The Commodities Feed: US draws & OPEC+ cuts

Your daily roundup of commodity news and ING views

Energy

Trade developments once again hit sentiment across markets yesterday, and it was no different for oil. President Trump suggested that a trade deal with China may only come after the election, and this has increased fears that the US could go ahead with imposing further tariffs on China on the 15 December.

Focusing on oil developments, and yesterday the OPEC+ Joint Technical Committee (JTC) met in Vienna ahead of the full ministerial meetings on Thursday and Friday. Reports suggest that deeper cuts were not discussed at the meeting, while compliance between OPEC+ members over October was reportedly 140%. Reports also suggest that the JTC is looking into Russia’s request to exclude condensate from its oil production cuts. Meanwhile, the Iraqi oil minister has once again suggested that OPEC+ will look at possibly deeper cuts and does not believe other members will be an obstacle to doing so. If all members were compliant with the deal this may be the case, however, with a number of members falling well short in cutting output, including Iraq, other members may be reluctant to cut further. The reassurance of stronger compliance will likely be needed before other members agree to deeper cuts.

Between trade and OPEC+ noise, the usual weekly US crude oil inventory numbers have fallen between the cracks for many in the market. However, API numbers reported yesterday were fairly constructive, with US crude oil inventories falling by 3.72MMbbls, which was more than the 1.5MMbbls draw the market was expecting (according to a Bloomberg survey). While on the product side, builds of 2.93MMbbls and 794Mbbls were reported in gasoline and distillate fuel oil respectively. These numbers suggest that refinery run rates picked up over the week, a trend that we would expect to continue, as refineries ramp up production following the turnaround season. The more widely followed EIA report will be released later today, and while the report may lead to an immediate price response, we believe attention will soon turn back to the OPEC+ meeting and any further news on the trade front.

Metals

Trade has once again dictated price action, hitting risk appetite yesterday. This has unsurprisingly been fairly supportive for gold, which settled a little over 1% higher yesterday, leaving it at levels last seen in early November. The shift in narrative, from ‘optimistic’ to ‘cautiously optimistic’ has seen a move back towards safe-haven assets. This has broken (or at least paused) a trend that we had seen over the last 3 months, where growing optimism, saw gold prices falling by around 6%, the speculative net long shrinking by around 30% from its peak, and gold ETF holdings declining from a little over 82moz in early November to 81moz currently. Assuming we do not see progress in trade talks before the 15th December, gold is likely to see a strong end to the year.

Turning to base metals, and the same developments could prove to be rather gloomy for the complex, with tariffs likely to weigh further on global industrial and manufacturing activity. The LME complex finished the day deep in the red, with nickel settling almost 2.5% lower, while copper was down almost 1.2% at the close. Meanwhile, China issued the 15th batch of copper scrap import quotas on Tuesday, which came in at 7,970 tonnes. This takes total quota issuances to around 561kt so far this year for higher quality scrap. The quota batches have been consistently decreasing throughout 2H19, along with reduced import arrivals according to customs data. This has partly helped to narrow the discount between recycled copper and cathode. Looking ahead, it’s difficult to predict what will happen next for scrap, as the market awaits answers to copper scrap's 'identity issue', and whether it should be redefined as 'rubbish' or 'resource', along with the policy that will define the future landscape for scrap imports into China.

Agriculture

Finally, turning to the sugar market, and there was some good news for the bulls yesterday, with the Indian Sugar Mills Association reporting that cumulative sugar production for the 2019/20 season in India through until the end of November stood at 1.89mt, down 54% YoY. While the poorer number does reflect some mills starting the crushing season late, expectations are that Indian sugar production in the 2019/20 will see a significant decline YoY. ISMA’s latest output estimate for the current season is 26.9mt, down 19% YoY. This number could end up being closer to 26mt, taking into consideration ethanol diversion. While lower output from India will help to shift the global market from a surplus to deficit, there is still plenty of domestic stock overhang, which will continue to threaten the world market. Therefore we remain modestly constructive on the sugar market.

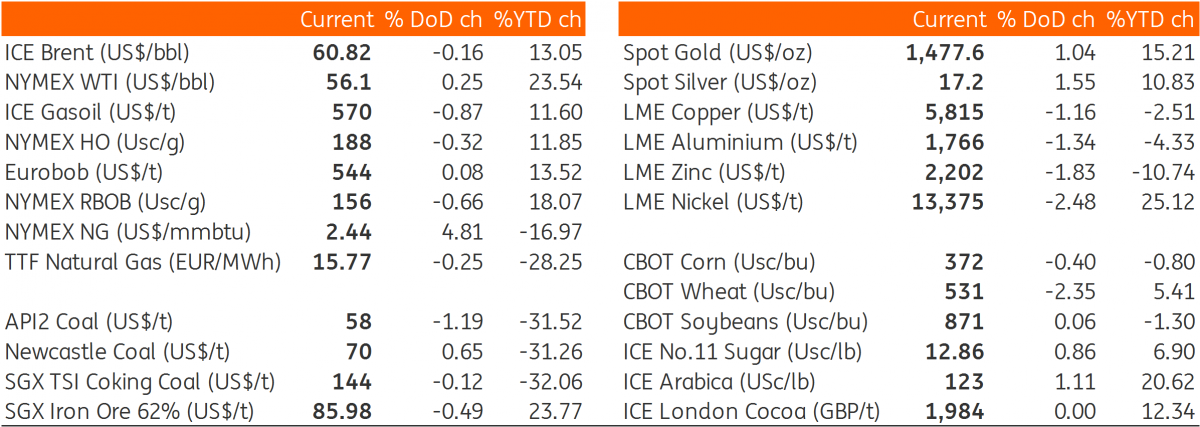

Daily price update