In Charts: 5 reasons why we’re still medium-term EUR/USD bulls

The recent fall below 1.12 has raised fears about another major leg lower in EUR/USD. We'd already penned a move to 1.10 in our profile for 2Q19 and we do acknowledge that the case for a rebound later this year has become a little harder. However, we think there are still 5 good reasons why EUR/USD will turn higher to 1.20 next year

ING's updated EUR/USD forecasts

Peak growth differential

Peak Economic Divergence

Looking at year-on-year growth rates, 1Q19 saw the US outperform the Eurozone by 2%. That outperformance was driven by the contribution of inventories and trade, the positive effects of which should fade through 2019. From 3.2% YoY in 1Q19, our US team expect the growth rate to slow below 2% into early 2020.

While nowhere near the 2.5% levels seen in 2017, our Eurozone team see growth staying in the 1.1-1.5% YoY area over the next 6-8 quarters. The narrative of US macro outperformance should therefore fade. This should have important implications for international equity flows and EUR/USD, where overweight US, underweight Europe positions were a core theme through 2018.

Peak interest rate differentials

Peak Interest Rate differentials

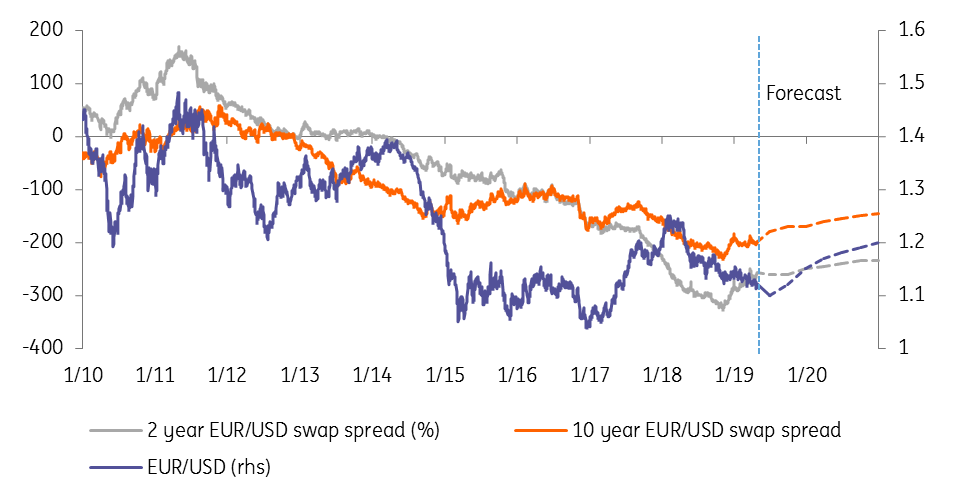

Rate differentials have not had much say in determining EUR/USD pricing over recent months – a prime example being the dollar holding up very well despite the collapse in US interest rates in December). Unless the European Central Bank cuts the -0.40% deposit rate (not our call), it is hard to see Eurozone market interest rates going much lower.

The change in rate differentials should therefore largely be a US story. Our macro and rates strategy team expect US market interest rates (both at the short and long end of the curve) to continue to drift lower over coming quarters as the US business cycle matures – for reference June 2019 will mark the tenth year of the US expansion.

We happen to think that interest rates at the short end of the curve are really important for FX markets right now. These have created exceptionally high USD hedging costs (now 3% for EUR and JPY-based investors) and these rates may only start to ease when it becomes clear the Fed is ready to ease – thus this may not be a story until 2020. Nonetheless, we don’t expect rate spreads to move any wider and the multi-quarter direction of travel should be narrower.

US twin deficits still need funding.....

... and the repatriation effects of overseas income look set to fade

US deficits still need funding...

It’s certainly a medium-term issue, but there’s no getting away from the overhang that US twin deficits have edged wider and are expected to deteriorate further over coming years. Consensus expects the US budget deficit to push close to 5% of GDP into 2020, with the current account deficit heading towards 3%.

Superior growth and interest rates have allowed the US to fund those deficits. As above, that US macro superiority looks set to dwindle. Additionally, the US received temporary funding of its current account deficit last year from the 2017 Tax Cut and Jobs Act. This prompted US companies to pay US$500bn more in dividends than a year earlier – ie, repatriating funds from overseas to distribute as dividends in the US. Data from the Bureau of Economic Analysis (BEA) shows that this dividend activity peaked in 1Q18 and was tailing off by the final quarter of 2018. We doubt this factor will help the US Balance of Payments any more.

Eurozone Balance of Payments

Eurozone Balance of Payments actually look constructive

The EUR has failed to derive much benefit at all from its near 3% current account surplus, largely because rock-bottom Eurozone interest rates have encouraged high FX hedge ratios on Euro area investments.

But quietly, behind the scenes, the Eurozone BoP position has been improving markedly. The ECB’s crowding out (into foreign bond markets) of European investors has slowed dramatically, meaning that the Basic Balance (Current Account + Direct Investment + Portfolio Flows) is now more Euro supportive. This is a compelling story for Euro bulls, but needs a catalyst from either a re-rating of Europe, or (more likely) a US slowdown.

EUR/USD looks cheap on a long-term basis

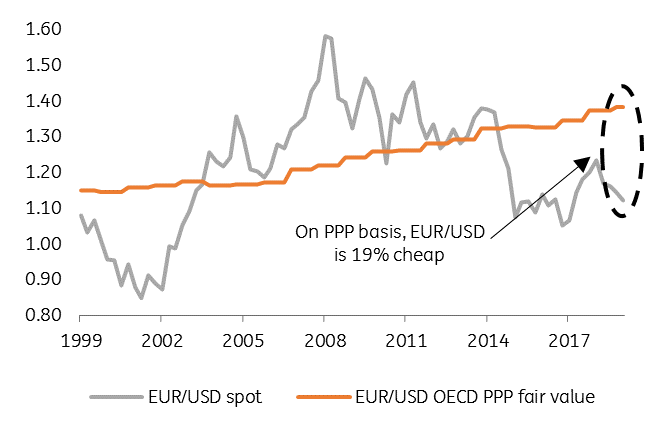

EUR/USD looks heavily undervalued on a long-term basis

On the long term valuation basis, EUR/USD screens as heavily undervalued. This is evident in the chart above, which shows Purchasing Power Parity fair value (the longest valuation measure) being at EUR/USD 1.38. This is almost 20% above the current spot level and one of the historically largest mis-valuations in absolute terms (on par with those observed in late 2016 / early 2017 and back in 2000-2002). The current extent of the mis-valuation should limit the scale of the EUR/USD downside from here - as was the case in 2015-2017 period, when the stretched valuation acted as a soft floor under the EUR/USD.

Macro-political risks and alternative EUR/USD paths

Macro-political wild-cards remain

The above analysis and baseline set of EUR/USD is largely built on our macro and interest rate forecasts and BoP views. As we've seen over recent years, however, politics and policies frequently have a major say in determining FX trends. Into 2020, US elections will have a major bearing on financial markets - see our team's Presidential election scenario analysis here.

Equally European Parliamentary elections later this month will shed light on the performance of the populist, euro-sceptic coalition and whether a political risk premium needs to be re-inserted into the Euro. And the Eurozone also faces a near term threat in the form of auto-tariffs from Washington.

Rather than taking a baseline position on all these political outcomes, we instead reprise our EUR/USD scenario analysis above, estimating which factors could deliver the best and worst outcomes for EUR/USD. Needless to say, stress-testing cash flows or investments against these alternative scenarios is an essential exercise.

Overall, however, we do think the medium-term path for EUR/USD lies to the upside.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 May 2019

What’s happening in Australia and around the world? This bundle contains 8 Articles