Telecom Outlook: 2022 could be the year mobile banking really takes off

The banking industry is undergoing massive digital disruption, with the mobile phone increasingly becoming the dominant method for banking

The history of digital banking

This could be the year in which the mobile phone becomes the dominant means through which people use banking services in Europe. This is already the case in some countries and for some services. Mobile banking takes place in different modalities; there are apps that provide banking services, while others offer relatively new services, such as "buy now pay later" (Klarna), or traditional services such as facilitating money transfers with the help of QR codes or a text message. Mobile phones are increasingly replacing banking cards because the NFC chip within the devices enables contactless identification services.

The development of the financial sector is different in Africa (outside of the large cities) than in Europe, which is why the mobile phone is, for many people in Africa, an important means of payment. In Europe, digital banking is relatively old. In the 1980s, banks started to offer their first digital services over telephone lines through electronic banking. It was when wired internet connections were replaced by broadband and mobile broadband networks that e-commerce and digital banking gained real significance. In Africa, developments were, to some extent, more phone-centric.

Many banking transactions are already performed on a mobile phone, and we expect that consumer behaviour in Europe will start to replicate practices in Africa with banking services becoming mobile-centric. We will also see, in both continents, an increasing number of transactions transition to smartphones.

There are two converging trends:

-

Mobile operators step up their efforts to provide banking services, especially in emerging markets.

-

New apps will take a larger share of the financial services market while traditional banks move to a digital-first model.

The two well-known providers of financial services on mobile in Africa are M-Pesa and Orange Money.

50 million people use M-PESA

Launched in 2007 by Vodafone’s Kenyan associate Safaricom, M-PESA is a very large, mobile phone-based payments platform active in Africa. The service has 50m customers and processes more than 15bn transactions a year. M-PESA (the 'M' stands for mobile and 'Pesa' is the Swahili word for money) is active in the Democratic Republic of Congo (DRC), Egypt, Ghana, Kenya, Lesotho, Mozambique and Tanzania. Key services focus on: money transfers, loans, savings and insurance brokerage services. Customers can convert cash at one of 919,000 agents and pay in stores that are M-PESA merchants. They can also pay utility bills, taxes, transfer money and pay school fees or buy airtime to make calls and surf the internet.

In 2019, around 25% of all M-PESA customers had access to a smartphone – a figure that was growing at the time by 10% a year. M-PESA clearly shows that the lines between banks and mobile operators are blurred in some countries. In 2022, we expect it to further improve its offering, especially in a country like Egypt. Vodafone has transferred its ownership stake in Vodafone Egypt to Vodacom, also to enable faster growth of M-PESA.

Orange Bank hopes to expand across Europe

Orange, the French telecom operator, has a couple of mobile financial services initiatives under the business lines Orange Money and Orange Bank. With Orange Money, customers can make payments from their mobile phone, but also transfer money to, for example, France. The service is active in 17 countries in Africa and the Middle East, and there are 49m customers with about 45% using the service every month. The service can be used to pay taxes, school fees or public services. International money transfers are a growth driver.

The other service is Orange Bank, which had about 1.2m customers at the end of 2020 in France and Spain, where it is active (up from 248,000 in 2018). Orange acquired the French neo bank Anytime at the end of 2020. Orange also launched Orange Bank Africa in Côte d’Ivoire, with about 350,000 registered clients at the end of 2020.

There are plans to make Orange Bank active in all operating countries in Europe, where Orange operates, by 2025. The bank, however, is loss-making, although it is expected to significantly reduce losses in 2021.

Orange claims the convergence between telecoms and financial services is a success, as they said in an October 2021 press release: “... In France, the average spending per customer who has also subscribed to an Orange Bank payment facility has doubled... and... in Spain, the attrition rate of Orange customers who have subscribed to the Orange Bank offer has halved”.

Mobile payment apps are booming

Mobile-centric innovation is taking place in the three core services of banks: payments, savings and lending. The following examples show how fast business models are changing and are becoming mobile-centric.

We have witnessed the rise of apps where you can store cash (PayPal, Apple Cash), invest (Robinhood), lend (Peerberry, Mintos), borrow to defer payments (Klarna) or pay (Apple Pay, Paypal, AliPay). To be fair, most payment apps and functionalities rely on traditional infrastructure. However, we have already witnessed the rise of electronics wallets since 1998, with PayPal. By making payments from one PayPal account to another at the other end of the globe, one bypasses the traditional banking system.

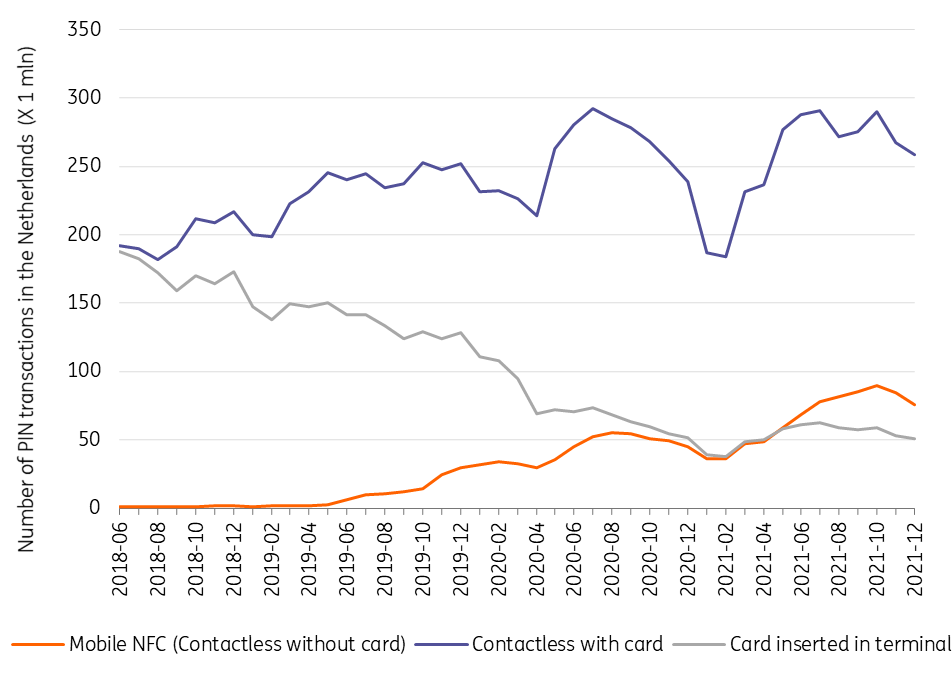

The availability of excellent, user-friendly, mobile devices, such as the iPhone, was a catalyst for banking services to become digitalised. The presence of a Near-Field Communication (NFC) chip in mobile phones is accelerating the trend of digital banking since people no longer need a physical card to make payments. This can be seen in the graph below which is created with data from the Betaalvereniging Nederland (Dutch Payments Association). Note that many of the examples given of app-based financial services are also offered by traditional banks these days.

Strong increase of mobile contactless payments in the Netherlands

Today, most of the challenges faced by existing universal banks come from digital competitors. There is a threat from large digital platforms, often used on mobile phones, which can offer their users finanical services. Given their size and innovative capacity, this could become a real challenge for more traditional banks. Challenger banks such as N26 and Revolut benefit from a lower cost base because they don't have physical bank branches to pay for. The Dutch banking market, for example, is going through an interesting transformation.

Our company, ING, is closing physical stores, something ABN AMRO and Rabobank are also doing. ING has moved to a digital-first model to be able to compete with neo banks and other challengers. The percentage of mobile-only active customers for ING in the Netherlands is already 40%, as can be seen in the graph below. It is likely that the mobile customer's channel, therefore, will be the dominant way of doing business. More than that, it shows how important the mobile phone has become within our society.

% of mobile-only active customers at ING Bank*

Will Deutsche Telekom team up with Revolut?

As a result of the merger between Sprint and T-Mobile USA, Softbank became a shareholder in Deutsche Telekom. When this was announced, the two companies presented a strategic alliance, also involving Revolut (the Softbank VisionFund 2 has a small stake in it).

It seems that Deutsche Telekom wants to provide its customers with the services of Revolut. Deutsche Telekom chief executive Tim Hoettges announced in a November 2021 media call that the company was “planning to integrate services of the Softbank portfolio into our app, prospectively, and offer that to our customers”, adding: “We are working with Revolut, a financial service.... where we will give an advantage to our customers in the upcoming months. That is how we are going to start...”, according to a Bloomberg report.

If this plan is to be executed it could potentially bring Revolut a lot of clients, as well as improve client retention rates at T-Mobile, as Orange indicated for its banking customers. For now, it seems a bit too early to predict what is going to happen and how successful a cooperation between Revolut and Deutsche Telekom could be. It is, however, another example of how telecom operators could find their way to also provide financial services.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 January 2022

Telecom Outlook 2022: innovation and M&A This bundle contains 8 Articles