Aluminium: Macro, fundamentals and uncertainty

Expectations of a bear trend may be misplaced this autumn. Instead, the risk to prices is more skewed to the upside in a reflationary macro environment. Fundamentals do have room to play out, but there is uncertainty in the short-term and China's market is still key

For producers, the strength in prices suggests few are losing money

Aluminium continued its upward march during August, with LME 3M prices shooting over USD$1,800/t last week, erasing all of the losses so far this year. Prices are running above most of the marginal producers’ costs, which is in stark contrast to the surplus market and weak demand (ex-China) post-pandemic. Shanghai aluminium prices have been leading the rally in the aftermath of the lockdowns, and they are above the average smelters' costs, which are believed to be at the high end of the industry curve on a cash basis. Most of the smelters are receiving positive cash margins, including those without a captive grid.

Fig. Aluminium exchange prices versus the US dollar index

The main drivers haven’t changed, but the tailwinds from the macro side may be having a stronger impact on the overall industrial metals sphere. In the meantime, China has been holding on to the demand recovery narrative and has continued to import both primary aluminium and alloys, easing the glut from the market outside the country. The inventory gains are somewhat below expectations amid a seasonal lull, but there have been growing expectations for more robust demand from China entering September. A rise in alumina prices has also helped to spark optimism.

Fig. Aluminium inventories (*LME off-warrant updated up to June)

Elsewhere, signs of demand recovery add to optimism

It is not all about China. The global recovery path has been asymmetric and economic indicators have suggested a continued recovery of industrial activity from other major economies. Regional premia may partially tell a story of aluminium demand recovery from some regions. In Asia, the latest reports indicated that some buyers had agreed on the 4Q20 premium with an increase of 11% to $88/t after it settled at a four-year low in 3Q20. In Europe, physical premia have also been creeping up, with higher premiums reported in Rotterdam P1020 aluminium, while there are also signs of better premia readings from Brazil.

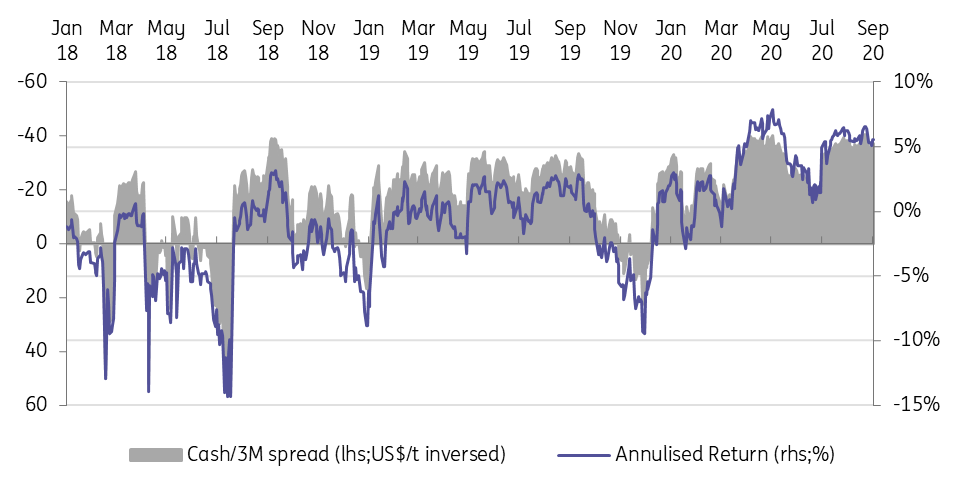

Nevertheless, rising premium in the ex-China market may tell a different story. Over the last couple of months, stocking financing seems to be offering a consistent annualised return, particularly considering a world of nearly zero interest rates. There may be a big discrepancy between what is readily available to purchase on the spot market and what inventories numbers are suggesting. As a result, the physical premia would need to match the profit margin from what the LME contango carry trade could offer. In the meantime, stock financing has been helping to lock away some excess supply, but pressure could still remain over the medium term.

Fig.Aluminium stocking financing annualised gross returns-implied

Key factors to unfold over the short-term

We tend to believe that expectations of a bear trend may still be misplaced this autumn. Instead, the risks are still skewed to the upside in a reflationary macro environment. As a real asset, of course, the fundamentals do have room to play out. However, there are some uncertainties in the short-term fundamentals, and China still plays a key role in this market.

- First, supply is set to accelerate, which could see higher production growth, and in theory, current margins should incentivise new capacity to switch on as quick as possible. August and September saw intensive commissioning of new capacity, together adding up to around 1.5mn of capacity against a total estimated 2.8mn tonnes of additional capacity scheduled for 2020.

- Second, on the demand side, there have been expectations for more robust demand during September and October after a relatively dull August. It remains to be seen which factor is more important and the net effect may be reflected in inventories. A bull case scenario that demand outweighs supply growth would lead to a destocking process, and there may be another leg higher. This scenario assumes that capacity ramps up at a slower pace so that more production doesn't hit the market too quickly. It could be that this case is pushed out towards the end of this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

AluminiumDownload

Download article