UK inflation notches higher as wage pressure builds

The reasons behind the unexpected increase in headline UK inflation in July were undoubtedly quirky. And while CPI has the potential to ease in coming months, we suspect the Bank of England will continue to focus on the strong wage growth backdrop. Unlike in other global economies, a UK rate cut seems unlikely in the near-term

At 2.1%, July’s headline rate of UK inflation is another sign that it may be too early to be talking about UK rate cuts.

July’s CPI numbers were a bit higher than expected, although it’s fair to say the reasons for inflation nudging back above the BoE’s target were fairly quirky. The prices of games and toys rose by a massive 8.4% in month-on-month terms, the biggest such rise since the series began in the 80’s. Accommodation prices, coupled with a less pronounced fall in clothing prices than the same time last year, also boosted inflation.

But even accounting for these distortions, we still think policymakers will remain relaxed about the outlook for prices. While we expect headline inflation to inch below target later in 2019, this is predominantly down to energy prices. Some of the recent slowdown in CPI also relates to the fact that the effect of the pound’s post-Brexit fall has filtered out – the contribution to inflation from items with a low-import intensity has been more stable (see chart below).

Goods with a large import-intensity have driven the move lower in headline CPI

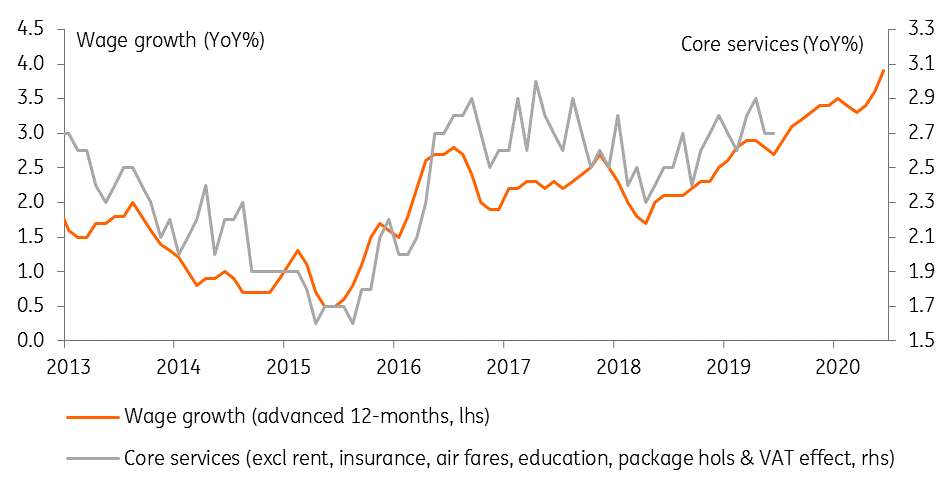

Importantly, wage growth is also at a post-crisis high and this has been a greater focus for policymakers over recent months. Given services make up a sizable share of the UK inflation basket, and these items tend to be fairly labour-intensive, we’d expect this to add a bit of upside to consumer prices in the medium-term. This relationship is shown quite neatly by the chart below, which matches so-called ‘core services’ inflation against wage growth with a 12-month lead.

Will UK services inflation increase following recent wage gains?

The domestic inflation backdrop suggests that UK rate cuts are unlikely to be forthcoming in the near-term, although as ever, everything depends on Brexit and where things stand after 31 October.