Aluminium: Yet another extension for Rusal

LME aluminium continues to trade at depressed levels. This is despite expectations of yet another ex-China deficit in 2019, a buoyant alumina market, and Rusal uncertainty. We remain bullish on aluminium moving into next year

Where do we stand with Rusal and sanctions?

In the aftermath of US sanctions on Rusal, LME aluminium surged to $2,537/t- a level not seen since August 2011. However since then, the market has trended back down towards the $2,000-2,100/t range, as the US Treasury provided a number of extensions to Rusal. The aluminium market has also been unable to escape the downward pressure across the base metals complex from an escalating trade war between the US and China. Deadline extensions from the US Treasury, including the latest, which gives Rusal and the US until 12 November to come to a deal (the previous deadline was 23 October), have given the market some comfort that the US is keen to come to an agreement. Based on media reports, Rusal also appears optimistic that a plan for Oleg Deripaska to reduce his controlling stake in EN+ and ultimately Rusal will be accepted.

Along with the extensions, the US has allowed existing Rusal clients to enter certain new supply agreements, as long as they are consistent with past behaviour. The move is aimed at maintaining the status quo, as the absence of supply agreements could force Rusal to curtail output, whilst buyers would be forced to look elsewhere for supply, in an already tight market. While the clarification allows agreements to be negotiated, risks remain as to how new agreements will be worked out after 12 November if the US Treasury doesn’t provide sanction relief. In that case, buyers might be exposed once again to supply risks.

We expect that the US and Rusal will come to a deal, and if this is the case, we could see some immediate downward pressure on the market. We believe this would provide a good buying opportunity for consumers, with the market outlook still remaining constructive, driven by expectations for yet another deficit year in 2019 and stronger alumina prices.

What happens if there is no deal?

Russia exported 3.2mt of aluminium in 2017 with nearly 31% (1mt) of it going to the US, followed by Japan (0.53mt), Turkey (0.52mt) and the Netherlands (0.23mt). Rusal exports contributed to nearly 12% of global aluminium trade, and without Rusal supply, the ex-China deficit would likely widen to somewhere in the region of 4.5-5.0mt.

Rusal reported that its aluminium sales fell 12% year-on-year to 1.75mt over the 1H18. The majority of this decline occurred in 2Q18, with aluminium sales falling nearly 22% YoY, as buyers became increasingly cautious following the announcement of Rusal sanctions. Meanwhile the company’s production was largely flat over 2Q18, resulting in the buildup of stocks. Rusal has already had to wind down some operations, announcing in August that it would shut production at the Nadvoitsy smelter, which has a capacity of 24ktpa but has recently been operating at about half this level. Whether we see further shutdowns will depend largely on the outcome of talks between Rusal and the US.

However, if we assume there is no deal, who can replace Rusal supply? One option is to draw down inventory, with estimates of off-exchange stocks outside of China in the region of 5mt, while inventories in the LME system stand at just under 1mt. But we would need to see a change in the shape of the forward curve. At the moment, it is largely in contango and so there remains an incentive for off-warrant holders to roll short hedges forward. We would need to see the curve move into backwardation (like we saw after the initial sanction announcement), in order to encourage off-warrant holders to liquidate their short hedges. The current shape of the curve, however, appears to confirm market expectations that there will be a positive outcome between Rusal and the US.

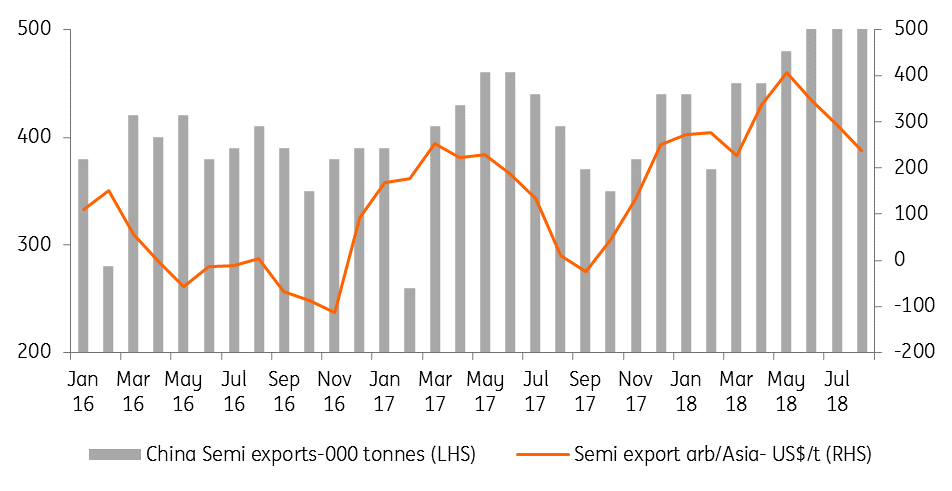

The other solution for the ex-China balance would be for the Chinese export arbitrage for primary metal to open up, which would allow the Chinese surplus to make its way onto the world market. This is easier said than done, with primary aluminium exports attracting a tax of 15%. Therefore we would need to see strength in LME prices, weakness in Chinese domestic prices, or a combination of the two. Chinese domestic prices, however, are unlikely to come under pressure in such a scenario. In order to see this, we would likely need to see Rusal material making its way into China at discounted levels, freeing up more Chinese material for the global market. However, before the potential for primary exports, we would likely see a pick-up in Chinese semi exports, with the export arb currently open.

While our current aluminium price forecast of $2,350/t over 2H19 assumes a deal between Rusal and the US, failing to come to a deal would likely mean prices of closer to $3,000/t.

Open Chinese semis export arb continues to support export flows

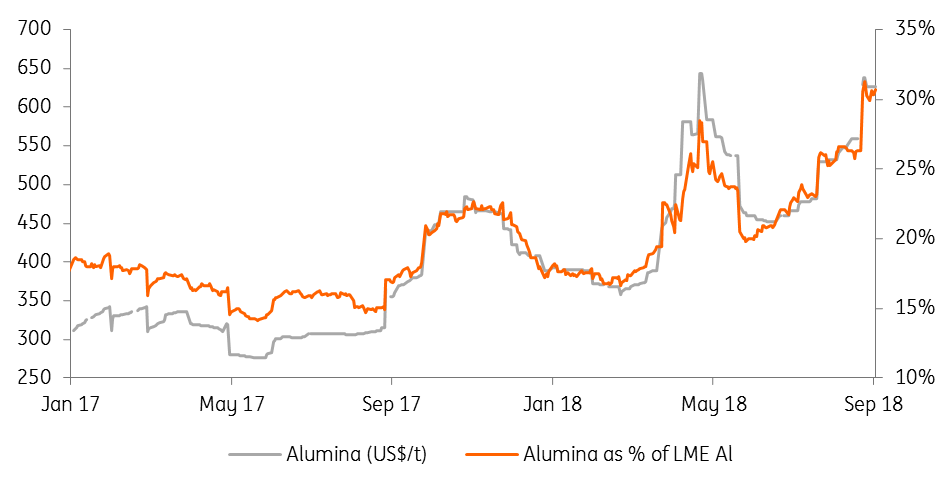

Alumina reinforces our bullish view

Stronger alumina prices should also be constructive for the aluminium market. Alumina prices traded back up towards nearly $640/t in early September- a level last seen when Rusal sanctions were originally announced. The strength in alumina prices and the depressed aluminium market have meant that the price ratio of alumina to LME aluminium has broken 30% compared to historical levels of around 15-20%. A rallying alumina market, along with strengthening power prices, has clearly put pressure on smelter margins. Given the continued outlook for deficit we do not believe this is sustainable, and would need to see margins widen to more attractive levels for smelters.

The key drivers behind a stronger alumina market have been Norsk Hydro’s Alunorte refinery operating at 50% of its 6.3mtpa capacity. There are also concerns over potential disruptions from Alcoa’s operations in Australia due to a labour dispute, while uncertainty around Rusal also has implications, given the company’s alumina operations; alumina sales from Rusal over 1H18 fell by 7% YoY to 953kt. The Alunorte disruption has gone on for longer than initially anticipated, but recently Brazil and Norsk Hydro signed cooperation agreements, including a Term of Adjusted Conduct (TAC) and a Term of Commitment (TC) to ease concerns on social and environmental action, which is expected to lead to the resumption of full production at site. For now, there is still no firm restart date but once Hydro receives the approval, it could still take a month to return to full production, according to the company.

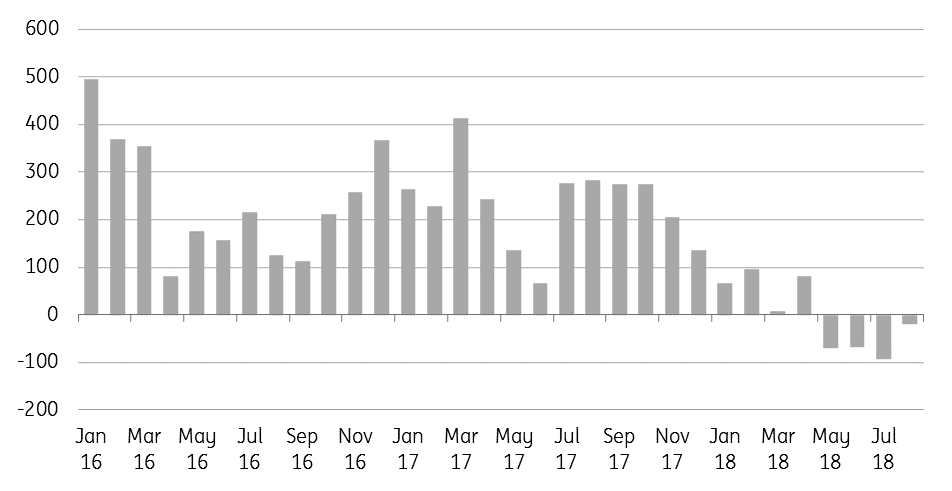

What has helped the ex-China alumina market to a certain extent has been the fall in Chinese imports. In fact, China has become a small net exporter of alumina to the world market. In the first eight months of 2018, China was a small net exporter of a little over 3kt, compared to a net importer of 1.9mt over the same period in 2017. However, this is unlikely to last, at least in the short term, given that the Chinese alumina market will likely tighten as a result of the upcoming winter cuts.

Alumina/LME aluminium price ratio breaks 30%

China moves from a net importer to net exporter of alumina (000 tonnes)

Tags

AluminiumDownload

Download article

26 September 2018

In case you missed it: Collision course with Brussels This bundle contains 8 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more