A hawkish hold from the Bank of Canada next week

We expect the BoC to leave the policy rate at 4.5% next week, but after stronger-than-expected consumer price inflation and GDP and with the labour data remaining robust we cannot rule out a surprise interest rate increase. The market is pricing a 25% chance of a hike on 7 June, and a hawkish hold should be anough to keep the Canadian dollar supported

Canadian resilience means a rate hike can't be ruled out

The Bank of Canada last raised rates on 25 January and have held it at 4.5% ever since. The statement from the last meeting in April commented that global growth had been stronger than expected and that in Canada itself, “demand is still exceeding supply and the labour market remains tight”. The bank warned that it was continuing to “assess whether monetary policy is sufficiently restrictive and remain prepared to raise the policy rate further” to ensure inflation returns to 2%.

Since then we have had additional warnings from Governor Tiff Macklem that the bank remains concerned about upside inflation risks with the latest CPI report showing a month-on-month increase in prices of 0.7% versus a consensus forecast of 0.4%, resulting in the annual rate of inflation rising to 4.4%. The economy added another 41,400 jobs in April, more than double the 20,000 expected with wages rising and unemployment remaining at just 5%. The resilience of the economy was then emphasised further by first quarter GDP growth coming in at 3.1% annualised, beating the 2.5% consensus growth forecast. Consumer spending was the main growth engine, rising 3.1%.

Canadian inflation is undershooting most other major markets

But we favour a hawkish hold – signalling action unless inflation softens again soon

Nonetheless, the BoC accept that monetary policy operates with long and varied lags and continue to believe that “as more households renew their mortgages at higher rates and restrictive monetary policy works its way through the economy more broadly, consumption is expected to moderate this year”. This will help to dampen inflation pressures and with commodity price softening we still believe that inflation can get close to the 2% target by the early part of 2024.

With the US economic outlook also looking a little uncertain, we doubt that the BoC will want to restart hiking interest rates unless it is certain that inflation pressures will not moderate as it has long been forecasting. Consequently we favour a hawkish hold, signalling that if there isn’t clearer evidence of softening in price pressures it could raise rates again in July.

The loonie’s resilience can continue

The Canadian dollar has been the best G10 performing currency in the past month, largely thanks to its high beta to the US economic narrative and a repricing of Canada’s domestic rate and growth story. These factors have outshadowed crude’s subdued performance in May and some risk sentiment instability.

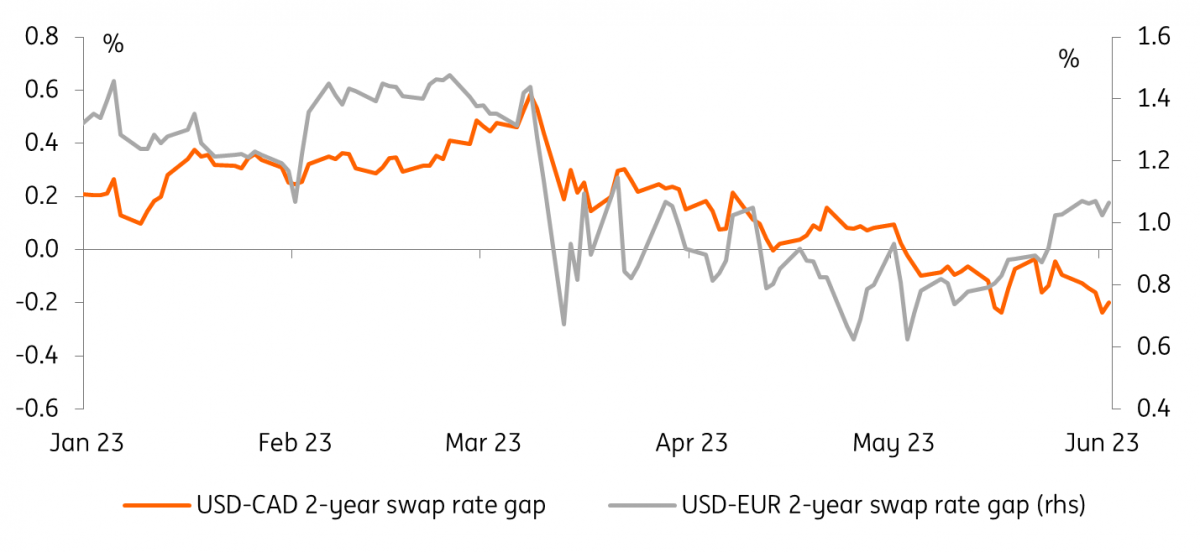

A hawkish tone by the Bank of Canada at the June meeting is clearly an important element to keep the bullish narrative for CAD alive. As shown below, the recent repricing in Fed rate expectations caused a rebound in short-term USD swap rates relative to most currencies (like the euro), while the USD-CAD 2-year swap rate differential has remained on a declining path also throughout the second half of May.

USD-CAD short-term swap rate differential on a steady declining path

As long as the BoC does not push back against the pricing for a hike in the summer, we expect CAD to remain supported. Some lingering USD strength in June can put a floor around 1.33/1.34 in USD/CAD, but we expect a decisive move to 1.30 in the third quarter and below then level before the end of the year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article