US: A final 25bp hike from the Fed as tighter lending conditions weigh heavily

The Federal Reserve has raised interest rates by 25bp and signalled the threshold for justifying future rate increases is now higher than it was. With lending conditions rapidly tightening in the wake of recent bank stresses, we think this will mark the peak for interest rates with recessionary forces set to prompt interest rate cuts later this year

Fed hikes one last time

No real surprises with the Federal Open Market Committee unanimously voting for a 25bp interest rate increase, taking the Fed funds target range to 5-5.25%. We can’t say that the Federal Reserve has dropped its tightening bias completely, but the statement is more balanced than it was in March. Back then it suggested that "some additional policy tightening may be appropriate". This has been dropped with the statement merely stating “In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments”.

The press conference talks of the potential for a pause at a future meeting, but Powell also suggests they are “prepared to do more” rate hikes if necessary. Nonetheless, he acknowledges that "policy is tight" with real rates "meaningfully above what many people would assess as the neutral rate". Either way the language shift via omission of “some additional policy tightening may be appropriate” is important and signals that the bar to justify future rate rises is now higher.

Rather surprisingly Fed Chair Powell states in the press conference that banking conditions have “broadly improved” since March when Silicon Valley bank and Signature Bank failed. This seems a little strange given what has happened to First Republic in recent days. Nonetheless, the statement acknowledges that "tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation". That last point on inflation is critical.

Indeed, the Fed will have seen the latest Senior Loan Officers’ survey and it isn’t likely to have been pretty if the yesterday’s ECB Bank Survey was anything to go by (the Fed’s survey likely to be formally published next week). The recent banking stresses are going to tighten lending standards markedly and that will act as a major brake on economic activity, significantly reducing the need for any further interest rate increases.

Tighter lending conditions heighten the chances of recession

Chair Powell spoke of plenty of risks to the outlook and we think today’s interest rate hike marks the peak for the Fed funds target range with the Fed set to leave interest rates unchanged at the 14 June FOMC meeting given recessionary forces are building, job lay-off announcements are mounting and inflation is slowing. This will coincide with new forecasts from Fed officials including an update of their dot plot chart for the projected path of the Fed funds rate. At this point we suspect it will suggest no change through year-end with potentially 75-100 basis points of cuts pencilled in by the Fed for next year. Powell again acknowledged that his personal forecast is for modest growth, not recession even though the Fed staff forecasts remains for a “mild recession”.

Historically, the Fed doesn’t leave it long before cutting rates – over the past 50 years the average period of time between the last rate hike cycle and the first rate cut has only been six months. This implies that if May is indeed the last rate hike in a typical cycle, we should expect a cut by around November.

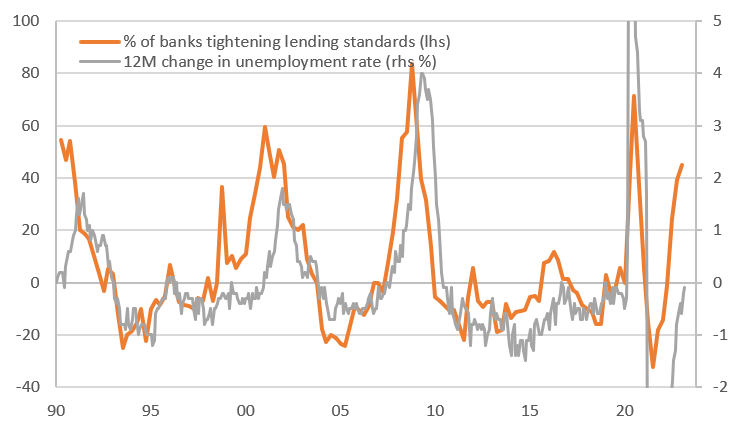

However, the March FOMC minutes warned that “historical recessions related to financial market problems tend to be more severe and persistent than average recessions”. Given the stresses in the banking sector and the rapidly tightening lending conditions we fear this could be the trigger for a painful economic downturn. The chart below shows that when banks tighten their lending standards, unemployment always rises. What turns struggling business into failed business is when the bank pulls the plug the company runs out of options. Job losses are the inevitable consequence.

Tighter lending conditions always prompts higher unemployment

Rate cuts possible in the fourth quarter of 2023

Fears over the US debt ceiling impasse and the potential for financial market and system pain before politicians come to a deal to prevent default adds to a sense that there are darkening clouds over the economic outlook that could necessitate a swift change in position from the Federal Reserve.

The market is currently pricing the potential for rate cuts as soon as September, but we doubt that the Fed will respond quite as quickly given inflation is still likely to be around 4% by that point, double the 2% target rate. Nonetheless, the Federal Reserve has a dual mandate of maximising employment as well as achieving 2% inflation over time. Policy optimisation for the Fed’s two targets implies it doesn’t need to see inflation hitting 2% before cutting interest rates if unemployment is starting to rise and it is confident inflation will slow.

We think the Fed will wait until the fourth quarter, but will end up cutting interest rates more aggressively, at least in the early stages. We forecast 50bp rate cuts at both the November and December FOMC meetings with the Fed funds rate getting down to 3% by mid-2024.

Market breakeven inflation rates support a Fed pause here, and indeed support future cuts

The impact reaction to the FOMC outcome was more downward pressure on market rates, driven by lower real rates, as breakeven inflation rates have edged higher. But that morphed into upward pressure on market rates, dominated by rises in breakeven inflation. This is an interesting reaction, suggesting a rise in market inflation concern remains in the period ahead. At the same time, the 10yr breakeven inflation rate at 2.2% is at a very tolerable level, impliedly discounting a return to 2% inflation. It's even more striking when you look at the 2yr breakeven, which is now at 2.05% and looking like it could dip below 2% if it keeps up the pace of decline seen in recent weeks. These breakeven trends support the Fed pause, and indeed provide room for eventual cuts, should delivered inflation actually trend towards the breakeven expectations.

We also note that all rates are up 25bp, including the rate on the reverse repo facility, now at 5.05%. Also the rate on the standing repo facility is up to 5.25%. And the rate on excess reserve is up to 5.15%. So no surprises there. All bands have been kept intact right through the rate hiking cycle. The Fed has concentrated on getting all rates higher throughout the process as opposed to any finessing of the different rates that it employs to manage other aspects of policy. Meanwhile, some US$3trn remains in bank excess reserves at the Fed and over US$2trn continues to go back to the Fed on the reverse repo facility. These are measures of the ongoing elevated size of the Fed’s balance sheet. The Fed’s reversal policy here also remains as was, as it continues to allow some US$60bn of Treasuries and US$35bn of mortgage backed securities to roll off their balance sheet on a monthly basis. That also tightens conditions.

No material directional impulse from this outcome. We continue to view 3% as a medium-term level that market rates can aspire to getting towards. The 10yr yield should get there first, while the 2yr will be constrained by Federal Reserve reluctance to nod towards cuts too soon. The 5yr area of the curve should remain quite rich in the months ahead, as the inversion on the 2/5yr segment remains deep. That will change later in the year though as the 2yr finally becomes untethered from the fund rate as cuts are more clear and imminent.

FX Markets: That’s all folks

The dollar initially softened on the release on the FOMC statement, which removed the key phrase over the need for further rate hikes. That the dollar did not fall further probably owes to the fact that this new Fed stance was largely expected, and it looked like investors had gone into the meeting slightly short dollars, especially against the euro. Equally the FX market has continued to take its cue from the short end of the US yield curve – which is largely unchanged after the statement’s release.

Where does that leave FX markets? For this year’s broad dollar trend to accelerate we probably need to see much clearer signs of weakening US activity data – especially in the labour market – and also the disinflation story to gain momentum. This looks more a story for the second half than for the next couple of months. We are comfortable with our baseline forecasts that the dollar does most of its selling-off in the second half of the year and have a conservative forecast of 1.15 for EUR/USD and an aggressive forecast for USD/JPY a 120 for year-end.

Should US rates continued to be trapped in ranges over coming months, interest rate and FX volatility would fall further and we would expect to hear more about the carry trade. Here the Hungarian forint and Mexican peso have the highest risk-adjusted yields and especially the Mexican peso could continue to advance now that the Fed has adopted a meeting-by-meeting approach to policy changes.

The wild card here, however, is the simmering US banking crisis and whether events so far merely slow the economy (dollar bearish) or spark contagion (yen and Swiss franc bullish). At the same time US debt ceiling negotiations look like they will go down to the wire and still threaten to upset risk assets over coming months.

We do think then that defensive currency plays may do well over coming months and feel a currency like the Japanese yen can perform well on the crosses – especially against the commodity exporters whose chief exports are suffering on global demand trends.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more