US spending patterns start to shift

US retail sales were flat in April, but after March's stimulus fueled surge this is no bad outcome. The re-opening means there are an increasing number of options for spending money and we will see a movement away from “things” that are picked up in retail sales, towards “experiences”, which are not

| 51.4% |

YoY change in US retail sales |

Shoppers still spending....

US April retail sales were unchanged on the month versus the 1% consensus forecast, but March's figure was revised up to 10.7% from 9.7%, so at the headline dollar spending level it is pretty much in line with expectations. March’s jump on the back of the latest $1,400 stimulus payment was always going to make for a tough comparison, but at least today’s data shows not let up in spending momentum. For what it is worth the year-on-year growth rate of sales is an astonishing 51.4%, but of course we are comparing with the depths of the lockdown last year.

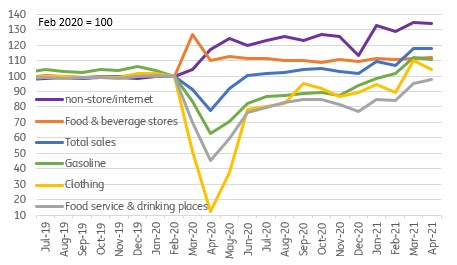

Autos led spending with a 2.9% gain after a 17.1% rise in March. The ex-autos figure fell 0.8% month-on-month with declines in 8 out of 13 categories, including a 5.1% fall in clothing, 3.6% in sporting goods and a 4.9% drop in general merchandise. Even non-store retailers (largely internet) posted a 0.6% decline. Nonetheless, eating and drinking out rose 3% and health spending rose 1%.

US retail sales levels by category Feb 2020=100

... but the patterns will change

The "control" group which excludes volatile food service, autos, gasoline and building materials fell 1.5%. This typically has a better correlation with broader consumer spending trends than the headline figure, but we suspect this relationship isn’t going to be as strong in the next few months since the economic re-opening is giving us more options on which to spend money.

We are going to see more and more people switching a greater proportion of their spending away from "things", which are picked up by retail sales, towards "experiences" which are reflected in broader consumer spending (and not retail sales). Consequently we still expect to see double-digit GDP growth in 2Q, led by consumer spending.

Looking further ahead the consumer story remains very positive.

Looking further ahead the consumer story remains very positive, underpinned by the more than $2tn increase in cash, checking and savings deposits built up through the pandemic – the result surging incomes (stimulus payments, extended and uprated unemployment benefits) with little option on which to spend the money.

As more businesses re-open and expand, the desperate hunt for workers points to upside risks for bonus payments and wages, at least in the near term. Consequently, consumers will have plenty of cash ammunition to keep spending.