Riksbank: Growing dissent hinders efforts to support the krona

The Riksbank hiked by 50bp as expected, and signalled another 25bp move in June or September. However, two members argued for a smaller increase today and rate projections showed the next quarter-percentage hike should be the last one. Governor Thedeen kept pointing to the need for a stronger krona, but the dovish tilt makes SEK-supporting efforts harder

A dovish 50bp hike

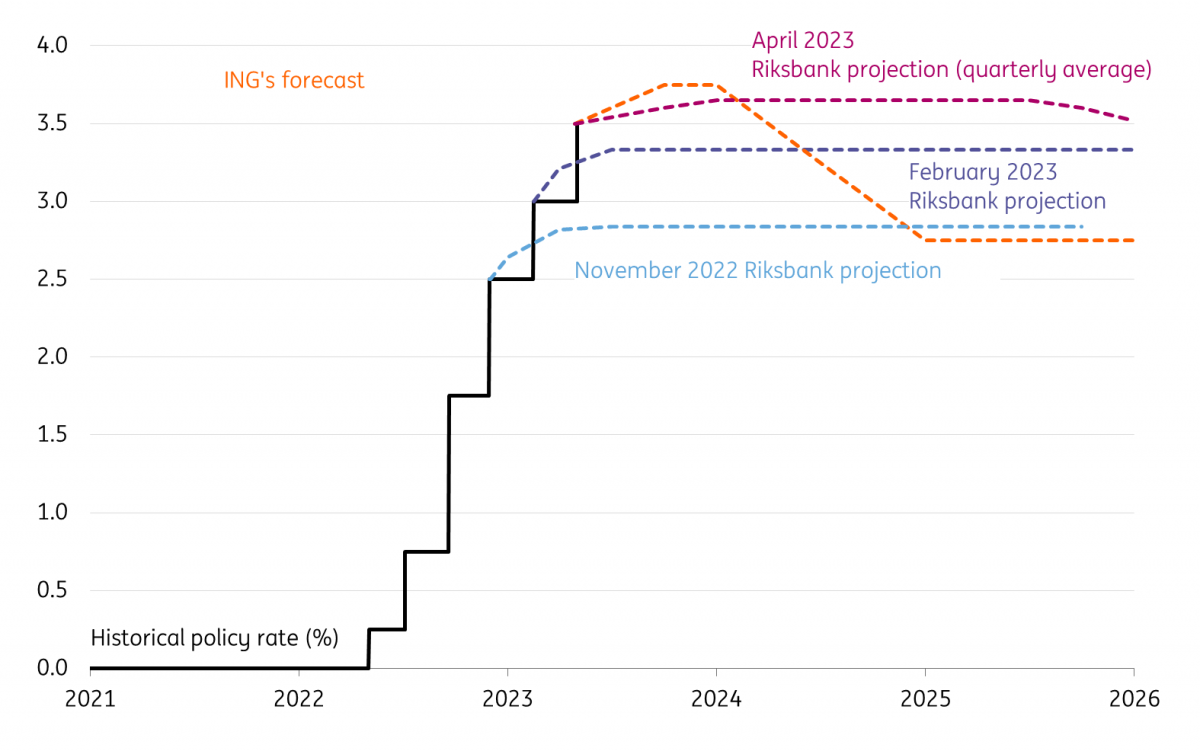

The Riksbank increased its policy rate by 50bp today to 3.50%, as widely expected, and signalled it will probably deliver another 25bp hike in either June or September. The updated rate projections show that should be the last move in the Riksbank tightening cycle, with rates peaking at 3.75% and being held around that level for the foreseeable future. This was the first bit of the dovish surprise: market expectations had priced in a peak rate higher than 3.75% and part of the consensus (including ourselves) had expected the new projections to display a 4.0% peak rate.

The other element of surprise came from the explicit dissent by two members of the Executive Board (Deputy Governor Anna Breman and Deputy Governor Martin Floden). They both argued in favour of a 25bp hike today and against the rate path projections, which they judged too hawkish in light of “well-anchored inflation expectations, moderate wage increases and the weak and downward-revised forecast for domestic demand”.

The other projections included an upward revision in CPI and CPIF inflation – especially the core measure (excluding energy) - as well as for the size of the GDP contraction in 2023 (from -1.1% to -0.7% year-on-year).

New rate projections

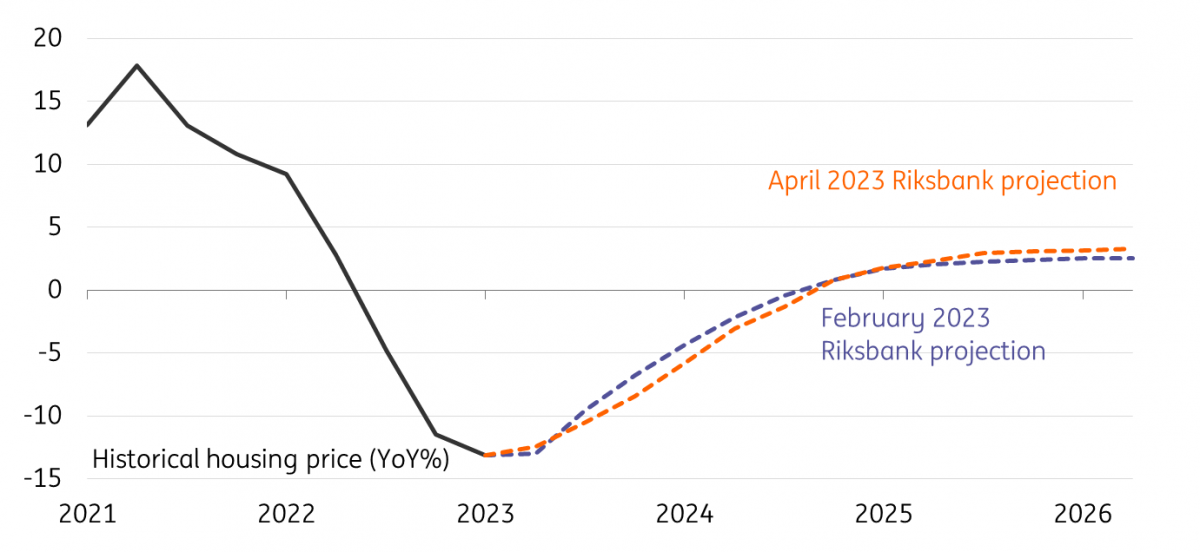

Words aren’t enough to support the krona

It is clear that there is a growing divergence of views within the Riksbank Board, and that today’s decision was probably the result of some sort of compromise, similar to what we saw at the latest European Central Bank meetings. The concerns of the Riksbank’s doves are reasonable, and while the anchored inflation point is a debatable one, the housing and growth fears are indisputable. As shown below, a higher peak rate meant that the projected slump in house prices is also longer-lasting, despite the slightly better-than-expected house price data in the first quarter.

House pain to be prolonged

We could see how Governor Erik Thedeen remained focused on his efforts to support the krona. His verbal attempts to support the currency have ranged from claiming that there are strong arguments in favour of SEK strengthening to highlighting how a persistently weak krona may affect policy. Unsurprisingly, those attempts did not prevent EUR/SEK from staging a big rally today as SEK dropped on the dovish surprise at the same time as the EUR was finding idiosyncratic strength.

We think that, more than the signal that rates will peak at 3.75%, it was the explicit dissent within the board that hit the krona today, and may well hinder the ongoing effort by Governor Thedeen to prop up the currency.

FX intervention? Still a risky path

Ultimately, this may be raising the chances that the Riksbank will have to take FX intervention into consideration. We continue to doubt an intervention campaign is a viable option for the Riksbank, considering the relatively contained amount of FX reserves and political hurdles that accompany unilateral FX buying for developed countries.

For now, we think that further SEK depreciation may see the Riksbank react with more verbal intervention including the threat of FX intervention to test the market’s reaction function. One key issue is still that many headwinds to the krona are beyond the Riksbank’s control (especially linked to idiosyncratic strength in the euro and risk sentiment swings) and the economic strains in Sweden have clearly dented the attractiveness of the krona from a fundamental perspective.

Our view is that EUR/SEK will remain around 11.30/11.40 in the near term, with risks of a spike to the 11.50 area in periods of risk aversion or should some risk premium related to the Swedish housing market/economic outlook be built back into the pair.

The dissent that has emerged within the Riksbank’s Board today poses upside risks to our baseline scenario for a descent below 11.00 in the second half of the year, although a generalised improvement in risk sentiment as the Federal Reserve's tightening cycle comes to an end, and the krona’s high beta to Europe’s decent growth story still point to a stronger SEK into year-end barring a material deterioration in the housing and economic outlook in Sweden.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article