6% plus US inflation and still climbing

US inflation again exceeded expectations by a wide margin. Headline and core rates are now at 30-year highs with near-term momentum suggesting 7% is possible. Pipeline price pressures show little sign of abating and inflation expectations are climbing as well, leading us to conclude QE tapering will be accelerated and rate hikes will come sooner

Up, up and away

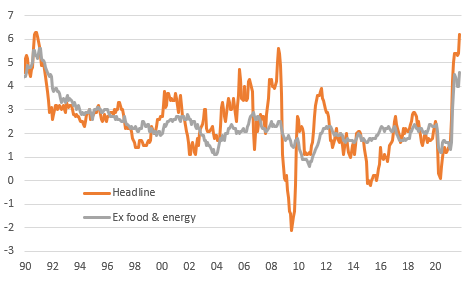

US headline consumer price inflation has come in well above consensus at 0.9% month-on-month/6.2% year-on-year with core inflation rising 0.6%/4.6%. The market had been anticipating 0.6%/5.9% and 0.4%/4.3%, respectively. This leaves annual CPI at its highest rate since November 1990 with core at its highest since August 1991.

US inflation at 30 year highs (YoY%)

The details show the jump in gasoline was a big factor, having risen 6.1% MoM, but there are clear inflation pressures in most categories. Housing jumped 0.7% MoM, food was up 0.8%, used cars up 2.5%, medical care up 0.5% and recreation up 0.7%. Only 2 components recorded MoM readings below 0.4% – 0% for apparel and 0.2% for education. Remember consistent 0.2% MoM readings trend towards 2.4% YoY inflation and even that is above the 2% Federal Reserve’s target.

7% CPI and a 1Q taper conclusion?

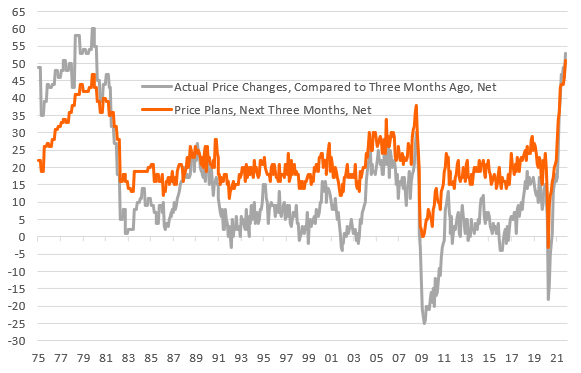

Inflation will rise further and at this point we can't rule out a 7% YoY reading in the next couple of months given housing, energy, second-hand car price developments. Meanwhile, retail inventories are at all-time lows so the need for seasonal discounts ahead of the key shopping season is simply not there. Furthermore, with the National Federation of Independent Business reporting the highest proportion of companies raising their prices in the survey's 46-year history and employment costs rising at rates not consistently seen since the early 1980s, the Fed's narrative on transitory inflation looks severely at odds with the data and pipeline price pressures.

second hand car prices continue to surge

With the economy set to grow 6%+ annualised in this quarter and inflation set to persist at 6%+ through 1Q why does the Fed need to keep stimulating? The November FOMC statement said the committee “is prepared to adjust the pace of purchases if warranted by changes in the economic outlook” and if this backdrop doesn’t justify QE taper concluding early we are not sure what will.

Price pressures are broadening and intensifying according to the NFIB

Higher for much longer

Then there is housing. Primary rents and owners’ equivalent rent account for a third of the CPI basket with movements in these components tending to lag 12-18 months below house price changes. Given house prices are up 20% YoY this will continue to contribute to both headline and core inflation. Currently primary rents are rising “just” 2.7% YoY while owners’ equivalent rate is up a mere 3.1% YoY.

The Federal Reserve expect supply chain strains to ease through the second and third quarters, but given the lack of visibility we suspect that this is more a hope rather than a conviction call. Yesterday’s PPI report showed pipeline price pressures remain strong with the annual rate inflation up at 8.6% for headline and 6.8% excluding food and energy. At the same time employment costs are surging as companies desperately compete to hire and retain staff. We now forecast inflation staying above 3% right through 2022, well above the 2% target.

Inflation expectations looking less anchored – Fed to respond

The Federal Reserve continues to assert that "longer term inflation expectations remain well anchored at 2 percent", but consumer survey suggest this is looking increasingly tenuous. The Federal Reserve's own survey (conducted nationally by the NY Fed), shows 1Y ahead inflation consumer expectations rising to 5.7% – not really surprising as it tends to track actual inflation. However, the 3Y ahead inflation expectations rose to a new all-time high of 4.2%. We wouldn’t be surprised to see the University of Michigan 5-10Y ahead expectations break-up toward 3.5% in the next few months.

It is a similar story for market inflation expectations using Treasury index protected securities. They are now show 3%+ inflation out to 7 years maturity with even the 10Y up at 2.7%.

Inflation expectations continue to build

Given this backdrop of strong growth and high inflation that will only go higher in the near-term the case for an acceleration of Fed policy normalization is growing. Hence our view of 1Q QE conclusion and a minimum of two rate hikes in the second half of 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article