US industry data adds to growth optimism

Full order books and rising energy prices mean robust growth momentum can continue and adds to optimism that second-quarter GDP will exceed 3%

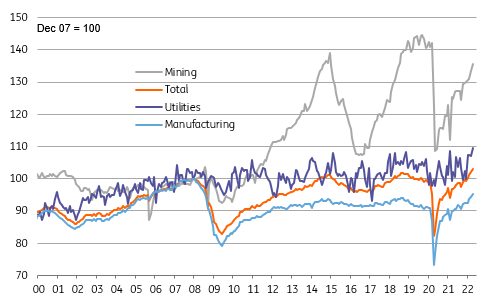

Following on from the very good retail sales report, we have a much stronger than expected US industrial production release for April. Output rose 1.1% month-on-month in April versus the 0.5% consensus with manufacturing up 0.8% (consensus 0.4%), utilities up 2.4% and mining up 1.6% with oil and gas drilling up 3.2%.

US industrial production level breakdown

Manufacturing output is now more than 4% up on pre-pandemic levels and is at its highest level since 2008. Motor vehicles and parts led the way with a 3.9% MoM increase to leave output up 17% year-on-year, which suggests there has been a clear improvement in supply chains. Importantly this points to more availability of vehicles that can take more steam out of the second-hand car market. Surging prices here have been a key factor pushing consumer price inflation higher over the past couple of years given its 4.2% weighting within the CPI basket.

Excluding autos, manufacturing output was up 0.8% with machinery output rising 0.8% and consumer goods also up 0.8% with business equipment up 1.1%

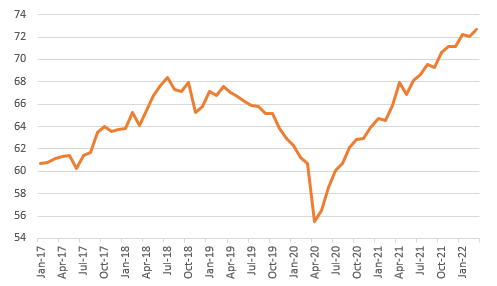

Order books suggest manufacturing momentum can continue

Decent order books point to ongoing strength in output while elevated oil and gas prices are prompting more drilling activity. The number of new oil and gas rigs is rising pretty rapidly now (714 last week versus 673 at the beginning of April). As with the good retail sales report, this all points to a strong 2Q GDP rebound, keeping the Federal Reserve on track with 50bp interest rate hikes.

Download

Download snap