40-year high for US core inflation heaps pressure on the Fed

US consumer price inflation surprised on the upside once again as rapid increases in housing costs, medical care, food and airline fares offset signs of moderation elsewhere. The Fed has admitted it is prepared to inflict economic pain to get a grip on inflation and today's report will ensure at least another 75bp rate hike in November and 50bp in December

| 6.6% |

Highest "core" inflation rate since August 1982 |

Sticky inflation means the Fed has more work to do

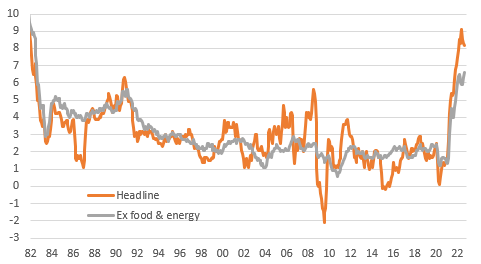

Once again US consumer price inflation has come in higher than expected with headline prices up 0.4% month-on-month in September (consensus 0.2%) and core – ex food and energy – up 0.6% MoM (consensus 0.4%). This means the annual headline rate slows to 8.2% from 8.3% while core rises to 6.6% from 6.3%, having been down at "just" 5.9% in July. With core inflation heading in the wrong direction (and at its highest rate since August 1982) and yesterdays’ Fed minutes to the September FOMC meeting warning that doing too little to tame inflation is worse than too much, it confirms that a 75bp interest rate increase on November 2nd is the minimum expectation with markets now pricing in the slight possibility of a 100bp hike.

Annual US headline and core inflation rates

75bp the minimum for November, but 100bp is only a small chance

Looking at the details, housing continues to big a major story with shelter (32.5% weighting) rising 0.7% MoM yet again. while medical care costs, which have been posting some solid price increases over the past six months, rose 0.8%. Airline fares were up 0.8% while food prices increased 0.8% on the month. On the softer side were gasoline (-4.9% MoM) while apparel prices declined 0.3% and used car prices fell for the third month in a row. Recreation and education/communication rose only 0.1% MoM each, weaker than we had expected. It is therefore a slightly more mixed picture than just looking at the headline and core MoM's with pricing power appearing to be softening in some components.

Why we favour 50bp in December

Nonetheless, the increase in the annual rate of core inflation is not a good story and the Federal Reserve has stated it is willing to inflict economic pain to get inflation moving back to the 2% target. 75bp is indeed the solid call for the November 2nd FOMC meeting, but we are still looking for the Fed to slow the pace to a 50bp in December (market is pricing just over 60bp, indicating a close call as to whether we get a fifth consecutive 75bp move).

Our rationale is that the economy is slowing and there is more evidence pointing to weakening corporate pricing power. The National Federation of Independent Business survey shows the proportion of companies looking to raise their prices is moderating quickly to reflect the shifting growth outlook and rising inventory levels, that they don’t want left on their books.

Corporate pricing power may be waning

Moreover, we think used car prices have much further to fall based on the Manheim car auction price data (4% weighting in the inflation basket) while slowing global chip demand suggesting new vehicle production issues (new vehicles also have a 4% weight) are possibly moderating, paving the way for more supply and less inflation.

Shelter could be key to lower inflation

The key swing story is going to be shelter though given it is the largest component of inflation. Historically the shelter series lags behind movements in house prices by around 12-14 months, but over the past week rent.com, apartments.com and CoStar Group have all been reporting rent price falls in major cities. House prices only started falling in July so this could imply a quicker transmission.

US rent CPI components lag turning points in house prices

A possible reason is that rents have risen so much on top of a broad cost of living increase. This is leading to fewer “household formations” – basically people can’t afford rent so are cohabiting with friends/family leading to less demand for apartments and prices are already dropping. We will see how this develops, but like the corporate pricing and the vehicle stories we still think the risks are skewed towards inflation falling more quickly through 2023 than the consensus.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article