allow E15 gasoline, a fuel that uses a 15% ethanol blend, to be sold between June and September. E15 gasoline is typically banned in summer due to worries about air pollution. E15 consumption is low also because of retail availability, automobile compatibility, and safety concerns. But heightened oil prices amid the Russia-Ukraine war have made the case for more E15 gasoline sales to ease prices.

State level policies are a powerful addition

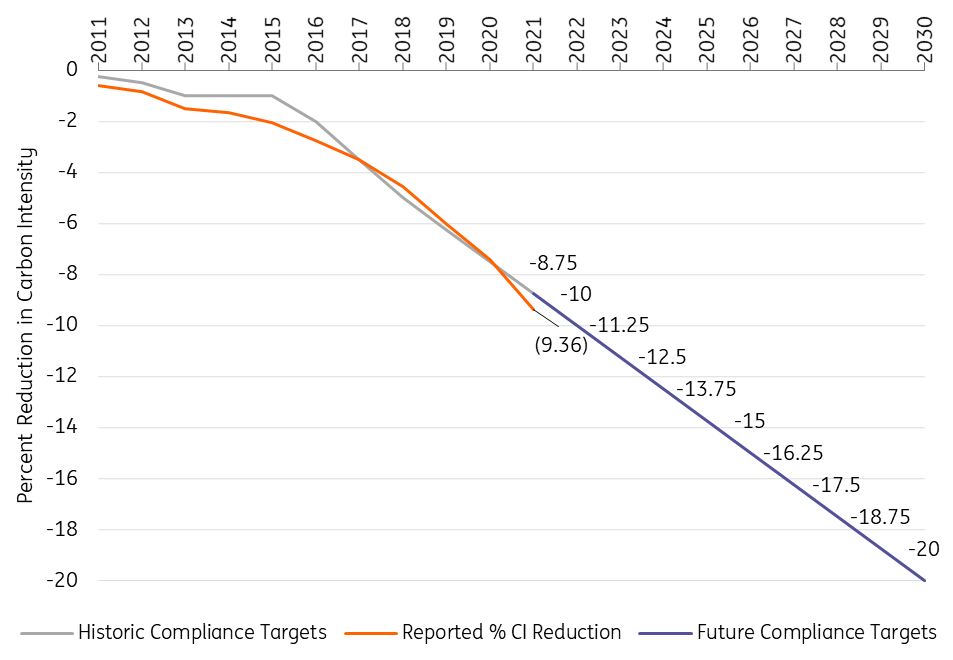

At the state level, California’s low-carbon fuel standard (LCFS), the backbone of a carbon intensity-based cap-and-trade system, has been playing a substantial role in incentivising biofuels production in and near the state. The LCFS aims to achieve a 20% reduction in the carbon intensity of California’s transportation fuel pool by 2030, with compliance standards set for each year.

Carbon intensity (CIs) based on composite of gasoline and diesel fuels under the LCFS

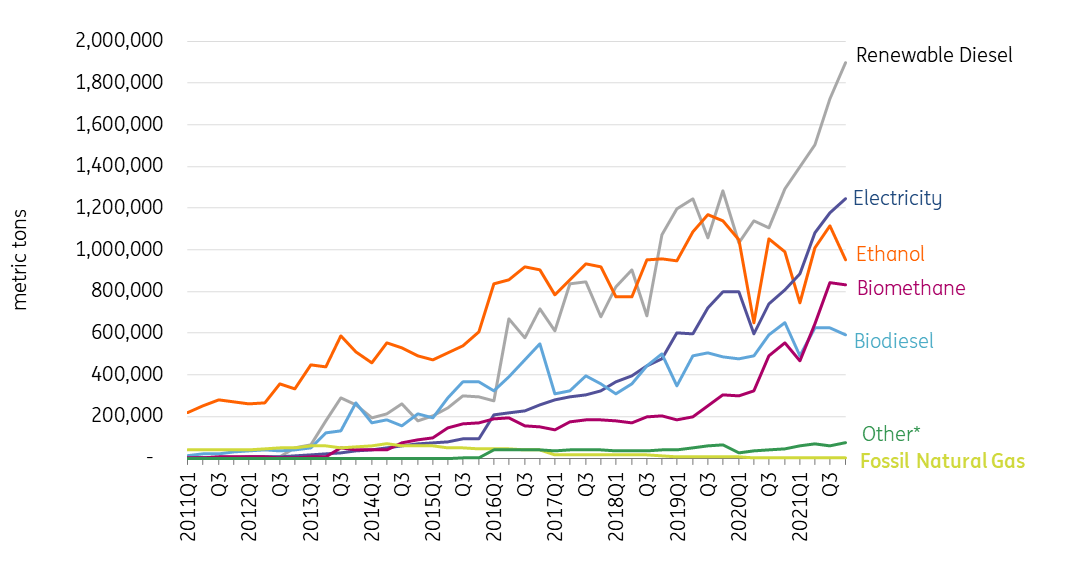

Since last year, LCFS credits (supply) generated from low-carbon fuels have increasingly outgrown LCFS deficits (demand), which has led to a 23% fall from the record high LCFS price of $206/metric ton to $158/metric ton in March 2022. This is mainly because the demand for gasoline and LCFS credits has not recovered from the pandemic, whereas the production of low-carbon fuels keeps growing steadily. The biggest driver of recent LCFS credit generation is renewable diesel, followed by electricity, which has been boosted by the continuing adoption of electric vehicles.

LCFS total credits and deficits for all fuels reported

LCFS credit generation by fuel type

It remains to be seen whether this deficit trend will be temporary or permanent; we also don't know how the expected implementation of similar programmes in adjacent jurisdictions will alter the LCFS system in California. In addition to the Clean Fuels Program in Oregon which is already in place, Washington State is expecting to implement its Clean Fuel Standard in 2023 and a federal fuel standard is set to come into force in Canada in the same year.

Other US states including New Mexico, Colorado, Minnesota, and states in the Northeast and Midwest are also in various stages of developing LCFS-style systems. These programmes will provide effective additions to the federal RFS programme in driving biofuels demand.

Renewable diesel takes the lead in advanced biofuel deployment

The production of biomass-based diesel – namely biodiesel and renewable diesel – has taken off in the US and is set to increase further. Of the two, biodiesel dominates the bio-based diesel market, but renewable diesel is seeing faster growth. This is partly because renewable diesel is compatible with existing distribution infrastructure and engines. With the same composition as fossil diesel, renewable diesel does not have a blending limit, whereas biodiesel typically accounts for up to 20% of fossil diesel in the US, because of insufficient regulatory incentives despite higher blends being available.

Renewable diesel’s ability to lower carbon intensity, particularly in trucking and aviation, has prompted several US refineries to invest in greenfield projects and/or convert traditional plants to process renewable diesel. Refineries set for conversion include Marathon Petroleum’s Martinez refinery in California, CVR Energy’s Wynnewood refinery in Oklahoma and HollyFrontier’s Cheyenne plant in Wyoming. Planned renewable diesel capacity in the US is expected to reach 6bn gallons by 2025, up from less than 2.4bn gallons estimated for 2021.

One major challenge to the growth of both biodiesel and renewable diesel is feedstock availability and costs. It is estimated by Bloomberg New Energy Finance (BNEF) that the demand for bio-based diesel feedstock will more than double from 2020 to 38.3bn pounds (17.4bn kilograms) in 2022, and soar to over 64bn pounds (19bn kilograms) in 2024. Prices for bio-based diesel feedstock have also climbed since 2020, causing some companies to postpone their renewable diesel projects.

US estimated bio-based diesel feedstock use and implied future demand from capacity additions

In the long term, despite the growth momentum for bio-based diesel, the Energy Information Administration forecasts that bio-based diesel will remain a small part of the diesel market, accounting for less than 8% of US diesel production in 2050. This is partially due to competition from food consumption and electric vehicles (EVs), which will be discussed in a later section. Nevertheless, that 8% still translates into roughly 0.23mn bpd of production, a considerable absolute amount.

RNG to see demand build up in the power sector

Another promising advanced biofuel which is set for growth is renewable natural gas (RNG), or biogas that has been upgraded to replace fossil gas. RNG production capacity in the US increased at a compound annual rate of 35% between 2017 and 2021, thanks to $1.7bn of investment from oil and gas companies. Looking forward, RNG demand is projected to jump from 0.2 trillion cubic feet (Tcf) today to between 2.3 and 3.2 Tcf in 2040, according to BNEF. The fuel is forecast to be capable of displacing 6-12% of the US natural gas demand.

RNG can be produced from various sources. Landfill has the strongest supply and cost advantage – most landfill RNG projects can be economical at $10/MMBtu or lower; landfill accounts for more than 60% of the RNG credits generated under the RFS and more than 90% of the RNG credits under the LCFS. In contrast, RNG produced from manure is more costly – at $30/MMBtu or higher – but remains attractive under the LCFS as it offers one of the lowest carbon intensities of less than -300 gCO2e/MJ.

Importantly, although RNG demand from transportation dominates now, the majority of demand for RNG by 2040 will come from the power sector. In California, where the LCFS is advanced, RNG already contributes to 98% of natural gas used for transportation, mostly in municipal buses and trucking. This can add risks to future project returns if the produced RNG cannot be contracted in time. There is a potential in the long term for more RNG to be used in shipping, though it will encounter competition from other biofuels or synthetic fuels.

RNG producers are starting to pivot their focus away from the transport sector. Archaea Energy is aiming to sell its RNG to natural gas utilities through long-term offtake agreements. The company plans to allocate 65% of its RNG production to non-transport applications.

Admittedly, electricity generation from RNG today is more expensive than from conventional gas and the contribution of RNG to the grid is limited. Yet demand is likely to be sustained in the future, driven by climate commitments from commercial/residential customers and precuring requirements set for utilities. California now mandates utility company SoCalGas to increase RNG’s share of gas deliveries from 4% in 2021 to 12.5% by 2030. Oregon passed legislation to allow RNG to account for 30% of a utility’s purchases by 2045; the state is also letting utilities recover prudently incurred costs to meet the target. A handful of other states are considering similar policies.

Outlook for US renewable natural gas demand

The favourable outlook for RNG/biogas can also augment the production of bio-fertilisers, which can be generated from the waste from biogas production. This will help meet the rising demand for bio-fertilisers in the US, spurred by growing preferences for organic food, as well as concerns over the likely harmful effects of chemical fertilisers on both health and the environment.

US to pioneer in BECCS development

The US is poised to lead the deployment of bioenergy with carbon capture and storage (BECCS) technology, a high-potential application of bioenergy. BECCS involves converting biomass to heat, electricity, or liquid fuels while capturing and storing the CO2 that is emitted during the conversion process. Since the growing of plant biomass absorbs CO2, BECCS can achieve net negative emissions when the emitted CO2 from bioenergy generation is permanently stored. Indeed, the UN's Intergovernmental Panel on Climate Change highlighted in its most recent report the need for carbon removal technologies for the world to reach net-zero emissions.

The US is already a front-runner in CCS – it is home to 36 of the 71 new CCS projects added worldwide during the first nine months of 2021. On top of this, several BECCS networks are emerging in the Midwest thanks to lower costs of bioethanol production. Summit Carbon Solutions, for instance, is progressing with a project to link more than 30 ethanol biorefineries across Iowa, Minnesota, Nebraska, North Dakota, and South Dakota. With a total potential capturing capacity of 8 Mtpa, the network would be the largest of its kind globally. Valero Energy and BlackRock are partnering with Navigator Energy Services to develop an industrial-scale CCS network that would connect biorefineries and other industrial plants across five Midwest states.

The challenges facing bioenergy

The use of bioenergy is not without controversy. The main challenge is the negative impact of bioenergy generation from excessive land use. From an environmental point of view, growing feedstocks such as soybeans and corn can lead to more deforestation, degradation of soil, and harmful changes to ecosystems. From a social point of view, despite yield growth potentials, the more feedstock is used for biofuels, the less there will be for food production. This has been exacerbated by the Russia-Ukraine war, which has disrupted the global food supply chain as both countries are major exporters of several leading crops. Hence, concerns have arisen in the US that the increasing use of crops for biofuels will limit food supply and add pressure to food prices.

To tackle the problem in the long term, there needs to be a switch away from conventional, food-based biofuel feedstocks to advanced biofuels which use non-food crops, municipal solid waste, and agricultural and forest residues. The IEA forecasts that to achieve net-zero emissions by mid-century, 60% of the global bioenergy supply in 2050 will need to come from sources that do not need dedicated land use. Accelerating advanced biofuel production requires stronger incentives compared to those for conventional biofuels. In the US, the federal Biomass Crop Assistance Program provides financial assistance to producers of advanced biofuel feedstock. The Biden administration has also included in its FY23 budget $245m to accelerate the R&D of next-generation biofuel technologies.

Another challenge is that the traditional use of bioenergy (burning wood or traditional charcoal) remains controversial as it can cause more emissions and deforestation. The EU still categorises bioenergy as green in its Taxonomy, but has strengthened the criteria to exclude certain forms of wooden biomass from qualifying as “renewable”. In the US, the EPA sees bioenergy as a cleaner fuel, while also recognising its negative potential if not managed well.

Moreover, bioenergy-based solutions face scepticism that the supply chain – which involves biomass growing, transportation, storage, and processing – can emit more CO2 and harm the environment. That is why more precise monitoring and reporting of life-cycle emissions along a bioenergy technology’s supply chain needs to be in place.

Finally, competing low-carbon technologies can complicate the growth of bioenergy. In the transport sector, the massive adoption of EVs will be a major threat to the demand for biofuels. As mentioned above, RNG developers are expanding their business footprint to the power sector, though these developers will likely encounter competition from renewable energy. Nonetheless, biofuels are still likely to maintain their niche in transportation, especially in heavy-duty trucks and aeroplanes, as it will be challenging for EVs to provide long-haul services without a step-change in technology.

Global bioenergy supply in the Net-Zero by 2050 Scenario, 2010-50

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

19 May 2022

So many questions… we’ve got some answers This bundle contains 6 Articles