Unstoppable! German Ifo increases again in April

The Ifo index surged for the third consecutive month, suggesting that Germany’s golden cycle has entered yet another round.

Germany’s most prominent leading indicator, the Ifo index, increased once again in April. The Ifo stands now at 112.9, from 112.3 in March, the highest level since July 2011. While the expectations component weakened somewhat, the current assessment component surged further and now equals its all-time high from June 2011. The surge in the current assessment component should be driven by the weather-related activity pick-up in the construction sector, but also by recent better data from the manufacturing sector.

The German economy seems to have entered an almost endless positive cycle. While new economic reforms are still hard to find, the mix of earlier reforms, low interest rates, a weak euro and strong private and public consumption has put the tune of solid German growth in an almost infinitely-looping cycle. With the end of the harsh winter weather, the construction sector has accelerated again. Also, the latest hard data suggests that the manufacturing sector should gradually move into a higher gear.

The only weak spot of the German economy remains rather sluggish investment. Here, another way to support domestic investment would be to receive the current international criticism on the German trade surplus in a more elegant and reflective way. As regards that criticism, it is hard to deny that German exporters are one of the main beneficiaries of the weak euro exchange rate, even though the German government is clearly the wrong address for criticism on a weak euro. Roughly 2/3 of all German exports go to non-euro countries. The weak euro and surging German exports is more than a coincidence. However, there is very little the German government could do to weaken exports. Instead, the government should focus on the import side of the trade surplus. Here, stronger domestic demand, preferably in the form of higher private and public investments, should gradually help reducing the trade surplus. Eventually, if treated correctly with investments in the growth potential of the German economy, a shrinking trade surplus is mainly in the interest of Germany itself.

All in all, today’s Ifo index adds to the evidence that, not only the German economy, but the entire Eurozone economy could become the positive growth surprise of 2017. With political risks now ebbing away, economics (ie at least a positive cyclical upswing) should gradually take over.

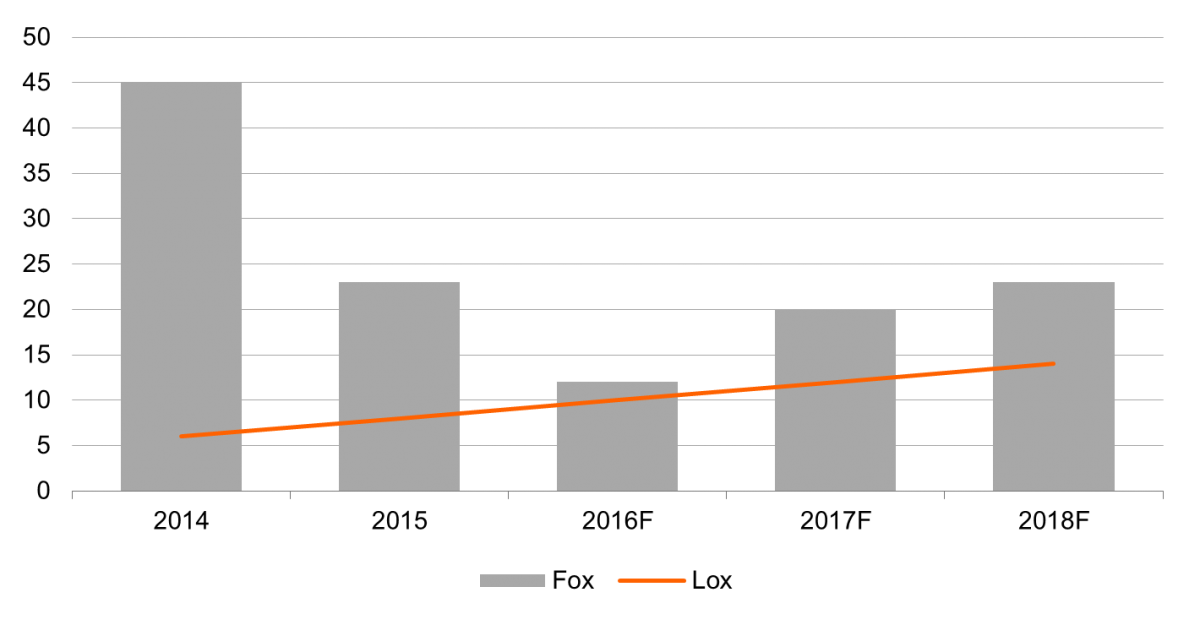

Our line chart

Test

Download

Download snap