Alumininium: Over to China to fill the void

Aluminium prices are up 11% since news that Rusal will be included in the US sanctions list. It’s now up to Chinese flows to fill a deepening deficit beyond its borders and curb the LME rally. Keep an eye on the following to navigate the volatility

Rusal sanctions extend beyond the US

On 6 March, the US placed Rusal under sanctions. A temporary license allows existing agreements to be wound down until June 5th. While only explicitly forbidding US entities from dealing with sanctioned parties a non-US entity can be penalised too, and that can vary from denying visas to freezing USD credit lines.

We think this is much more than just a US issue, consumers are worried globally about taking Rusal material especially multinationals with exposure to the US. Rusal produced 13% of aluminium outside of China last year, so the repercussions are serious.

Aluminium was already poised to turn

The pace of the rally should be placed in context as LME prices were already looking heavily oversold and ready to jump.

With the LME price now breaching below $2,000/mt, we highlighted before the sanctions were announced, that because prices had fallen less on Shanghai, a closed arbitrage for Chinese semi exports would soon see ex-China markets tighten and prices were likely to recover. With Chinese margins averaging zero, a Shanghai and incremental LME uplift seemed inevitable.

Ex-China deficits get tighter, it will be up to China to fill the void

Even before Rusal sanctions, we were bullish aluminium expecting $2,300 by second-half of 2019 because of deepening deficits outside of China which is the main domain of LME prices.

We already had a 1.75Mt 2018 shortage with generous assumptions for US smelters to restart. In a perfect storm, Hydro’s recently announced 230kt loss at Albras increases shortage to 2Mt. The more Rusal supply exempt from consumption (3.7MT in total) then deficits both global and Ex-China get astronomical, but we suspect customers will yet appear (at a discount).

The last thing China needs is more aluminium units, but those companies have least to lose from US penalties, and if Rusal can stomach the discount we would expect units to flow here. China could, in turn, boost semi and even primary aluminium exports to ease the rest of world shortage as we explain further below. Chinese capacity utilisation was only 80% last year if higher prices can incentivise an additional 10%, which alone can add 3.6Mt of supply although doing so faces challenges from environmental controls.

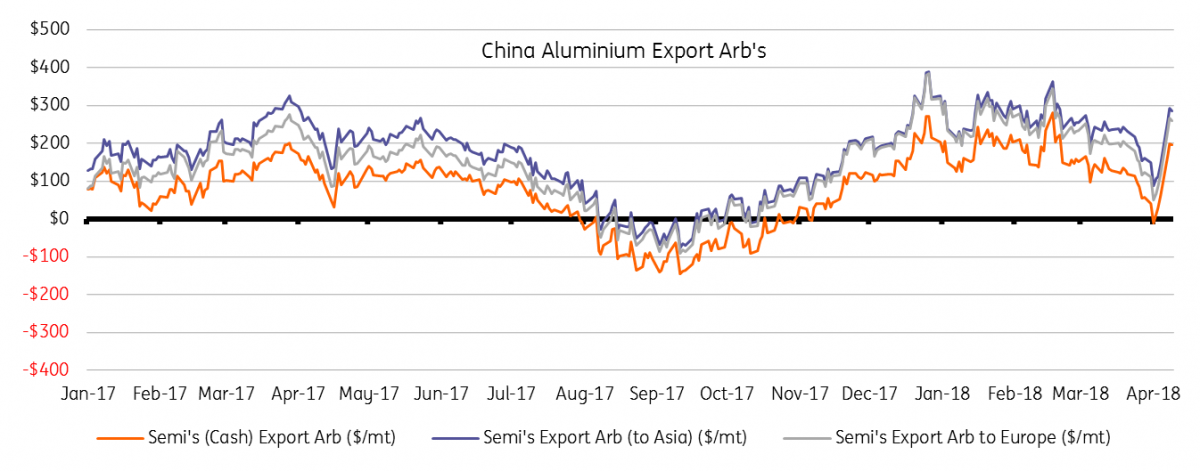

Turning profitable for Chinese semi's exports

($/mt)

The US looks tightest, but rest-of-world premiums should also rise

Russia provided almost 20% of US unwrought aluminium imports last year, so just as US premiums were starting to retreat on section 232 exemptions, the latest scramble by consumers has pushed the front month on CME above 20c/lb. Even the forwards think this has overrun with the curve in backwardation, but 2019 is still a hefty 19.75c/lb.

Since Russia was not 232-exempt, we were expecting Rusal imports to be increasingly displaced by those exempted including Canada, Australia and EU but it will now get even more competitive to source.

High premiums play to our original bullish stance of discouraging LME metal to appear on warrant and escalating the trend of sharp backwardations as explained in our 2018 Aluminium outlook.Section 232 and 301, will keep the US looped out from any Chinese export relief supporting the high premiums. Europe and MJP premiums expected to play catch up with the US in near term.

LME suspending Rusal brands

After April 17th only material produced before the imposition of sanctions, which was 6 April can be delivered on to the exchange and only if it doesn't involve sanctioned parties. This is a U-turn from the announcement on Friday that the Bourse had no immediate plans to change its requirements.

We had previously cautioned that Rusal deliverability would render premiums more exposed then LME prices, but now its game on for all (ex-China) price benchmarks with Rusal supply excluded. Comex also suspended Rusal, but it remains deliverable on Shanghai.

Existing stocks

LME warehouses can still put pre-sanction produced metal on to warrant after April but to avoid challenges, the next few days could see a rush of material. Best estimates circulating suggest Rusal might represent 25% of off-warrant stocks which we believe are around 4MT ex-China. The LME published that already 36% of LME stock are of Eastern European origin, so mostly Rusal.

Meanwhile, just 18kt of LME stock cancelled at Port Klang shows a surprisingly mild run on the non-Rusal stockpiles. Should Rusal stocks continue to dominate, we could see a divergence between premiums and LME back on the cards.

Spreads flip

As aluminium surged on Monday, the lLME Cash-3M flipped from a contango of $20.50c to a backwardation of $16b. Anticipated tightness amid the loss of 13% of ex-China production resulted in a big shuffle of short positions with the resulting squeeze escalating the outright rally.

As Rusal (pre-sanction) stock is delivered, we still expect many consumers to shun those brands. Should this result in, those warrants being churned through clearing rather than financed this could indeed loosen spreads.

We have always emphasised that for Aluminium the curve matters more than it does in any market. If the spreads do indeed ease this will pose near-term resistance for the rally. On the other hand, as the deficits pull on off-warrant metal, the curve will need to tighten to incentivise the unwinding of stocks in financing.

Chinese exports: watch the arbs!

As we mentioned above, (point 2) the closed semi’s export arb was a sign, markets had oversold, but now the export incentive has rebounded to previous January and February highs.

The growing shortage outside of China will incentivise LME to trade at a growing premium to Shanghai to incentivise exports. Should this differential surpass the 15% export tax, China could even begin to export primary metal.

Should Rusal metal indeed make its way into China then the local SHFE benchmark could depress enough to make this profitable. The flow of Chinese material to fill the rest of world shortage will provide the fundamental ceiling to this rally. We estimate that given average Chinese smelting costs the LME price must trade at above $2,200 for a Chinese smelter to produce and export at a positive margin.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 April 2018

In Case You Missed it: Trumpian uncertainties This bundle contains 5 Articles