A moderate recovery is already underway in the eurozone

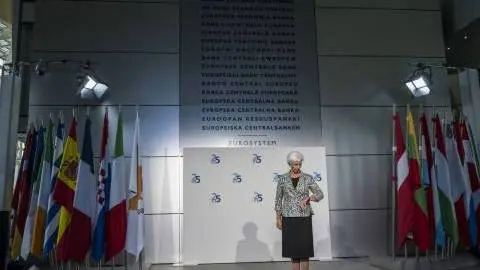

Eurozone first-quarter growth was surprisingly strong, but the initial data for the second quarter is mixed. The upturn has certainly started, but its pace is likely to be moderate. Inflation is still comfortable enough for the European Central Bank to begin cutting rates in June

Surprisingly strong first quarter

After two quarters of negative growth, eurozone GDP increased by a stronger-than-expected 0.3% in the first quarter. The question is, where do we go from here? The first indicators for the second quarter are a mixed bag. The European Commission’s Economic Sentiment Indicator was disappointing in April, with moderate service sector activity and weakening manufacturing output. The PMI, while increasing in April, still showed industry in contraction territory. It seems that the inventory correction has yet to run its course, but we expect that excessive inventories will have been reduced sufficiently in the second half of the year to allow for more production growth.

The eurozone unemployment rate remained at a historic low of 6.5% in March for the fifth consecutive month. That said, labour market tightness seems to be easing somewhat. The European Commission’s labour hoarding indicator fell in April and is now clearly below last year’s level. Job vacancies, though still high, are coming down and the Employment Expectation Index is now also in a downward trend.

All those indicators are still above historical levels, and adverse demographics likely preclude any significant uptick in unemployment. Rising real wages should continue supporting consumption over the coming quarters.

Cometh the taxman

While there are sufficient reasons to expect growth to continue, we don’t anticipate much of an acceleration. The US economy is likely to soften over the coming quarters, which might negatively affect European exports. And in June, the European Commission will finally publish its assessments of EU member states’ public finances. That will force several of them to conduct much tighter fiscal policy in 2025, likely tempering the pace of the recovery.

In that regard, we expect quarterly growth to hover around 0.3% non-annualised over the next six quarters. With the stronger-than-expected first quarter generating a positive base effect for 2024, we revised our growth estimate for this year upwards to 0.7%. For 2025, we maintain our 1.4% forecast.

Inflation in a bumpy downtrend

The April figures confirmed that month-on-month inflation dynamics are softening. And, so important for the European Central Bank, wage developments are seeming to moderate. The Indeed wage tracker stood at 3.3% year-on-year in March, down from 4% in January and 4.9% a year ago. While this is not a perfect reflection of the dynamics in negotiated wages, it indeed seems to indicate that wage inflation is coming down. That said, the fading out of energy support measures and base effects is a recipe for inflation volatility in the coming quarters. We now expect 2.5% inflation this year and 2.1% for 2025.

In recent comments, some members of the ECB’s governing council indicated that barring any unforeseen surprises, a June rate cut was a “fait accompli”. The question is pretty much what happens after June. A continuing modest recovery has taken away the need for aggressive easing. And we cannot exclude that the labour market tightens again later this year, reversing the downward trend in wage growth. And that will be enough for the ECB to tread carefully in its rate normalisation process.

For now, we maintain our call of three rate cuts this year, but there is a risk that we’ll see only two of them.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 May 2024

ING Monthly: I wanna dance with somebody This bundle contains 14 Articles