US jobs report - the worst possible outcome?

The US created more jobs than expected in July. The risk is this eases the pressure on politicians to agree on an immediate fiscal deal. With confidence already under pressure, incomes being squeezed by benefit cuts and Covid containment measures hurting job prospects, we are entering a more challenging period for the economy

| 12.88mn |

How far employment remains below February's level |

Payrolls beats expectations

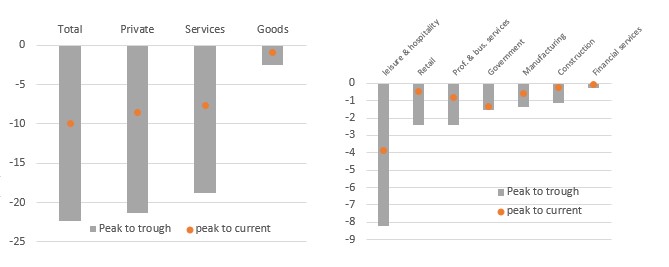

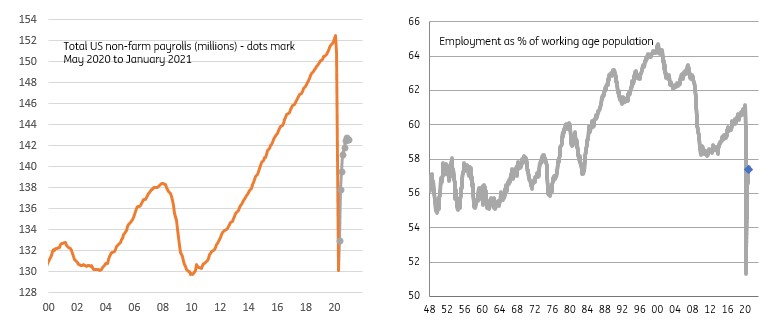

US non-farm payrolls rose 1.763mn in July, above the 1.48mn consensus with unemployment rate falling to 10.2%. Wages growth is at 4.8% year-on-year supposedly, but should be ignored – it is caused by the fact there are fewer people in low-income employment as they have been fired so “average” hourly earnings are skewed higher versus 2019.

The details show that the service sector saw most of the gains with leisure/hospitality up 592k, trade and transport rising 291k, retail up 258k and business services up 170k. Manufacturing (+26k) and construction (+20k) saw more muted gains while government employment rose 301k. Despite these impressive gains we have to remember the number of people in work is still 12.88mn lower than February. There is still a mountain to climb…

US payrolls change and the level of employment

But the labour market remains weak

“Officially” unemployment is now 16.338mn, but this grossly misrepresents the true state of the jobs market. That’s because to be “officially” unemployed you have to be actively looking for work. When there isn’t any if you are a bar worker or a gym instructor, for example, there isn’t a great deal of point – remember, you don’t need to be looking to claim unemployment benefits.

That is why we are more focused on page four of the weekly jobless claims report from the Department of Labour. It shows there are now 31.038mn people claiming benefits under all programmes. The big issue here is that these 31 million people are experiencing a US$600 income drop this week due to the ending of the Federal unemployment benefit payment. Republicans and Democrats continue to look to get a deal on another fiscal package, but even if they do the result is likely to be a substantial drop in the Federal benefit payment and therefore lower incomes for many millions of households.

Unemployment differences

Growth challenges are mounting

Overall, while today’s report is certainly better than expected, from a medium-term perspective it is possibly the worst outcome. It doesn’t intensify the pressure on politicians in Washington to compromise on a new fiscal a deal, which means that the US$600/week unemployment benefit that ended last weekend will not be replaced with anything for at least another week, so 31 million people will continue to experience a considerable drop in their incomes at a time when job availability is becoming more scarce.

The August jobs report is going to be worse

The August jobs report is going to be worse as the economic effects of Covid-19 containment measures increasingly bite. There is plenty of evidence suggesting it is resulting in business closures and jobs being lost, be it Homebase’s employment tracking numbers or the Census Bureau’s Household Pulse survey. Throw in July’s big plunge in consumer confidence and the ending of the US$600/week Federal unemployment benefit payment and we have the recipe for a much more challenging environment for growth. We would not be surprised to see a negative August payrolls number (published 4 September) and a negative August retail sales number (16 September).

Time will tell if this is the catalyst for a more realistic assessment of recovery prospects by equity markets. Remember it took three years to recover the lost output following the Global Financial Crisis and the current situation has seen a far deeper economic contraction with little clarity on the efficacy and timing of a potential vaccine. Throw in the prospect of significant structural change in the economy relating to working from home, business travel, retail, commercial real estate etc and we continue to see a bumpier and more gradual recovery process than is currently seemingly being priced.