The Commodities Feed: Virus fears

Your daily roundup of commodity news and ING views

Energy

Risk-off sentiment continues in the energy market as the coronavirus spreads at an accelerated pace and fresh cases are reported outside China. ICE Brent slipped below US$60/bbl in the morning session, extending its fall to around 9% since the virus was first detected last week. Macro concerns over energy demand due to curtailed movement of people and trade have been weighing on an oil market that is otherwise tight due to ongoing supply concerns in Libya and OPEC+ output cuts.

CFTC data shows that money managers were very bullish on ICE Brent until last week. Managed money net longs were reported at 428,990 lots (+2,828 lots WoW) on 21 Jan, levels not seen since October 2018. It appears that some of these longs have been liquidated over the past few sessions as demand expectations are dimmed in the short-term at least.

LNG prices in Asia dropped to a decade low of US$4/MMBtu. Ample supplies from the US and Australia amid soft demand are keeping the market well supplied. Freeport started commercial operations at Train-2 of its Texas LNG terminal earlier in the month and T3 is scheduled to start operations within the next few weeks. Bloomberg data shows that pipeline receipts at LNG terminals in the US increased to a record high of 9.5Bcf/d last week, compared to an average of 7.8Bcf/d in December 2018. The majority of this LNG is likely headed for the Asian and European markets, creating further gas surplusses in these markets.

Metals

Base and ferrous metals drifted lower this week. Demand concerns linked to the virus spreading continue to weigh on economic activity. Also putting pressure on the metals market is the stronger US Dollar, with the USD index rising to a 1-month high of 97.9 as demand for safe-havens increases. LME copper was trading at around US$5,830/t at the time of writing, down 8.3% from its peak earlier in the month. Nickel slipped below US$13,000/t. SGX iron ore prices dropped more than 10% over the week to trade at US$85/t in the morning session, reflecting growing uncertainty over steel demand.

Industrial activity in China could be slow over 1Q20 due to the extended Lunar New Year holidays (now due to conclude on 2 Feb, extended from 30 Jan) and slower pickup later due to continued restrictions on movement if the virus threat persists. Turning to the US market and the Trump administration has expanded sec 232 tariffs on steel (25%) and aluminium (10%) to some downstream products, including nails, staples, and electrical wires.

Precious metals performed have been performing well as traders and investors increase allocation to safe-haven assets. Gold recovered to US$1,580/oz. Bloomberg data shows that ETF holdings of gold have increased by over 1m oz since 16 Jan to 82m oz currently and now only marginally below the recent peak of 82.3m oz in November 2019. Looking ahead, the US Fed is meeting this week and our economics team expects it to keep rates unchanged for now. Risks remain skewed towards lower interest rates rather than higher ones later in 2020.

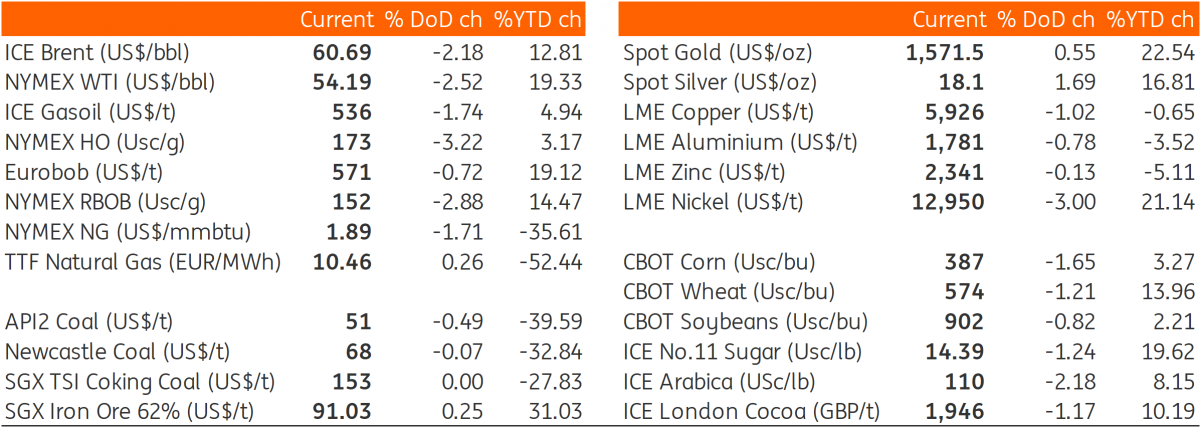

Daily price update

Download

Download snap