Does secular stagnation help the dollar?

The Dollar Index has broken to a new high for the year – largely on the back of weaker growth prospects overseas. If secular stagnation fears grow and asset allocation shifts towards bonds from equities, prohibitively high dollar hedging costs could mean the dollar does even better

Secular stagnation fears in the ascendancy

This week the trade-weighted dollar has rallied to a new high for the year. This has been driven less by US growth news, but more by sluggish activity and softer monetary policy prospects in the rest of the world. In fact, most fund managers have a growing conviction that the world economy is entering into a period of low growth and low inflation - or secular stagnation.

Fanning the fears of low growth and low inflation this week have been: soft CPI readings in Australia, continued pessimism from European manufacturers (German IFO) and a poor 1Q19 GDP release from Korea. We’ve also seen a dovish raft of central bank communication from the likes of the Bank of Canada, Sweden's Riksbank and, surprisingly, the Central Bank of Turkey.

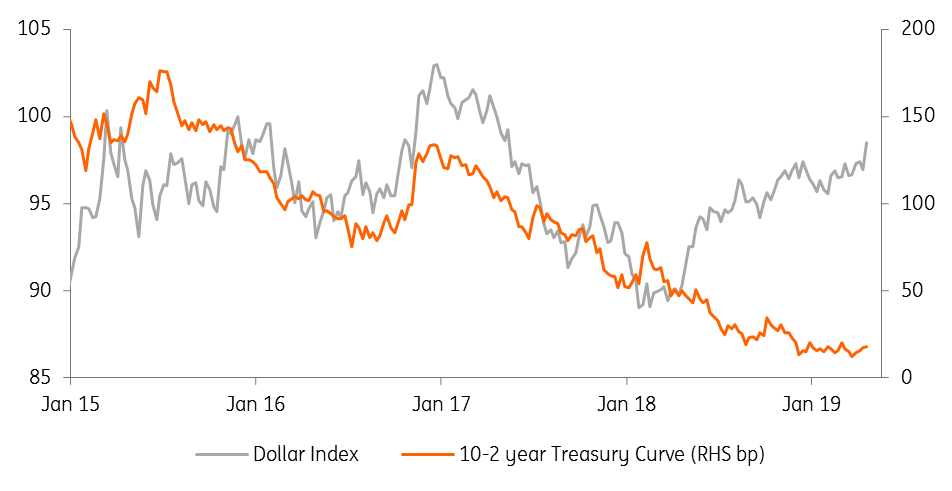

Despite prospects of some better US activity data near term, the interest rate market has struggled to shrug off fears of a slowdown. And while the jury is still out on whether a flat/inverted yield curve foreshadows the next US recession, the dollar continues to perform well. In fact, the dollar index (DXY) has broken to a new high for the year and has now reclaimed around three-quarters of the decline since Trump took office in January 2017.

Despite US yield curve flattening, the dollar rallies

Asset allocation shift to bonds from equities?

If increasing fears of secular stagnation are realised, we would expect to see the investment community (eg, those running balanced funds which invest in both equities and bonds) rotate away from equities and into the bond market.

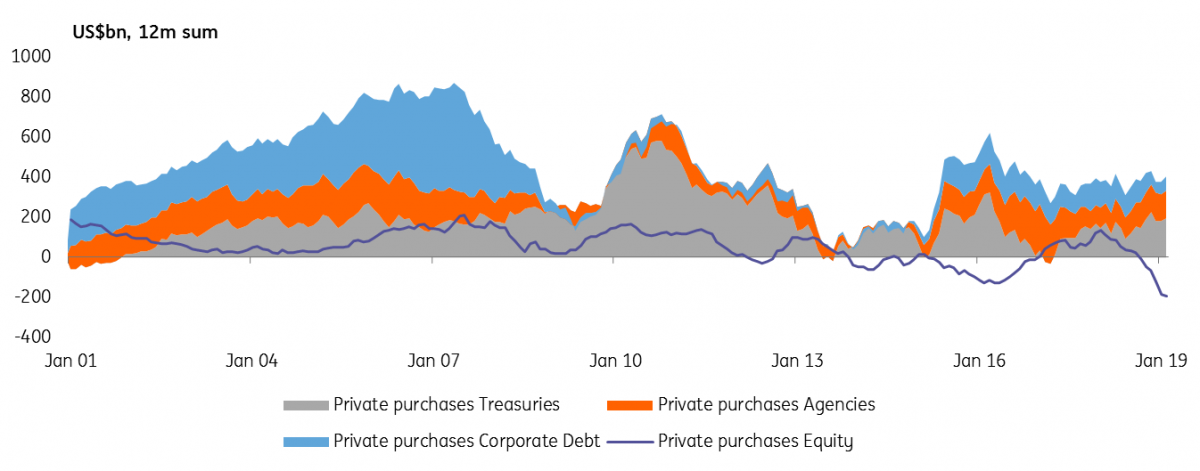

Buy-side surveys suggest investors are still underweight bonds and overweight equities, although there is some evidence that the rotation (at least in US asset markets) is already underway. Here the US Treasury releases its Treasury International Capital (TIC) data series, showing foreign purchases of US securities and US purchases of foreign securities. The data (as of February 2019) shows consistent foreign private sector purchases of US bonds (Treasuries, Agencies and Corporates). In contrast, foreigners have sold US equities for the last ten months.

Were secular stagnation fears to take hold and more investments be directed towards bonds, market liquidity considerations mean that US fixed income would receive sizable inflows as a result of its large weight in global bond benchmarks. Currently, the US has the largest weight (around 30%) in the Bloomberg Barclays Global Sovereign Index.

Foreign private sector purchases of US securities (US$bn, 12m sum)

A rotation to bonds could send the dollar even higher

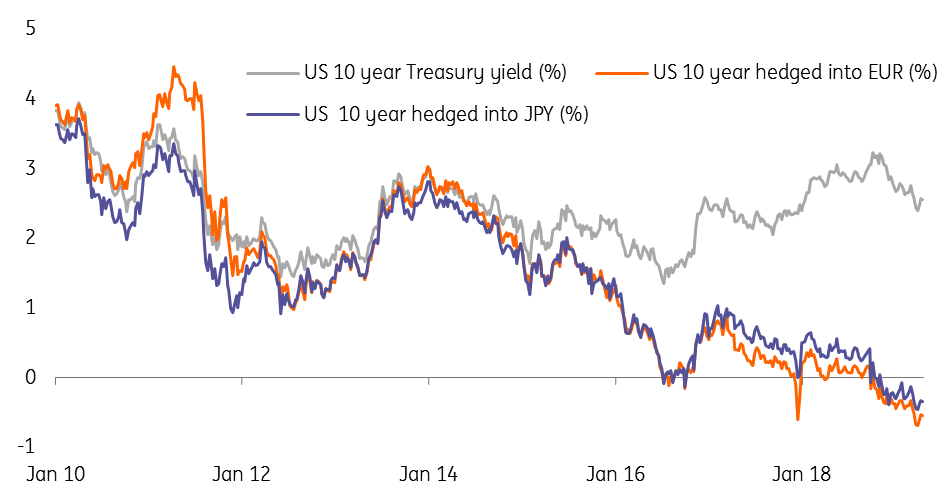

The recent decline in market interest rates seems to have done the dollar no harm at all. This may be because those foreign asset managers wanting to increase their exposure to the US bond market are faced with prohibitively high dollar hedging costs. For Eurozone or Japanese-based investors the annual cost of hedging FX exposure to US asset markets is now around 3.00/3.10% (using the 3 month FX forwards markets as a proxy). This cost exceeds the yields available across the entire US Treasury curve. It would be no surprise to hear that some of the Japanese Life Insurers are increasing their allocations to unhedged foreign bond positions in the new fiscal year starting this month.

Unless we see a sharp, positive re-assessment of growth overseas, or much weaker US growth to trigger a serious re-assessment of Fed policy including expectations of an imminent easing (such that the short-end of the US curve really softens and USD hedging costs cheapen), we fear that the dollar is going to be staying much stronger than our current baseline forecasts. As such our year-end 2019 EUR/USD and USD/JPY forecasts of 1.18 and 108 look like they’ll have to be revised in favour of a stronger dollar.

US Treasury yields, unhedged versus hedged into EUR and into JPY (%)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

25 April 2019

What’s happening in Australia and around the world? This bundle contains 9 Articles