Prepare for huge US trade changes as Trump goes America First

You can be sure that big changes are coming as far as US trade is concerned, even if we didn't get any new tariffs on President Trump's first day in office. A comprehensive investigation into US trade relationships was initiated via a memorandum. China, Canada, and Mexico are clearly in the immediate firing line. Here's what to expect

There's been a whirlwind of news, threats, and plans on potential US trade policy in recent months, with figures like 10%, 25%, or 60% tariffs, new geographical names, and potential changes to the US landscape. Now, after all this anticipation, President Trump has ordered a comprehensive investigation into America’s trade policy, divided into three key areas, and it's set to conclude by April.

Potentially, a massive overhaul of current trade policies

To address unfair and unbalanced trade, the Secretary of Commerce and the U.S. Trade Representative will investigate trade deficits, unfair practices, and currency manipulation, recommending measures such as tariffs and new agreements. They will review the USMCA, existing trade agreements, and federal procurement impacts while assessing the feasibility of an External Revenue Service (ERS) to collect trade-related revenues. Additionally, they will tackle issues related to anti-dumping duties, counterfeit products, discriminatory taxes, and the duty-free exemption's impact on tariff revenues.

Intense investigations into trade policy with China will include reviewing the trade agreement for compliance, assessing the 2024 report on China's practices, investigating unreasonable practices, and reviewing legislative proposals. The Secretary of Commerce will also evaluate U.S. intellectual property rights in China and recommend measures for balanced treatment.

Additional economic security measures will be investigated, such as reviewing the U.S. industrial and manufacturing base for necessary import adjustments, assessing the effectiveness of import measures on steel and aluminium, evaluating national security technologies, and examining the impact of foreign subsidies on federal procurement to propose measures to combat distortions.

April deadlines loom for trade reviews: Will Trump invoke IEEPA before that?

The results of those reviews and recommendations are to be delivered in three reports by 1 April 2025 and the report on foreign subsidies on U.S. federal procurement by 30 April.

That doesn’t mean, however, that President Trump will not make use of his wild card, i.e. invoking a national emergency using the International Emergency Economic Powers Act (IEEPA). By invoking IEEPA, tariffs could come into effect immediately. To declare a national emergency under the Act, the President must issue a written proclamation or executive order specifying the nature of the threat and the legal basis for invoking it. This proclamation must be sent to Congress and published in the Federal Register. The declaration can take effect immediately or at a specified future date.

Congressional approval is not required, although it is advisable to consult with Congress beforehand. However, Congress has the authority to approve or disapprove the action. If Congress approves, no further steps are necessary. If Congress disapproves of invoking IEEPA to impose broad tariffs, it can:

- Terminate the national emergency through a joint resolution of disapproval using NEA procedures. Like a law, the resolution would need either a simple majority in both chambers and the President's signature or both chambers would need to override the President's veto by a 2/3 majority.

- Amend IEEPA to limit its use for imposing tariffs. Several bills were introduced in the 116th Congress to restrict IEEPA following President Trump's 2019 tariff threat against Mexico but were not approved or enacted into law.

While there would be legal backlash, as the Act has never been used for tariffs, it remains far from clear whether this would result in a successful legal challenge. It's worth noting that President Nixon declared a national emergency in 1971 to justify imposing a 10% additional tariff on all imports entering the US but under a different law.

Canada and Mexico remain in the spotlight for the time being

President Trump's commitment to invoking IEEPA was evident when he addressed reporters in the Oval Office on inauguration day. He announced that tariffs of 25% on Mexico and Canada could take effect starting 1 February.

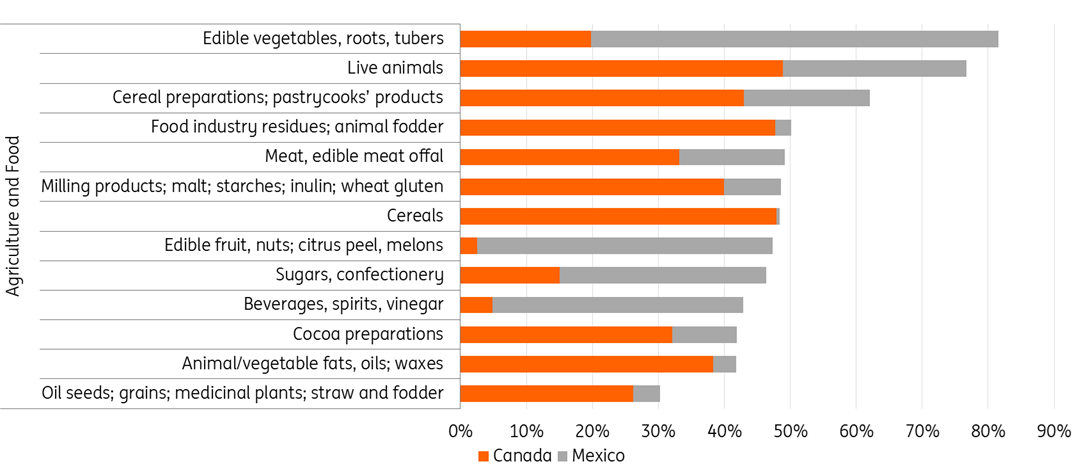

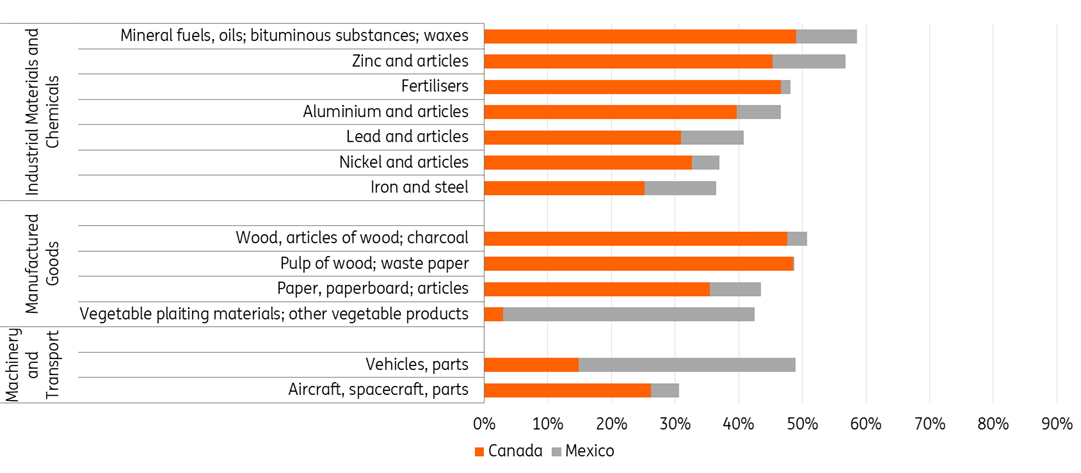

With more than 15% of all US imports coming from Mexico and 13.7% from Canada in 2023, about a third of everything the US imports would be affected by unilateral tariffs, potentially disrupting supply chains and impacting the economy significantly. Mexico’s share of US imports exceeds 25% in seven categories, Canada’s share of US imports exceeds 25% in 20 HS2 (Harmonized System Code) categories.

These categories include agricultural products, food and beverages, automobiles, metals, wood, and industrial products. As a result, everyday items, including a typical US breakfast, could see a significant price hike this year, in addition to already soaring coffee prices.

Share of Mexican and Canadian goods in all US imports

as of 2023 by HS2-Code

Watch for actions, not just words

Remember that in 2019, Trump announced on 31 May that he would impose a 5% tariff on all Mexican imports starting 10 June, using the IEEPA. This tariff was set to gradually increase to 25% until illegal immigration across the southern border was halted. However, on 7 June 2019, he cancelled those plans, stating that the U.S. and Mexico had reached an agreement. It's important to note that simply announcing action without following the legal steps does not constitute an official act. The threat remained just that because the statement was not published in the Federal Register, where all details and reasons must be explained. This does not mean that a national emergency under IEEPA would not have been officially published eventually, but for that week, it remained a mere threat and not an official act.

While we cannot assume the same will happen during Trump's second term, given his tendency to stir markets and create volatility, it is wise to remain cautious and not take anything for granted until it is a confirmed reality.

For now, our baseline trade outlook for this year remains unchanged

Our educated guess back in December was that new tariffs would be implemented from the second quarter of 2025 onwards.

That said, we expect the US administration to use targeted tariffs to gain concessions, possibly delaying implementation, as tariffs will negatively impact US consumers and the economy. Despite disruptions, trade in goods is projected to grow by 2.5% year-over-year in 2025, driven by heavy front-loading in the first quarter and increased intra-continental trade throughout the year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article