A Goldilocks US jobs report

The August employment report paints a very positive picture regarding the current state of the US economy with solid jobs growth yet signs that supply strains are easing as workers return to the labour force. With wage growth coming in lower than expected it points to a slower pace of rate hikes after September's expected 75 basis point move

Broad-based jobs gain despite "recession"

The US economy added 315k in August versus 298k consensus. There were 115k of downward revisions, primarily to June's figure, but this still means 3.5mn jobs have been created in 2022 despite the economy technically being in recession.

The establishment survey of employers (used to generate the payrolls figure) shows broad-based gains across virtually all sectors. There was no one real standout with trade and transport up 65k, education and health up 68k and leisure and hospitality up 31k. Only Federal government saw a fall.

US employment levels (mn)

Unemployment rate rises for a positive reason

The household survey (used to generate the unemployment rate) was even more impressive. It reported employment rising 442k. However, the eye-catching thing was the jump in worker participation (to 62.4% from 62.1%) with the civilian labour force increasing 786k in August. Consequently the unemployment rate rose to 3.7%, but for a really positive reason. It looks as though workers may finally be returning as the rising cost of living and higher wages, together with rapidly receding Covid caution, incentivise finding a job. Wages themselves rose a little less than expected at 0.3% month-on-month versus 0.4% consensus, but the year-on-year rate held steady at 5.2% for the third consecutive month.

The near-term outlook for jobs remains very positive with job vacancies surprisingly rising earlier this week to 11.2mn, equivalent to two job vacancies for every single unemployed American. If labour supply is rising as well, this will ease some of the strains on corporate America. It allows companies to keep growing while also dampening medium to longer term inflation pressures by keeping a lid on wage growth.

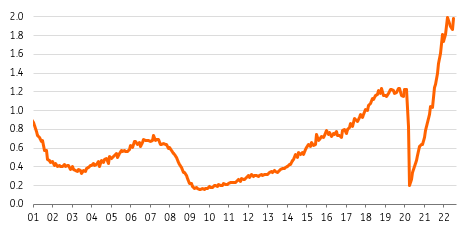

Ratio of US job vacancies to the number of unemployed Americans

75bp hike in September, but the pace to slow thereafter

With jobs being created in significant number, consumer spending continuing to grow and inflation running at more than 8%, it is hard to argue this is a “real recession”. In any case GDP is likely to rebound 3% in the current quarter and core inflation is set to rise to 6.1% from 5.9% on September 13th so a 75bp rate hike on September 21st looks a solid call.

Nonetheless, if workers do keep returning, bringing labour supply into better balance with demand, this can keep contributing to the easing of inflationary pressures in the economy. We consequently expect the Fed to slow the pace of rate hikes to 50bp in November and 25bp in December, leaving the range for the Fed funds target rate at 3.75-4.0%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article