The US’s strong start continues

We had been nervous that reduced people movement in response to the Omicron wave of the pandemic would be the prelude to economic weakness in the first quarter. This has simply not been the case with today’s stunning construction data and solid ISM report adding to the positive news already seen regarding jobs, consumer spending and manufacturing orders

Construction surges on all fronts

Today data flow has delivered more evidence that Omicron has had a negligible impact on the US economy. After really strong consumer spending, durable goods orders and jobs data in January, we now have stellar construction spending numbers and a very solid ISM manufacturing report for February.

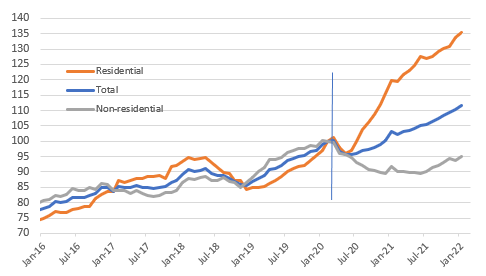

Construction spending jumped 1.3% month-on-month in January plus there were 0.6 percentage points of upward revisions, which is far stronger than the 0.1% MoM expected by markets. Both residential and non-residential spending increased by the same 1.3% with residential construction now 35.5% above the pre-pandemic peak of February 2020. The plunge in mortgage rates stimulated demand with inventory levels plunging and property prices surging. Residential construction continues to play catch-up to fill the gaps.

US construction spending (Feb 2020 = 100)

Non-residential construction is still down 5% on pre-pandemic levels. Lodging (hotels) are down particularly heavily (-24.5% year-on-year), which is understandable given the hit to tourism and business travel while public safety is also weak (-35.4%), presumably as local government budgets felt the squeeze. However, there are encouraging signs for office and commercial, despite the move to hybrid working. Meanwhile, manufacturing-related construction activity is booming (+31.4%), presumably as US companies seek to build more resilient, more domestically orientated supply chains.

We remain upbeat on construction, but see a stronger bias towards non-residential construction spending in coming quarters given mortgage rates have risen sharply and this is already prompting a drop-off in mortgage applications. Strong investment intentions amongst US corporates point to non-residential continuing to make rapid progress.

ISM highlights full order books and ongoing pricing power

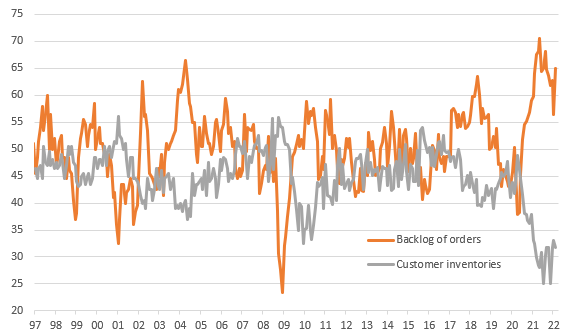

Then there is the encouraging ISM report for February with the headline index rising to 58.6 from 57.6 (consensus 58.0) and new orders at 61.7 versus 57.9. The employment component slipped to 52.9 from 54.5, but it is still at least in expansion territory. Prices paid remain elevated at 75.6. Indeed, inflation pressures are likely to remain elevated with customer inventories falling rapidly again (anything below 50 is a contraction), while order backlogs are rising again. This suggests that US manufacturers continue to hold significant pricing power – they have months and months worth of orders on their books and they know customers are desperate so they can easily pass on higher costs to customers.

ISM order backlogs and customer inventories suggest manufacturers have pricing power

Powell to make the case for higher interest rates

As such, the economic data justifies higher interest rates and we will be revising our 1Q GDP growth forecasts from close to zero to around 1.5% annualised. Russia's actions in Ukraine do argue for some caution and a 50 basis point hike does look a step too far, but 25bp in March looks valid and we expect Fed Chair Jerome Powell to continue backing the call at his monetary policy testimony to the House tomorrow. Indeed, an economy that looks set to grow by 3.5% this year, with an unemployment rate of 4% and inflation running at 40-year highs can tolerate much higher interest rates.

Download

Download snap