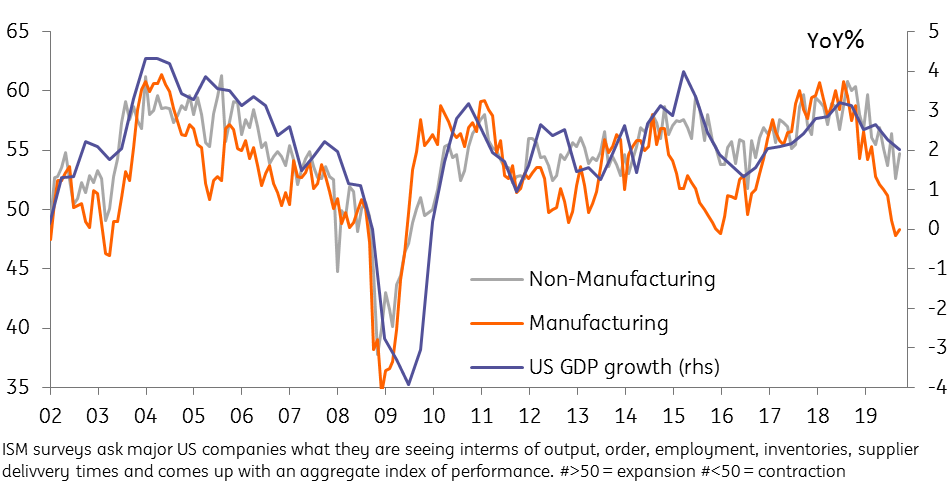

US: ISM non-manufacturing survey offers positives

The ISM non-manufacturing index rose a little more than predicted in October and fits with the narrative of a Fed pause at the December FOMC meeting

While the manufacturing ISM continues to point to a recession in that sector, the ISM non-manufacturing index shows that there continues to be respectable growth in other parts of the economy. The composite index improved to 54.7 in October from 52.6 in September, leaving the index a touch below its 6-month average of 54.9. Business activity, new orders and employment all improved and remain in growth (above 50) territory, soothing concerns that the deceleration in US activity was gaining momentum. Nonetheless, the headwinds from weaker global activity are clear with new export orders recording its weakest reading since January 2017.

ISM indices imply slowdown rather than recession

As can be seen in the chart above the manufacturing and non-manufacturing ISM readings are pointing to a slowdown in the rate of US growth, but are not signaling recession is imminent. The Federal Reserve will be hoping that the three rate cuts in July, September and October will support growth while the easing in trade tensions will be sustained. If so then the Fed will likely leave monetary policy unchanged in December. Nonetheless, with business investment having contracted in 2Q and 3Q19 and lead surveys suggesting we could get another contraction in 4Q19 there is a sense that more economic weakness is coming. We anticipate more interest rate cuts – probably two 25bp moves - in 2020.

Download

Download snap