Mexico: Signs of a honeymoon emerge

Mexico's President-elect Lopez Obrador will take office with remarkable political capital amid positive signs on the economy. Initial focus on corruption and security initiatives is encouraging, as is the signalled commitment to central bank independence. But scepticism remains about energy policies and the feasibility of his fiscal programme

Improving confidence adds to economic activity

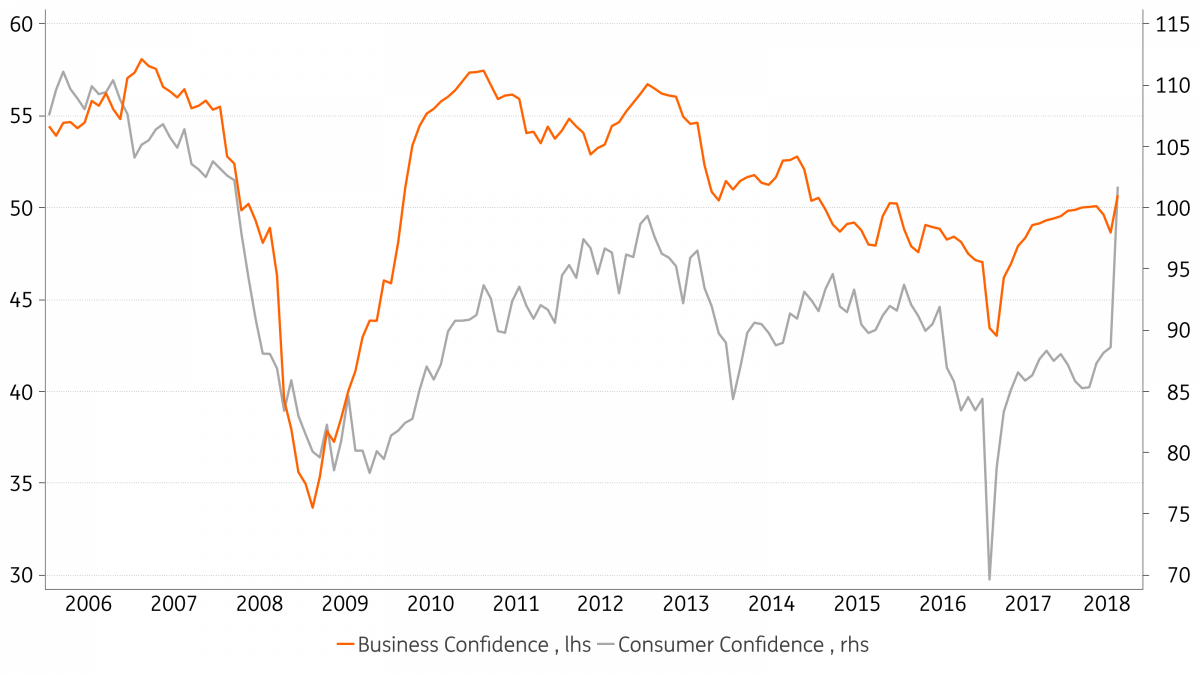

The surge in consumer confidence in the aftermath of the 1 July elections (as seen in the chart below) is perhaps the most surprising element gleaned from the economic data released over the past month in Mexico. Business confidence is also rising, albeit more gradually, which is especially surprising given the considerable pre-election trepidation by the business community with respect to Andres Manuel Lopez Obrador, widely known as AMLO.

The data suggests that AMLO’s post-election actions have been broadly well-received. It remains to be seen, however, if improving confidence will be sufficient to lift domestic demand, which has expanded at a steady, if unremarkable, pace in recent quarters. A turnaround in relatively depressed levels of investment and bank lending could help here. In any case, the result bodes well for an upbeat start for the recently-elected administration.

The new Congress will be inaugurated on 1 September while Obrador will take over from President Peña Nieto on 1 December.

Stronger peso should alleviate price pressures

The sharp rally in the Mexican peso seen over the past couple of months, up until the Turkey-related sell-off seen in recent sessions, also stood out. It reflected, to a large degree, investor relief after a period of electoral uncertainty and generally pro-market economic policy-signalling by the new economic team.

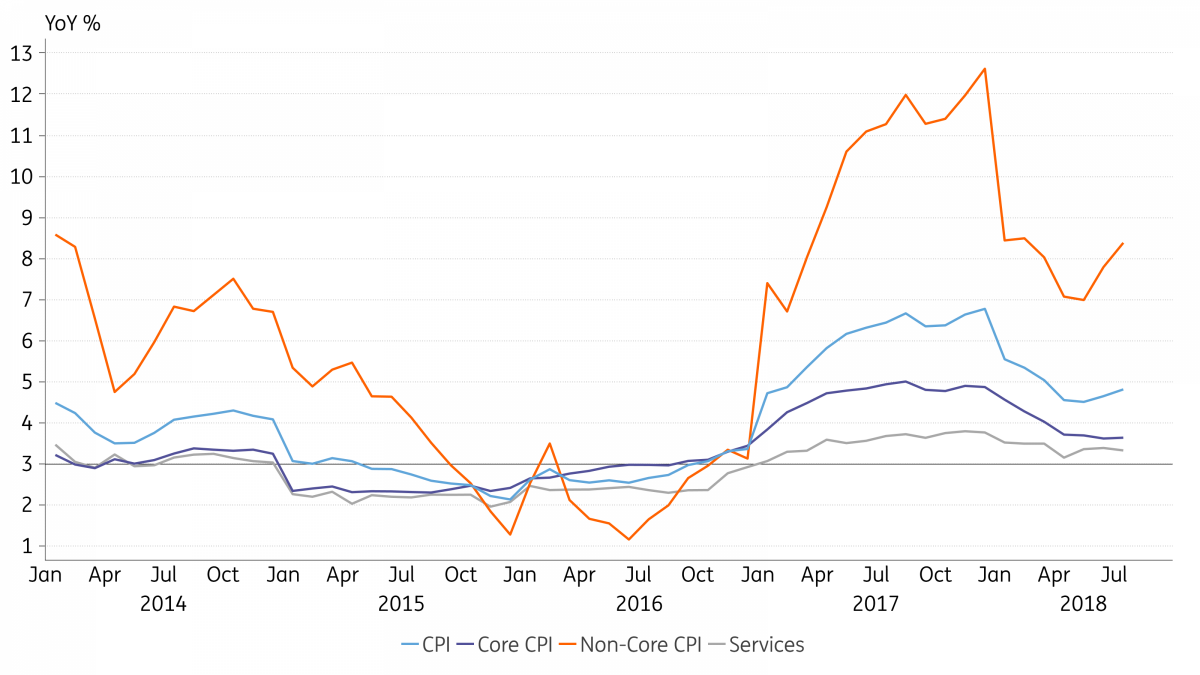

The peso’s rally, which likely contributed to the rise in confidence, also adds a more constructive bias to inflation trends. Consumer prices have risen faster than expected over the past couple of months. Yearly inflation decelerated sharply during 1H18, going from a peak of 6.8% year-on-year in December to 4.5% in May, but that correction has lost steam, with yearly inflation rising to 4.8% in July.

We don’t expect inflation to continue to climb from here, with monetary authorities likely characterising the rise as narrow-based and temporary, concentrated in more volatile, non-core components of the basket (energy). Near-term inflation expectations surged, but longer-term expectations remain stable while core and service sector CPI indicators remain moderate, as seen in the chart below.

Indeed, with the policy rate (7.75%) already deep into contractionary territory, the threshold for rate hikes seems to be quite high at this stage. In our view, a hike would materialise only in reaction to a drastic deterioration in FX trends, which seems unlikely at this stage.

In our view, the next rate move is likely to be a cut, but the timing should be heavily data-dependent, with inflation, the US Fed decisions, and FX dynamics dominating Banxico’s reaction function. In particular, as prospects for inflation to re-enter the targeted range (2-4%) seem more distant now, possibly only during 2H19, room for Banxico to ease monetary policy conditions during 2019 has been reduced.

As a result, in the near term, so long as Nafta remains unresolved and the external environment unsettled amid prospects for continued rate hikes by the US Fed, the bank should opt to maintain a vigilant/hawkish policy stance and downplay the risk of rate cuts.

Nafta is back on the front-burner

AMLO’s first year in office could also benefit from a successful conclusion to the Nafta negotiations. Discussions appear to have taken on a surprising urgency of late, with the US focused on ironing out its differences with Mexico, while apparently freezing Canada out of the talks.

News reports suggest that important advances took place in the critical auto-sector rules of origin, covering minimum national/regional content specifications, and wages in Mexico. Canada will apparently re-join the negotiations once the auto-chapter, which primarily involves concessions from Mexico, is concluded. Lingering challenges regarding the dairy sector could presumably be negotiated in bilateral negotiations between the US and Canada as well.

US demands for a (five-year) sunset clause, and changes to dispute resolution mechanisms appear to be the next items on the agenda. Canada is expected to re-join the negotiations for that, while reports that Nafta would be replaced with bilateral agreements between the three countries, a move that Mexico and Canada have previously resisted, seem premature. But an August deadline for completion of the negotiations seems too ambitious, especially considering the tough stance signalled by the US vis-à-vis the sunset clause not too long ago.

Overall, while the recent push confirms our view that an agreement is just a matter of time, an early deal would help to further diminish uncertainties that have hampered investment in Mexico since President Trump was elected, almost two years ago.

Investment outlook hindered by energy sector worries

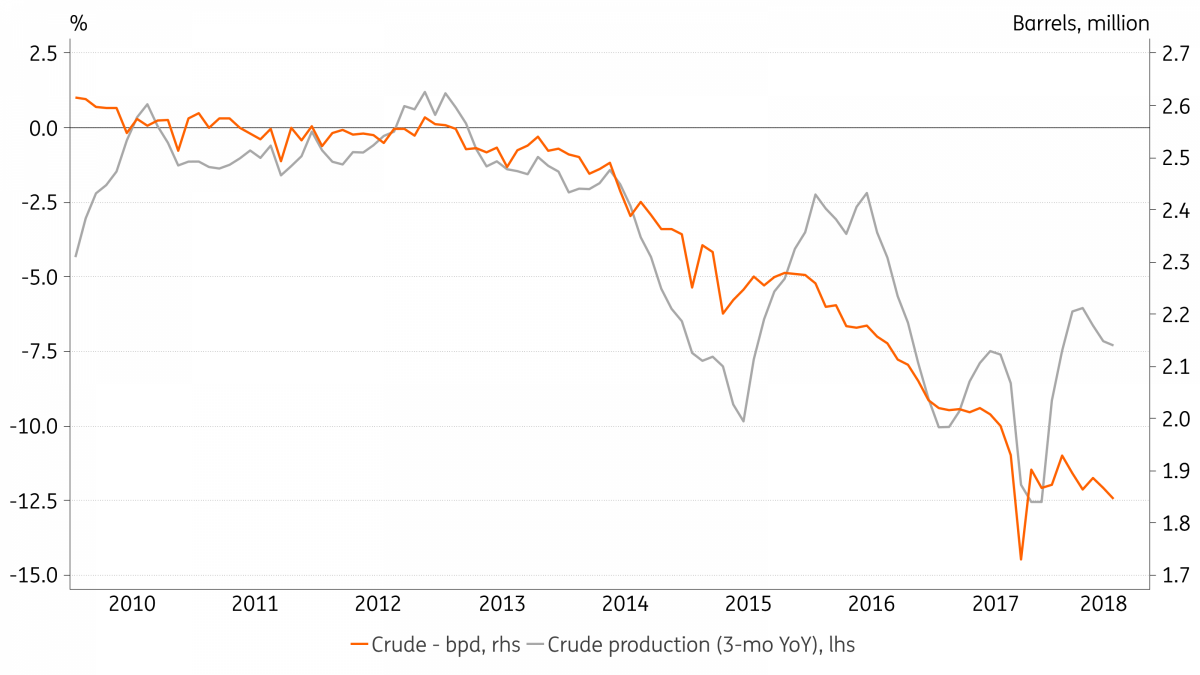

Greater clarity regarding electoral and Nafta-related risks are clearly supportive developments for investment, but the new administration has yet to provide greater clarity about the direction it intends to take with regards to the crucial energy sector. The energy sector remains a heavy drag on the Mexican economy, with persistent drops in production severely affecting external trade and industrial activity data.

Over the past five years, PEMEX crude production has fallen 27% (see chart below), output from its refineries has dropped by more than 40%, while the oil-sector external trade balance has deteriorated by almost $30 billion in annual terms, moving from a $9 billion surplus to a $20 billion deficit.

Given that much of this problem originated with the investment and financial difficulties faced by the public sector (and PEMEX), AMLO’s campaign pledge to halt the expansion of private sector participation in the sector is a major source of concern. Mexico’s ability to reverse these alarming trends would require greater, not smaller, private sector involvement.

Relying solely on PEMEX’s investment capacity is arguably a difficult proposition, given the company’s track record and strained finances. But the new administration is likely to, at least initially, insist on that, indefinitely phasing out the oil exploration auction rounds and the PEMEX/private-sector partnership agreements initiated by the Peña Nieto administration. Any efforts to change the energy sector regulatory environment would have an additional negative impact on investor confidence.

PEMEX has underperformed other local financial assets since the election amid risk that the new policy priorities would overburden the company. Plans to halt divestment plans, boost investment (refineries) and the implementation of fuel price controls would add material downside risk to the company’s already weakened credit metrics.

Too much power and the risk of policy excesses

AMLO’s resounding victory and large Congressional majority suggest that the new President is likely to take over with ample power, backed by an impressive popular mandate. He will face a weakened opposition and (likely) sufficient support from other left-leaning Congressmen to clear the 2/3 threshold necessary for the approval of controversial constitutional changes.

The positive reception by financial markets also suggests the new administration should have some leeway in implementing new policies, with investors arguably inclined to give the new president the benefit of the doubt.

Avoiding the temptation of sharply expanding the state-presence in the economy, jeopardising Mexico’s fiscal and growth outlook, is the main risk to watch. Apart from the changes to energy sector policies, investor scepticism is centred on the feasibility of social and public investment policy, with the upcoming budget negotiations providing a first glimpse into how deep a departure the new team will attempt.

The potential new initiatives that may pressure fiscal accounts include a new initiative aimed at keeping fuel prices stable (in real terms), an effort to increase public sector investment and the new social/entitlement programmes for the elderly and unemployed youth. No new taxes are planned to fund these initiatives, which are expected to be funded by an estimated 2% of GDP in fiscal savings.

There is growing scepticism however that planned initiatives such as the reduction of public sector salaries/personnel, tighter administrative cost-controls and the elimination of corruption and waste will be sufficient to generate these savings.

A potential silver-lining is that strict fiscal constraints and the focus on new social and security policy priorities should result in a more pragmatic stance vis-à-vis the state presence in productive sectors, especially with respect to the future of the energy sector.

Without vibrant private sector support, the prospects for Mexico’s medium-term macro outlook would be much-diminished, marked by low growth and lingering vulnerabilities on the fiscal and external side. In the longer-term, the risk is that policy failure and ample political power, thanks in part to an electorate beholden to the new MORENA-party signature entitlement programmes, would pave the way for increasing policy radicalisation, as seen in Brazil during the Workers' Party (PT) years.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).