How AI productivity gains are set to diverge across European sectors

Wondering how AI could impact sectors across Europe? We’ve taken a look at the details, and we’re inclined to think that smaller sectors stand to benefit the most in the near term. Larger sectors may not be ready to implement AI just yet – and for some, perhaps not at all. We think productivity gains will be limited to around one percentage point per year

Smaller sectors benefit the most from AI

In order to profit from artificial intelligence, companies require good data – and this gives sectors with more digital business processes a leg up. This means that sectors that are more digitalised will be able to implement Generative AI and enjoy subsequent improvements in productivity sooner. Interestingly, more digitalised sectors, such as the Information and Communications Technology (ICT) sector, are also those that contribute a smaller amount to GDP than less digitalised sectors like manufacturing and transportation. The larger sectors of the economy will therefore need a longer timespan to unlock the benefits of AI. In turn, we believe that productivity gains from AI in the near term (i.e., within the next three years) will be limited.

Limited digitalisation in some sectors does not mean that there aren't any potential benefits of the use of AI in the longer term. Our article looks at how AI will impact productivity in sectors in both a near and longer-term timeframe and at the potential size of this impact. We'll also take a look at where exactly in the value chain this impact takes place.

The most promising applications we have witnessed so far are mostly centred around language and image generation. Other examples include image recognition in the healthcare sector, customer communication, marketing, administrative tasks and software programming.

Smaller sectors of the economy are set to profit more from AI

The relative economic importance of the sector versus the degree of digitalisation

What is AI?

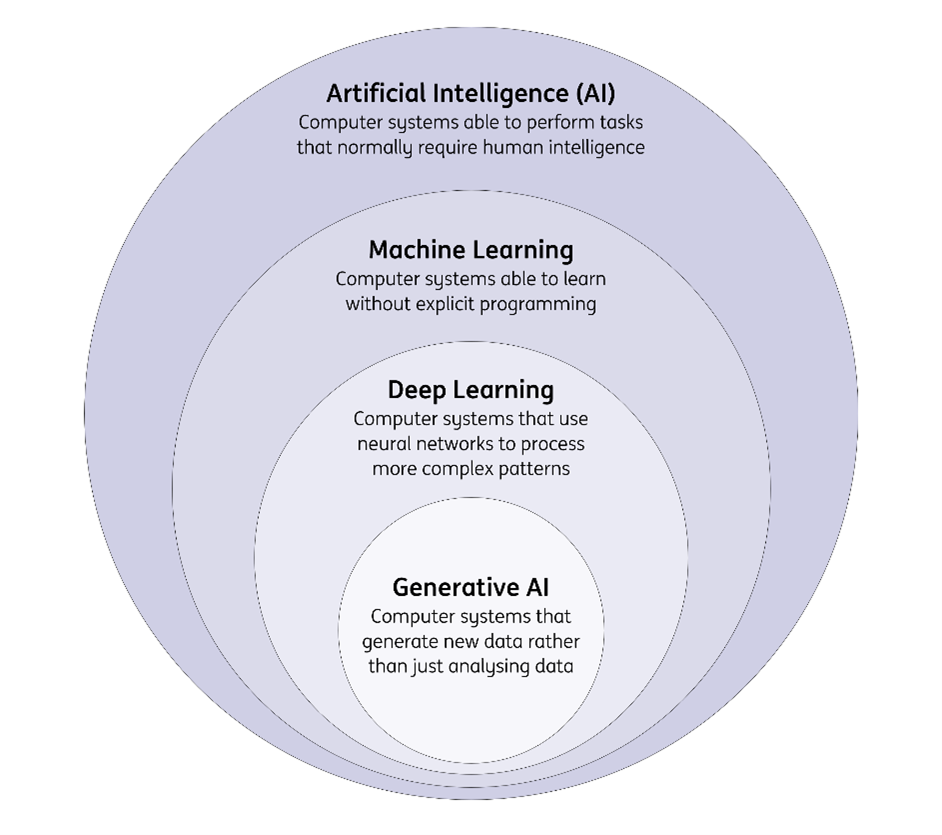

Artificial intelligence is a fairly broad term that can mean different things to different people, so before we dive into the differences between individual sectorsm let's first take a look at a solid definition.

AI is essentially the study and development of computer systems that can perform tasks that generally require human intelligence. It therefore includes both machine learning and deep learning. Generative AI is a subfield of deep learning – computer systems that can generate new data instead of merely analysing it. It differs from other forms of AI in its ability to generate content (for example, creating text, maths, coding and videos) that emulate human-generated content. This article focuses on the effects of AI on specific sectors. Throughout our analysis, we'll explicate the type of AI we are referring to.

While AI is a broad term, it does not include robotics. AI entails computer programming to emulate human tasks, whereas robotics is a field of engineering that aims to construct and operate robots. When put together, you get artificially intelligent robots where AI acts as the brain, and robotics acts as the body. Better AI can therefore enable development in the operation and intelligence of robots – but it's an altogether separate field.

AI also faces a few general obstacles and risks, and we discuss those here in more detail. They apply to all sectors covered in this article and we will therefore refrain from reiterating those.

AI consists of several levels

Generative AI can speed up specific tasks

Similarly to the digitalisation of business processes, the tasks carried out by employees also matter for expected productivity gains. Employees with tasks that involve working with large amounts of data, text or graphics will likely see large productivity gains when performing them with the help of AI. The graph below illustrates how tasks that can be carried out more efficiently with the help of GenAI match the degree of digitalisation in different sectors.

Generative AI offers most productivity improvements for tasks in highly digitalised sectors

Degree of exposure to Gen AI and degree of digitalisation

Business services

GenAI as a reliable and productive assistant

The business services sector has potential for multiple AI applications – and gains could be considerable in accountancy, legal and staffing productivity.

The business services sector covers a wide range of activities, ranging from professional business services – including accountants, architects and consultants – to facilities service providers, such as cleaners and security guards. Specialised service providers in particular are to a large extent digitalised, as are the travel and staffing industries. A significant part of the work in these sectors can be completed more efficiently with the help of AI in the long term. On the other hand, AI is less relevant for facility services because most of the work (e.g., cleaning, gardening, security) cannot yet be carried out digitally.

In the legal profession and in accountancy, AI is already used (among other things) for compiling and checking contracts. While currently still in the experimental phase, AI can also be used for audits by accountants. This could ease some of the workload caused by the persistent shortage of auditors in the longer term. The use of AI speeds up processes and ensures quality gains by reducing error sensitivity and enabling faster detection of fraud.

Generative AI is revolutionising the staffing industry by enhancing operational efficiency and strategic decision-making. AI is already used to draw up vacancy texts, job descriptions and matching work with the right candidates. AI can do this faster and more efficiently than hiring managers because it can analyse large amounts of data in a short period of time. This also increases the chances of a successful placement. The next step is that AI will also be used for screening candidates and predicting market trends, such as future hiring needs and determining which skills will be in demand.

Real estate

Data improvements needed to unlock potential of GenAI

While real estate is a bit more digitalised than the average sector, we do not expect productivity improvements in the near term because of data issues.

The potential value added by GenAI in the real estate sector lies between $110 billion and $180 billion according to research by McKinsey Global Institute from 2023. From its own work with real estate companies, it measures an increase in net operating income of more than 10% due to GenAI applications. The positive effects are among others driven by cost reductions and improved services to tenants.

How long it will take for these gains to manifest – and whether or not they will – remains to be seen. Currently, the lacking availability and quality of object-specific data remains an important hurdle. Real estate's reputation of being a sector with a low rate of innovation may be a second barrier.

Due to digitalisation in the real estate sector, the availability of data on building characteristics is steadily increasing. This will increase opportunities for real estate investors to deploy GenAI over time. For example, the emergence of online platforms for connecting supply and demand in the occupier and investment property market in the late 1990s has been a major development.

Apart from the current issues around data quality, the available real estate data is spread across many different sources that are sometimes, but in many instances not, publicly accessible. The latter suggests that commercial real estate service providers with a rich proprietary dataset have an asset in hand to reap part of the potential extra value added from GenAI applications.

One potentially important value add of GenAI is that it can help achieve better and faster property valuation. Currently, this is still a relatively time-consuming process, as the differences between buildings are large and not all relevant features can be found in one place.

GenAI can also enhance the efficiency of property management and leasing. Applying a copilot for various interactions with existing tenants is one example. Applying GenAI to shape the optimal pathway of properties to net-zero is another.

Manufacturing

Slow digitalisation prevents rapid breakthrough of AI

AI has the potential to aid manufacturing outside its current use cases. However, sluggish digitalisation means that these benefits will be slow to materialise.

AI is a promising technology for the manufacturing industry. In addition to the more regular efficiency benefits of AI applications for functions outside the factory floor (such as engineering, marketing, sales and customer service), AI will ensure increasing productivity gains in the production process and the supply chain. The sector has been working on further automating and robotising processes, with strong productivity gains and cheaper products for decades. However, growth in productivity in European manufacturing has been declining steadily for several decades. AI can cause a trend break, but this will not be the case from today to tomorrow.

The digital transformation is accelerating in all sectors, and manufacturing is no exception. However, the manufacturing industry's lag behind other sectors is considerable. The fourth industrial revolution, also referred to as Industry 4.0, is the next phase in the digitalisation of the manufacturing sector, driven by interconnectivity, automation, and machine learning. The European manufacturing industry is not yet halfway through this (r)evolution. Apart from the development of new industrial AI tools, more digitalisation, more interconnected IT systems and more integration of IT systems and production technologies are needed to disclose the data AI applications run on. It will therefore take years for AI to live up to its full industrial potential.

In the meantime, AI is already being used in various forms. For example, for optimisation of production planning or for quality control. In addition, AI systems analyse sensor data during production to be able to adjust the process early in the event of errors. With predictive maintenance, AI uses data from the production process to be ahead of machine storage. AI-controlled robots can work more autonomously than pre-programmed robots, which makes automation possible with increasingly an smaller product series – i.e., to minimise manual actions during assembly work and product handling at the beginning and the end of machine operations. If the supply chain is further digitised in the longer term, AI can also be used to have purchasing and order processing take place more autonomously.

Transportation & logistics

AI takes logistics planning and supply chain management to the next level

AI offers promising avenues for the optimisation of planning and supply chain management. Yet data availability is not optimal, which means the benefits of AI will not arrive immediately.

AI has a tangible, physical impact in transportation by bringing the fully autonomous driving of trucks and cars closer to everyday reality. But given concerns and legal constraints, this will continue to be a gradual process by developing and extending driver assistance systems.

In logistics services and supply chain planning, where AI has already made inroads, more advanced applications could probably add most short-term value. The world is an increasingly complex and uncertain place to operate in for international shippers and their logistics partners. This makes the game of matching supply and demand (preferences) more challenging. Over the last couple of years, the reliability of overseas shipments has weakened due to shocks related to the pandemic, wars and geopolitical tensions. More extreme weather also brings permanent uncertainty. This all leads to swings in supply and demand, with seasonal patterns shifting, while sustainability-related policies also have a growing impact. Consequently, shippers and their logistics partners are seeking to build resilience by diversification or securing more buffer stocks to reduce risks. But more intelligent and predictive analytics could probably also be part of the answer.

There’s still plenty of opportunity to improve decision-making by including more variables and (large quantities of) data, such as congestion and waiting times, weather conditions and environmental footprint. This could allow players to improve transport forecasting, find better alternatives for clients, enrich reporting and save on equipment hiring and staff. Logistics is a cost-driven and low margin business. With respect to improving performance, potential gains mostly focus on reducing cost and this is also where AI can make a difference. The optimisation of route planning and load factors still offers potential gains. In European road haulage, for instance, progress in reducing empty running has stalled over the last couple of years, with 20% of the truck miles still in operation empty.

This sounds promising, and companies can incorporate internal and external data. But it’s also good to realise that supply chain cooperation and the interchange of data are critical factors. Mutual interests should therefore be at the forefront here. Road transportation in particular is still largely the domain of small and medium-sized enterprises (SMEs). Sometimes, they’re able to leverage the services of their charterers – but unlocking the potential of AI requires both ICT investments and expertise, for which scale is necessary.

Energy

Potential for smart solutions, but also increased energy demand

AI will likely increase energy demand, but can also be leveraged for smarter energy solutions.

There are three ways AI can improve productivity through energy.

- AI is used in the energy sector itself to balance energy supply and demand in an energy system that is increasingly dependent on renewables and weather conditions. Furthermore, AI is used to execute efficient energy trading strategies, predict maintenance on power plants, run large call centres and secure the energy system from cyber attacks. While these effects are positive, they remain relatively small.

- AI is likely to boost energy demand, especially in the service industry where computer power requires significant energy. Higher energy demand translates to improved productivity as the current energy system is better utilised. But here too, the impact is relatively small and limited to the energy sector.

- AI might provide relief from grid congestion as it can manage complex electricity flows between generators, the grid and users. Since grid congestion increasingly limits entrepreneurs' ability to meet growth targets, any relief enhances productivity. This likely has the biggest impact because it spills over into other sectors.

Healthcare

Great potential, but issues with harmonisation and security of data will slow implementation

There are many great potential applications of AI within the healthcare sector, such as the analysis of images or easing the administrative burden. However, benefits are not expected in the near term due to privacy issues and data availability, which are an especially big hurdle in the healthcare sector.

In the healthcare sector currently, AI is mainly used in clinical applications – for example, to support diagnoses. Consider analyses of radiological images and recognition of patterns in health outcomes, or risk assessments in the ICU based on analyses of vital body functions. The number of medical applications will rise, and AI will be able to predict the course of diseases with increasing accuracy. A second application will be in supporting daily business operations.

AI will also be used to make hospitals smarter. For instance, in the sustainable use of energy or capacity planning. A third area of application is Generative AI. Speech technology and large language models (LLMs), for example, help to administratively process conversations between healthcare workers and patients. This way, healthcare workers have to worry less about administration and there is more time for patient care. Healthcare employees now often spend around 40% of their working time completing reports, retyping patient data and other administrative work. GenAI not only saves time and increases productivity, it also reduces the chance of human error. Time-consuming processes – writing discharge letters, matching protocols with results, or searching patient files with a complex history – are ideally suited for Generative AI. Some Dutch hospitals are currently using ChatGPT's LLM to help healthcare providers answer written questions from patients. The healthcare provider reads the AI-generated draft answer, adjusts it where necessary, and sends it to the patient.

However, the healthcare sector still has a long way to go to successfully apply AI on a large scale. The smooth digital exchange of (uniform) medical data between healthcare providers is often still a stumbling block. In addition, high demands are placed on the security of privacy-sensitive patient data. Both must be properly arranged in order to reap the full benefits of AI.

ICT

Best placed to profit from AI

The ICT sector is the sector that is best placed to profit from AI. Not just through new applications developed by the IT sector, but also in telecoms and media.

ICT will be the sector that sees the greatest change from AI, although the impact on its subsegments will vary. We distinguish three subsectors: the IT sector, the communication sector and the media sector. The communication sector can benefit from a greater need for bandwidth. AI applications often need to communicate with remote servers, preferably with low latency. This drives a need for fast fibre connections and 5G mobile solutions, as well as data centre services. Note that the telecom operators may be able to lower their cost base as well through more efficient marketing efforts and administrative services. The IT sector is the primary beneficiary from AI solutions as it provides the software for it, as well as many other solutions such as data management. We have seen that the cloud sector is already growing at relatively elevated growth rates, at the expense of legacy mainframe technologies. Finally, the media sector will likely see a greater use of content generated by GenAI. Note that the increase in IT hardware sales is not accounted for under the ICT sector. Overall, we expect a 6.5% growth rate for the ICT sector, with higher growth in the IT sector and slower growth in the communications sector, in line with historical trends.

Investments in AI startups also show that investments are not spread evenly over sectors, and larger amounts of investment go to sectors that focus on ICT. It's striking that investments in most other sectors are of a very limited nature. This again shows that investors expect that the benefits will initially arise in specific parts of the economy.

Private investments mainly go to ICT-related subsectors

2023 private investment in AI by focus area (US$, bn)

Food & Agri

Limited benefits from AI expected

Aside from a few applications that spot crop diseases, we don't belive that the food and agriculture sector will see any quick or sweeping productivity improvements from AI.

Food manufacturing tends to score a bit lower on digitalisation compared to manufacturing in general. What doesn’t help is that the sector consists of many SMEs because smaller companies tend to be slower in implementing technology that increases labour productivity. Meanwhile, for agriculture, the required capital investment in equipment that uses AI, such as robots, can be a major hurdle.

Many AI applications in agriculture and food manufacturing ultimately focus on lowering costs or improving the quality of food products that end up in consumers' shopping baskets. AI can, for example, lower costs by speeding up and improving the formulation of new products since models are able to assess a greater number of combinations of potential ingredients. Meanwhile, visual scanners with AI software are able to spot fresh products (like strawberries) that go out of date before reaching the consumer and ensure better quality products on the shelves.

Traditionally, agriculture can involve very labour-intensive tasks, such as marking plants that are infected by pests or diseases, or picking fruits. Clearly, there are productivity gains to be made when such tasks are carried out by robots that use AI. While we do see them being tested and deployed on larger farms and in controlled settings like greenhouses, there's still a long way to go before this becomes commonplace.

Construction

The rise and limits of digitalisation and AI

While the construction sector has caught up a bit in terms of digitalisation, large productivity gains are not expected in the near term. This is specifically because the scalability of applications is limited due to the physical nature of the work.

Compared to other sectors, the construction sector lags behind in digitalisation. Despite this, the growth rate has been higher in the last 25 years compared to other sectors. The main reason for this catch-up effect is that the internet became mobile during this time. All kinds of handheld devices (tablets and mobile phones) in combination with wireless networks (2G, 3G, 4G and the current rollout of 5G) have made it possible for digital information to be accessed from the construction site. This is key for construction companies; a computer at the office doesn’t offer much value for contractors, as most of the building process is outside and at a different location for every single project.

Generative AI provides all kinds of new applications for more efficient design, such as parametric design, where mutiple designs and various options are automatically generated in the design model. A parametric model instantly calculates the consequences if you change one variable (e.g., the size of the building).

AI also aims to optimise construction processes. AI systems can determine the most efficient work sequences, allocate resources and identify potential bottlenecks in projects. However, we believe that the impact of Generative AI will be limited compared to other sectors. The improving but still low level of digitalisation of the sector and limited scalability (due to the phsycial structures that must be produced) mean that the implementation of GenAI in construction is less attractive than it might be for other sectors.

Financial services

Banking sector poised to benefit from Generative AI

The banking sector could benefit from AI quickly. Applications are related to both back office and client-facing procedures.

The development of digital technology over the last few decades has reshaped client interactions for banks, as well as their internal processes. It’s with little surprise that the banking sector was quick to explore the potential of GenAI.

Research has highlighted that the banking industry is among those that could benefit the most from the development of Generative AI. These gains are estimated at an additional $200bn to $340bn per year upon full implementation, stemming from both back-office improvement (mostly cost-cutting) and client-facing business.

For back office operations, GenAI has proven efficient in optimising coding, information processing and freeing employees from repetitive work. This is especially the case for processes requiring a significant amount of information and complex analyses such Know Your Customer (KYC) and Customer Due Diligence (CDD) processes, significantly improving productivity. Some reports also show the development of AI tools in improving cyber security and detecting information breaches. This would improve banks’ safety and potentially affect client trust towards the sector.

GenAI has also been developed to improve client relationships through personalised platforms and apps, as well as AI-powered chatbots to enhance customer satisfaction. Instances where GenAI has been used to predict lending trends have also been reported. While these different uses of AI coincide with higher revenues (in the case of improved customer satisfaction) and lower costs (through productivity increases), their implementation raises several challenges. Data privacy is the most important challenge to note.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article