America booms: A strong GDP report across the board

The US economy expanded at an annualised rate of 4.1% in 2Q18. With inflation on the rise and the jobs market looking strong the Fed may have to strike a bolder tone at next week's FOMC meeting

Breaking down the numbers

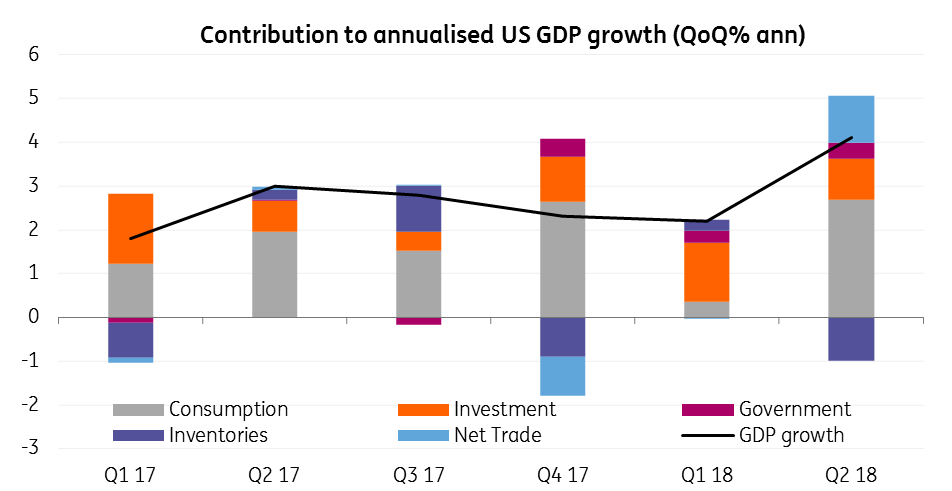

US second-quarter GDP growth has come in at 4.1% annualised, broadly in line with expectations, while Q1 was revised up from 2% to 2.2%. The report is incredibly strong throughout. Consumer spending rose 4%, government spending was up 2.1% and non-residential investment was up 7.3%. Exports surged 9.3% and imports barely changed meaning net trade contributed 1.1 percentage points to the headline growth rate.

The only weakness was in residential investment which fell 1.1% after a 3.4% drop in Q1 while inventories subtracted 1% from headline growth. These developments are actually very supportive for 3Q18 growth – inventories will be rebuilt after such a sharp run down, while the strength in housing demand means a rebound in residential construction is only a matter of time away.

US GDP growth bounces back

The Fed's next move

In terms of the outlook, trade tariffs and worries about protectionism appear to be making business a little cautious. But we have to remember that the effective tax hike from the tariffs enacted so far is dwarfed by the $1.5 trillion dollars of tax cuts on wages and profits President Trump signed into law last December. As such household incomes and corporate cash flows are in great shape with the high-frequency data suggesting the US has very positive momentum for the second half of the year.

Growth could slow a touch overall in 2H18 given trade uncertainty (which could depress capex and hiring) and the effects of monetary policy tightening, but we still think the economy can expand 3% over 2018 as a whole. At the same time, all the key inflation measures are at or above the Federal Reserve’s 2% target and there is growing anecdotal evidence that wages are rising more quickly (the Fed’s Beige Book for example). Consequently, we continue to look for a September and a December rate hike with the Federal Reserve potentially providing a more forceful statement of intent at next Wednesday's FOMC meeting.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

27 July 2018

In case you missed it: From ‘foe’ to friend? This bundle contains 6 Articles