2024 set to be the year that the ECB hike cycle is felt

The ECB hike cycle seems over, but the shockwaves of tightening will still shape the eurozone economy in 2024. Traditional lags in transmission are now accompanied by longer ones in average interest burden increases, potentially extending the impact of tightening. For the ECB, the risk of being behind the curve for the second time in one cycle is growing.

The end of the hike cycle is most likely here. The ECB has raised interest rates aggressively - from -0.5% to 4% in just over a year. With inflation coming down quickly and the economy stagnating, it is hard to see how the ECB could continue hiking rates, either this week or in the coming months. Instead, the focus is shifting towards possible first rate cuts. This makes it an excellent moment to focus on how fast monetary transmission is happening and what to expect from the impact of this in 2024.

The initial impact of tightening was significant

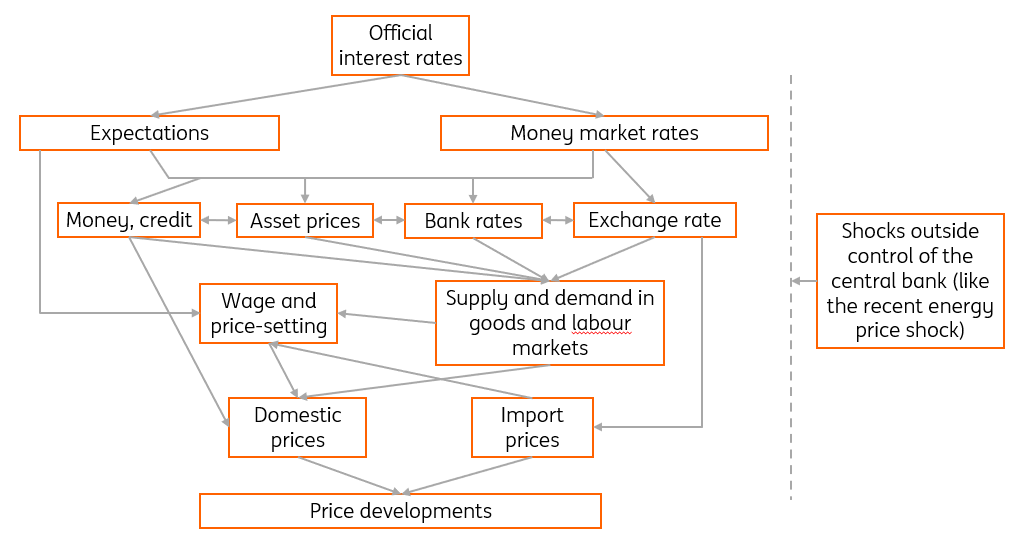

In March, we concluded that the early signs of a rapid impact on transmission channels were significant. Since then the pace has moderated a bit, depending on the channel. As back in March, we follow the ECB’s own categories of transmission channel. At the end of 2023, broad money supply is still contracting quickly, currently at an annual pace only seen in 2009. Bank rates for loans for households and businesses are still rising rapidly and the euro has broadly appreciated against the currencies of major trade partners since late summer - it is now slightly above levels seen at the start of ECB’s rate hikes. Asset prices have also corrected, but with very different results across asset classes.

Flow chart of how monetary policy impacts the economy, according to the ECB

Moving on from the channels to the real impact of monetary tightening so far, the impact on bank lending has slowed. Most importantly, the bank lending impact was strong at the start of the tightening cycle - lending growth to non-financial corporates has slowed from around 1% month-on-month in the summer of 2022 to 0% in November and has stabilized around 0% since. This also seems related to a working capital and inventories-related lending surge in summer, the need for which faded when supply chain problems eased. Lending to households slowed from 0.4% month-on-month in May 2022 to 0% in April 2023, since when it has also stabilized around 0%. Overall, the lending correction is not dramatic, but has a significant impact on future investment. Don’t forget that there is likely more to come - the ECB Bank Lending Survey suggests continued weakness in lending ahead. In short, the impact of monetary policy tightening on lending and consequently on the real economy is unfolding like every textbook model would suggest.

At face value, monetary transmission is working quickly

Not every aspect of tightening works quickly, quite some of the burden is still to come

While at face value the transmission of monetary policy tightening is working as planned, looking slightly deeper reveals more complexity and more sluggishness. Coming from a long period of negative rates is having a big impact on how fast interest payments are rising. Looking at net interest payments from corporates, we see that these have increased disproportionally slowly so far (chart 4). The same holds for households, where the average mortgage rate paid by households in the eurozone has only increased by 0.8% while new mortgage loan rates are up by 2.7%. For governments, the same is true. Interest rate payments are increasing but remain at relatively low levels. Low locked in-rates have caused a relatively small increase in debt burdens so far.

Average interest payments have started to move up only slowly

This means three things:

- First of all, costs have not increased materially so far, which would be an additional tightening effect. Higher costs force cuts in spending or investment elsewhere, which results in weaker activity. While the relationship between interest rates for new loans and average debt burden was more synchronized in previous hike cycles, the initial effect on debt burdens has been relatively limited.

- Secondly, this means that the impact of the hike cycle is likely more spread out this time. Over the course of next year, loans will have to be refinanced at higher rates, which will continue to increase average debt burdens. So, while the initial impact of ECB tightening has already been forceful, it is reasonable to expect that the effect will not fade quickly in 2024 as more businesses, households and governments adjust to a new reality of higher rates.

- Lastly, since there is now such a discrepancy between the current interest rate and the average interest rate paid in the economy, the ECB could cut rates but average interest payments could still be increasing. So, if the ECB were to start the process of decreasing interest rates, part of the tightening effect would still be coming through the pipeline. This would dampen the effect on monetary easing.

Important moderating effects have kept the impact on GDP mild so far

Much to the chagrin of the ECB, governments have continued to provide ample fiscal support to the economy. As chart 6 shows, the fiscal stance is falling moderately, but continues to be generally supportive of economic activity. It is not the first time that fiscal and monetary stances are at odds with each other - think back of the 2010s when fiscal austerity countered ECB efforts to bring inflation up to 2%. Now this is working the other way, as fiscal support boosts economic activity and therefore counters the ECB’s efforts to reduce underlying inflation.

As in the 2010s, monetary and fiscal policy are working in different directions

The labour market is also moderating the impact of tightening; at least for now. The weaker economic environment since late 2022 has not yet translated into a weaker labour market. While a relatively simple Okun’s Law would suggest that the labour market should be cooling slightly, it remains red hot. This supports economic activity and maintains wage pressures for the moment. Tightening efforts in the labour market remain relatively invisible for now.

Finally, investment has continued to be supported by the supply-side problems from 2021 and 2022. While new orders have fallen, production has been kept up by the large amount of so far unfulfilled orders brought forward. The size of eurozone order books has fallen rapidly since late 2022, which has boosted activity and masked weakness in drying up orders when it comes to total economic activity.

These factors have so far suppressed the impact of tightening on the economy, but we expect them to be less supportive of growth in 2024. While the fiscal stance is set to remain expansionary, with the exception of Germany, it will likely be less so in 2024 than in 2023. The labour market has recently shown more serious signs of weakening, which leads us to expect that unemployment will finally start to slowly increase over the course of next year. Backlogs of work have largely been depleted, meaning that the full effect of monetary tightening will likely be felt more strongly next year as mitigating factors fade.

Unemployment is lower than you would expect on the basis of current economic activity

The landing has been very soft so far, but gets bumpier in 2024

Inflation has come down very quickly over the course of 2023. Peaking at 10.6% YoY in October, it has fallen to 2.4% in November. This has been achieved with economic activity stagnating but not falling and the labour market continuing to go from strength to strength. The monetary stance has moved from an interest rate of -0.5% and QE to a 4% interest rate and QT.

Can we really move from a broadly accommodative stance to a very restrictive stance and not notice any economic pain? That seems unlikely: much of the impact of the higher rate environment is likely to be felt next year because of the usual lag of monetary policy, because some effects of tighter policy are now more lagged than in previous cycles, and because mitigating factors are set to fade. Milton Friedman’s famous quote that monetary policy has ‘long and variable lags’ seems to be an understatement in the current complex monetary environment.

That does mean that the restrictive impact of monetary policy on the economy is set to increase while inflation already looks to be solidly under control. The month-on-month core inflation rate in November was negative and the trend has been sharply down. Disinflation in 2023 was mainly the result of base effects due to ending supply shocks and not so much to monetary policy tightening. Disinflation in 2024, however, will be mainly the result of the further unfolding of monetary policy tightening. While there are clear uncertainties about the inflation outlook - including how wage growth will develop and whether new spikes in energy prices could emerge - there is a high risk that the ECB is getting behind the curve for the second time in one cycle. It was late in responding to inflation on the way up and could well be late in responding on the way down as well.

Expectations of rate cuts have moved forward and have grown a lot recently. Given the wrong assessment of inflation dynamics on their way up and concerns about possibly more persistent inflationary drivers, we think the ECB will be very hesitant to simply reverse the rate hiking cycle. Instead, we expect the ECB to wait for additional wage growth data for the first quarter and then start cutting in June - but rather gradually, with three cuts of 25bp every quarter. That would still leave monetary policy restrictive and keep average interest rate payments going up as society adjusts to higher interest rates. It would also make new investments slightly more attractive again. The hike cycle may have so far seemed like an easy adjustment to swallow, but ironically the pain of tightening will likely be felt most when the ECB already starts to ease.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more