A fair-weather bounce in US housing

US housing transactions and prices have surprised in the early part of the year as warmer weather lifted demand. Amid a dearth of supply, prices are being supported, but higher borrowing costs and tighter lending conditions suggest the outlook remains tough

Warmer weather boosts demand

US home prices rose surprisingly in February, up 0.06% month-on-month versus the -0.4% expected according to S&P Case Shiller data released today. Western cities remain under pressure with Seattle, Portland, San Francisco and Las Vegas all down the bottom of the city comparison with MoM falls between -0.3% and -1.5%. Los Angeles, however, bucked the trend by rising 0.6%. In year-on-year terms, Seattle (-9.3%) and San Francisco (-10%) are at the bottom of the table with Miami (+10.8%) and Tampa (+7.7%) sitting at the top.

The warm weather in January appears to have lifted housing activity, most probably bringing forward buyer interest from the Spring rather than creating a whole new set of buyers. Amidst a dearth of supply, this generated the first positive MoM house price index change since June 2022.

New home sales benefit from a lack of existing homes on the market

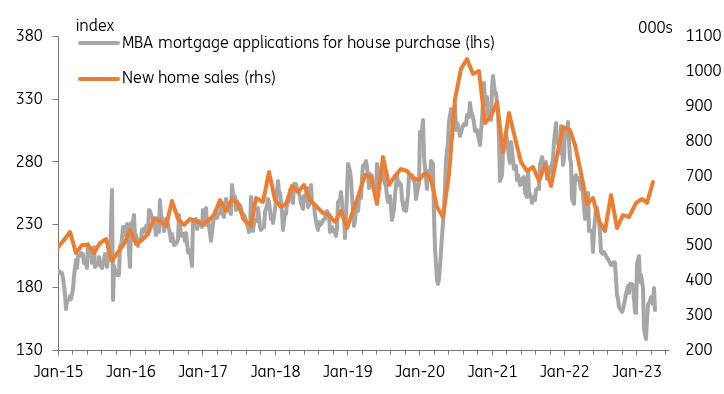

Meanwhile, new home sales jumped 9.6%MoM in March to 683,000 – well above the consensus prediction of 632,000. This is especially surprising given the steep decline in mortgage applications for home purchases. The historical relationship between the two series suggests that new home sales should be closer to 300,000 than 700,000. There isn’t a huge amount of evidence suggesting a sudden surge in all cash purchases, so we can only really rationalise it as a function of the lack of existing homes on the market for sale. This leaves potential buyers little option but to to buy newly constructed homes.

New home sales are stronger than mortgage applications imply they should be

Challenges remain for US housing

Nonetheless, the doubling of mortgage rates over the past 16 months and tightening of bank lending standards – which recent bank stresses are likely to make even worse – means that demand will start to soften again. In January 2022, borrowers could take out a $400,000 30Y fixed-rate mortgage and their monthly payment would be $1,750. Based on today’s US mortgage rates, if that person were to pay the same $1,750 monthly payment, they would typically only be able to borrow $280,000.

Moreover, with house price to income ratios above where we were at the peak of the 2006 housing bubble, the affordability metrics continue to point to downside risks for transactions and prices. Should the US economy experience a hard landing and the start of a rise in unemployment, this would threaten a rise in default rates and an increase in the supply of homes for sale. Falling property prices at a time when construction costs and labour remain elevated also means squeezed profit margins, which is another disincentive for construction.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article