Canada’s labour market: What soft patch?

Record-breaking job gains in April show that the labour market is proving resilient, despite domestic and global headwinds. Given that economic growth should regain some strength in the second half of the year, we don't expect a Bank of Canada rate cut in 2019

The latest Canadian employment report gives us a reason to remain cautiously optimistic and suggests the jobs market is proving relatively resilient in the face of both domestic and global headwinds.

Employment grew by 106,500 in April according to Statistics Canada – the largest monthly increase going all the way back to 1976. Gains were fairly broad-based on a provincial, demographic and sectoral level. At 5.7%, the unemployment rate remains close to its 40-year low.

Thanks to productivity, there’s room for further wage upside in coming months

This tightness is gradually translating into higher pay. Average hourly wages for permanent workers increased from 2.3% in March to 2.6% in April. While consumer price inflation looks a little more benign this year, skill shortages look set to continue to place pressure on pay.

Labour shortages were still the most frequently cited bottleneck by firms in the Bank of Canada’s (BoC’s) spring Business Outlook Survey – notably in services industries – suggest there’s room for further wage upside in the coming months.

What’s actually keeping the labour market healthy?

The Canadian economy is undergoing a more muted growth spell – largely due to slowing demand (both internally and externally) and global trade uncertainties. But while we expect this to persist for a bit longer, it looks like the services sector has played a vital role in supporting both job and income gains in the meantime. We suspect it will continue to do so throughout 2019 and into 2020.

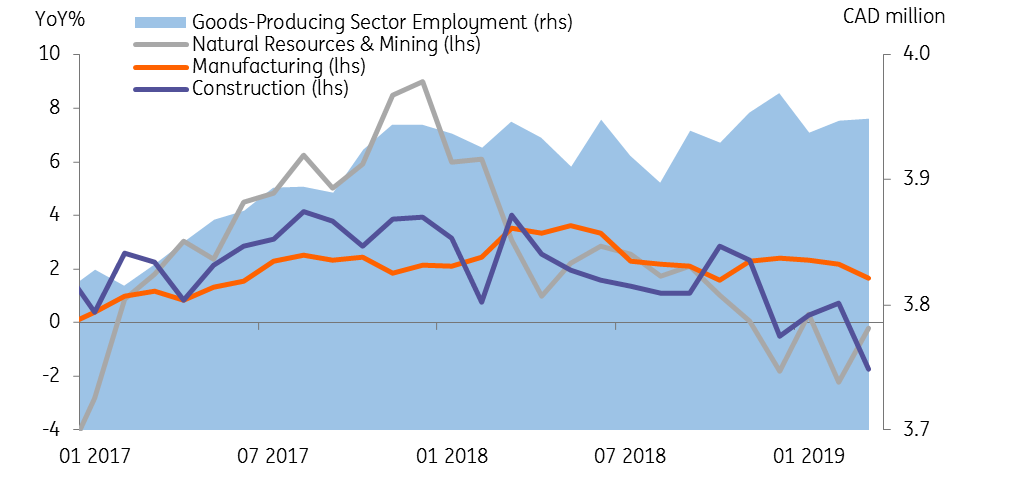

We also expect that the performance of goods industries will also improve throughout the second half of the year, and the noticeable increase employment in both the trade and construction sectors could be an earlier indication of this.

What soft patch?

The April employment report reinforces our view that economic growth will start to regain some strength. The economy should begin to recover from the late-2018 oil price decline, while changes to housing policies should add some gradual support to domestic demand too. A lot depends on trade policy, but if a US-China trade deal can be struck in the third quarter as our team expects, this too could help support the recovery.

Employment growth in goods-producing sectors have suffered more recently, but a recovery is on the horizon

While other dollar-bloc central banks have either cut rates, or have signalled they could do so soon, we think its less likely that the Bank of Canada will follow suit. That was emphasised when policymakers described the current monetary stance as "accommodative" at its last meeting. Given prospects for better economic news later in the year, we think a rate cut is unlikely at this stage.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article