Introducing the ING weekly economic activity index for the eurozone

Economic activity has been on a rollercoaster thanks to Covid-19 and the measures taken by governments to curb the spread of the virus. We have developed an indicator to track economic activity from week to week to get a sense of how the eurozone economy is performing

Innovation allows for high frequency tracking of economic activity

Thanks to longer term trends in digitalisation, transparency and the urgent need for quick economic guidance in the pandemic, the pool of data for tracking economic activity in almost real time has grown significantly. Researchers and policy makers now have access to new and innovative data sets, the most known probably being Google mobility reports.

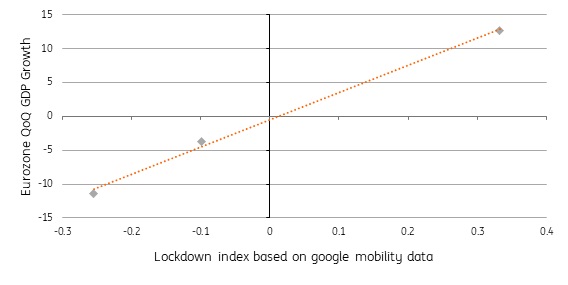

The pandemic has also shown just how useful high frequency indicators can be. High-frequency data can be volatile, but the swings in economic activity associated with lockdowns and other restrictions are clearly visible, and have been closely associated with GDP outturns so far (Chart 1).

Chart 1 – Google mobility data and GDP growth

This relationship may fade again once life goes back to normal, making it difficult to isolate the information from the noise in high frequency data once economic swings reduce to tenths of a percentage point. In the meantime, the process of opening up is not likely to be smooth, so these measures are likely to provide value as long as the “corona economy” remains in place.

Creating an index for tracking eurozone economic activity

Based on similar economic activity data calculated by the Bundesbank and the New York Federal Reserve, ING’s indicator uses open access data covering the activity of both households and firms in the economy to construct a eurozone economic activity index. Our indicator, the ING weekly economic activity index (ING-WAI) for the eurozone is based on data from the five largest countries: France, Germany, Italy, the Netherlands, and Spain, which together represent about 83% of the eurozone’s output.

The underlying data of the index

- Google searches for “unemployment” and “unemployment benefits”

The data shows the number of times these search terms are used per day in a given country. People may use these search terms when they lose their jobs or expect to do so. This means that a higher quantity of Google searches may indicate an increase in unemployment and a decrease in economic activity. We translate the search terms into the relevant language for each country. - Google Community Mobility data

"The data show how visitors to (or time spent in) categorized places change compared to our baseline days. A baseline day represents a normal value for that day of the week. The baseline day is the median value from the 5‑week period Jan 3 – Feb 6, 2020" .We use separate series for retail and recreation, groceries, and workplaces, so that the data provides information about household consumption as well as work not being conducted at home. In each case, higher mobility scores indicate an increase in economic activity. - NO2 emissions

The data, published by the European Environment Agency (EEA), show emissions of nitrogen dioxide for each country. NO2 is a chemical associated with industrial production and road traffic, and increases indicate increases in economic activity. - Energy consumption

The data, published by the association of European transmission system operators (ENTSO-E), shows the consumption of electricity for each country. The main consumers are firms, but use by households is also captured. Increases in energy consumption indicate higher levels of economic activity. - Trucking mileage (Germany only)

The data shows the distances travelled along motorways in Germany, an indicator of the amount of goods being transported to industry as inputs, and to wholesale and retail outlets. Trucking mileage can also reflect the status of supply chains, with hold-ups causing decreases in mileage.

How it’s made

We transform the data to weekly series, giving a dataset from 2019 to the most recent week. We invert the Google search data so that increases indicate an increase in economic activity. For the Google mobility data, we create a synthetic time series starting in 2019 and running to 2020 week six, with the mean and standard deviation equal to weeks seven to nine of 2020. (Without this step, the short time series of the Google mobility data would limit our ability to include longer time series of the other variables.) For NO2 emissions, energy consumption and trucking mileage, we seasonally adjust the data and then de-trend each series by taking differences from a 12-month rolling average.

We then normalise the seven data series (eight in the case of Germany) and calculate the first principal component for each country. This component captures one of the dynamics causing movements in our data. (For an overview of Principal Component Analysis, please see for example, this tutorial.) The ING-WAI is then calculated as the GDP-weighted average of the first principal component from each the five countries. For ease of interpretation, we index the average of the series to 100.

How the index tracks economic activity

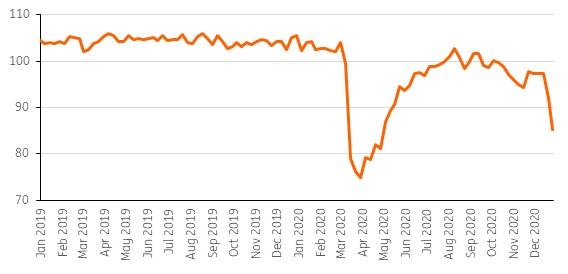

The most recent reading of the weekly indicator shows how economic activity in the past week compares to the average over the entire series (represented by 100). Chart 2 below shows the indicator as of the week beginning 28 December. The sharp drop in economic activity from the first lockdown between weeks 9-13 was followed by a recovery, which had levelled off in weeks 29-40 (broadly the third quarter). With most countries implementing new restrictions, economic activity has taken another dive, starting week 51.

Chart 2 – ING weekly economic activity indicator

Index, average = 100

To get a sense of what the weekly indicator means for quarterly GDP growth, we also calculate a rolling average of the past 13 weeks on the 13 weeks before that. This gives a first look at quarterly GDP growth once the end of each quarter is reached, when a scaling factor is applied. The comparison between this rolling quarterly average, and GDP growth is shown in Chart 3.

Chart 3 – ING-WAI and quarterly GDP growth

Looking ahead

As the economy changes, the relevance of different indicators for measured economic activity will change. This indicator is designed to pick up the pronounced changes in economic activity caused by the Covid-19 virus and the measures being taken to contain it. Over time, the indicator may start to miss changes in economic activity due to the volatility of the high-frequency data or the composition of the indicator.

The indicator is easily adjusted to include different Google search terms, and other data sources. In time, it will be important to capture different countries’ experiences of opening up, and we may need to adjust the country coverage if there are markedly different approaches within the eurozone. If changes are made, we will record these changes in this methodology document while we continue to publish the indicator.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article