The Commodities Feed: WTI/Brent spread pressure

Your daily roundup of commodity news and ING views

July WTI/Brent Spread (US$/bbl)

Energy

US weekly inventories: The EIA reported yesterday that US crude oil inventories increased by 5.43MMbbls over the last week, which very different from the 1.2MMbbls draw the market was expecting, but less than the 8.63MMbbls build the API reported the previous day. This large build came despite the fact that refiners increased their utilisation rates by 1.6 percentage points over the week to 90.5%- the highest utilisation rate seen since early February. Despite increased refinery activity, gasoline inventories declined by 1.12MMbbls over the week, compared to expectations of a small build. Crude oil imports increased by 919Mbbls/d over the week to average 7.61MMbbls/d.

Crude oil inventories in Cushing increased by 1.8MMbbls over the week to total 47.8MMbbls- which is the largest stocks have been at the WTI delivery hub since December 2017. This crude build has weighed on the WTI/Brent spread, which is trading at more than a US$9.50/bbl discount. We expect this spread to remain under pressure.

IEA demand forecasts: In its monthly oil market report, the IEA revised lower its demand growth forecast for 2019 by 90Mbbls/d to 1.3MMbbls/d. This reduction was concentrated in 1Q, with demand growth lowered by 410Mbbls/d for the quarter. Weaker than expected demand was seen in Brazil, China, Japan, Korea and Nigeria. However the IEA does believe that demand will pick up as we move through the remainder of the year.

Moving away from demand forecasts, and to Middle East tensions, the Saudis reported that the East-West Pipeline in the country has restarted operations following a drone attack.

Metals

China alumina closures & Alunorte: A number of alumina refineries in Shanxi province in China have suspended operations amid environmental inspections. The outages have seen alumina prices in the region rally by 14% since mid-April to reach levels last seen back in December. A tightening in the domestic market does mean that we are likely to see China remain a net importer of alumina in the near term. Over 2018, China turned to a net exporter of alumina as a result of the strength in international prices.

Sticking with the alumina market, and the Federal Court in Belem Brazil lifted a production embargo on the Alunorte refinery yesterday under a civil lawsuit. However production will remain at 50% of capacity, as the refinery is still subject to an embargo by the court for a criminal lawsuit.

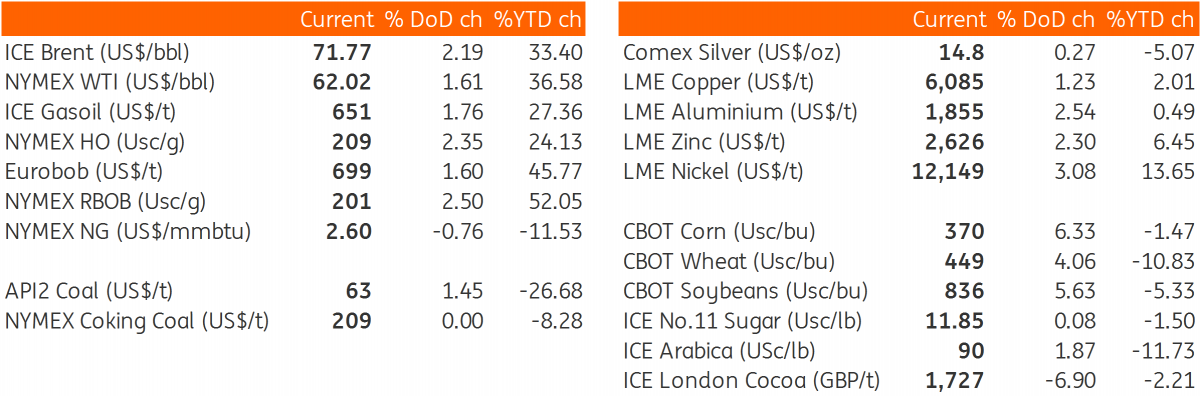

Daily price update

Download

Download snap