UK: Inflating the risks?

Inflation is likely to hit 2.8% but with Brexit uncertainty unlikely to fade, we doubt a rate hike is round the corner

Inflation data for August is due tomorrow, and given the rise in petrol prices, it looks likely headline inflation will push up to 2.8% year on year from 2.6% in June and July. This is well above the Bank’s 2% medium term target but is within the +/1% band of tolerance. Core inflation, which excludes food and fuel, is likely to rise more modestly to 2.5% from 2.4%.

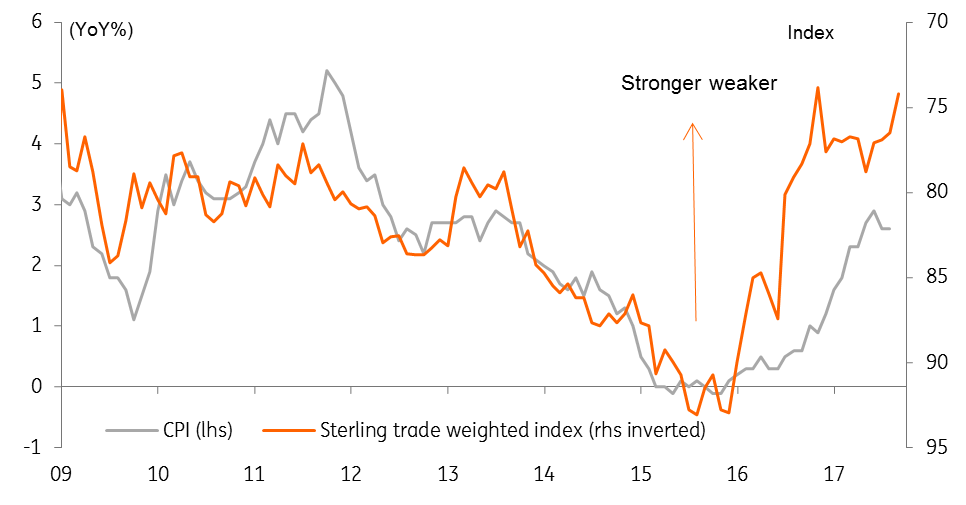

The 1.6% month on month increase in motor fuel versus a 1.3% drop in the same period last year means we are going to see a big swing in the YoY rate of inflation from this component. However, the primary factor responsible for above-target inflation rate remains sterling's weakness, which has pushed up the cost of imported goods and services.

The chart below suggests sterling’s fall is still to fully feed through, implying that headline inflation could rise further.

Sterling weakness to push inflation higher

However, the relationship with PPI suggests there is less to fear and indicates the relatively subdued economic environment for growth means that corporates are having to absorb some of the higher import costs in their profit margins.

Domestically generated price pressures remain weak, as highlighted by modest wage growth. Indeed, the squeeze on household spending power is a key reason why the economy is currently experiencing such slow GDP growth.

This means that the economy is likely to be operating with spare capacity. Add in the Brexit related uncertainty, which won't fade anytime soon given the noises coming from London and Brussels, and it seems to us that the most likely path for central bank policy is one of stable interest rates.

Download

Download snap