The Commodities Feed: US drilling slowdown

Your daily roundup of commodity news and ING views

US drilled but uncompleted wells

Energy

US crude oil inventories: The API is scheduled to release its weekly inventory numbers later today, and market expectations are that US crude oil inventories increased by around 2MMbbls over the week, according to a Bloomberg survey. On the product side, draws of 2.55MMbls and 1MMbbls are expected for gasoline and distillate fuel oil, respectively. Moving forward, refinery utilisation rates should pick up, which should see a reversal in the large draws that we have seen on the product side recently. In fact, US gasoline inventories have fallen back below the five-year average, which has been supportive for the gasoline crack.

US drilling productivity: The EIA's monthly Drilling Productivity Report estimated that US shale output will increase to 8.46MMbbls/d, up from an estimated 8.38MMbbls/d in April. Meanwhile, the EIA reported that the number of drilled but uncompleted (DUCs) wells fell by four over March to total 8,500. This is the first month-on-month decline in DUCs since March 2018. Drilling activity did slow over March, with the number of active oil rigs falling by 27 over the month. This slowdown appears to reflect the price weakness seen over late 4Q.

Metals

Iron ore supply: Steelhome data shows that Chinese iron ore port inventory fell 3.4% week-on-week to 143.9mt, the biggest weekly decline in nearly four years as Brazilian supply declines. Brazil’s Ministry of Trade and Commerce says that iron ore exports from the country fell to 0.75mt per day over the first ten days of April compared to last year’s 1.23mt, reflecting the Vale declines. Meanwhile, Rio Tinto has also lowered its guidance on iron ore shipments due to cyclones and a fire at one of its facilities. The company now expects shipments to come in between 333-343mt, compared to their previous forecast of 338-350mt. These supply disruptions are likely to continue offering support to iron ore prices.

Agriculture

US export inspections: Latest data from the USDA shows that over the last week, 461kt of US soybeans were inspected for export, down from 889kt in the previous week. Of the volume inspected over the week, 130kt is destined for China. Cumulative US soybean export inspections total 30.6mt, compared to 42.4mt at the same stage last season. Meanwhile, corn export inspections over the week totalled 1.18mt, up from 1.06mt in the previous week.

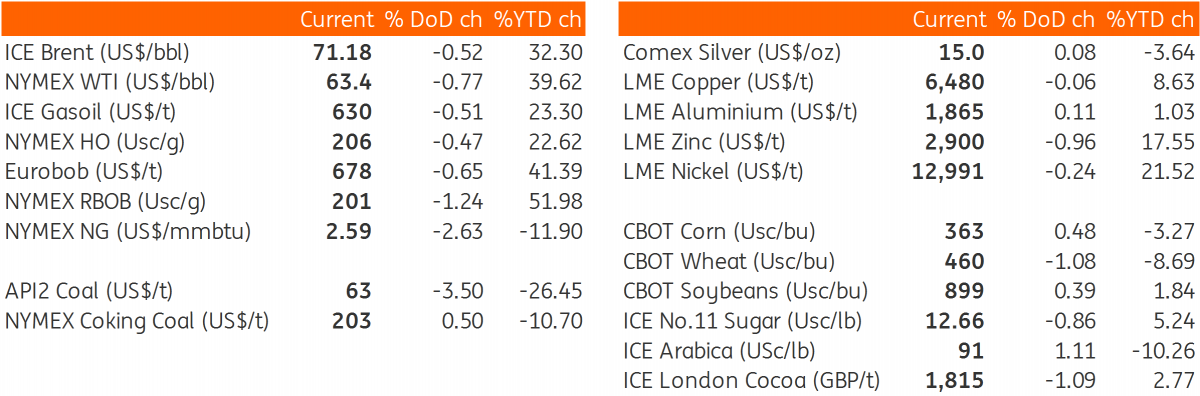

Daily price update

Download

Download snap