The Commodities Feed: Renewed trade concerns weigh down metals

Your daily roundup of commodity news and ING views

Energy

US oil stocks: Ahead of the API crude oil data later today and the EIA report tomorrow (it’s been delayed by one day), markets expect that US crude oil inventories increased by 1.5MMbbls over the last week, according to a BBG survey. The expectations of an inventory build in the US and uncertainty over the OPEC+ strategy on output cuts and US/China trade deal are weighing on oil prices. President Trump’s speech at the NY Economics Club did not provide any new perspective on the progress of a trade deal and hinted that higher tariffs are likely if a deal were not reached soon.

For products, the BBG survey sees gasoline and middle distillate stocks falling 1.5MMbbls and 1MMbbls respectively due to seasonally low refinery utilisation. The IEA will be releasing its monthly oil market report on Friday and that will be watched closely for its oil demand outlook. Last month, the IEA revised down oil demand growth forecasts for both 2019 and 2020 by 0.1MMbbls/d to 1MMbbls/d and 1.2MMbbls/d respectively on economic slowdown concerns.

Metals

Metals weighed by renewed trade concerns: Base metals continued to extend losses during London trading sessions on Tuesday, waiting for further signals from President Trump's scheduled speech at the Economic Club of New York. However, as we note above, there weren't many clues as to future progress and the markets continued to slide further on Wednesday morning. (See No clues on trade)

As for copper, short term supply risks returned after a news report on Tuesday that miners at Codelco's northern copper mines were impacted by strikes. There are few details, but copper repaired some losses during the later trading session yesterday. Nickel's Indonesia narrative has not yet ended. Just after officials granted ore shipments, 26 miners from Indonesia on Tuesday decided against exporting nickel ore and instead agreed to sell ore with a nickel content of less than 1.7% to domestic smelters at around $30/tonne. This has added renewed uncertainty to Indonesia's ore exports for the rest of this year.

As the heating season starts in northern China, there have been growing expectations of supply curtailments, particularly in the steel sector. The authority has just released an air pollution action plans for the 2019-2020 winter targeted to the Yangtze River delta and the Fenhe and Weihe plain. The plan aims to put strict limits on fine particulate matter (PM2.5). There's uncertainty, however, about how this can be enforced as slowing economic growth raises concerns that such enforcement is too strict given industrial activities.

On the raw material side, the counter-effect to the expected iron ore demand is that Vale trimmed its pellet sales guidance to protect margins. The company is expected to sell 307-312 mln tonnes (revised down the upper limit from 332 mln) and with Q4 sales to range from 83-88 mln tonnes.

For precious metals, platinum prices dropped to a 2-month low as the mineworkers’ union AMCU in South Africa reached a wage agreement with the mining companies after a four-month negotiation. That averts immediate supply disruption.

Agriculture

US export inspections and crop progress: The USDA data shows that the US inspected 1.33mt of soybean for exports over the week ending7 November 2019, marginally down from 1.48mt inspected over the previous week but still significantly higher than levels seen in 3Q19. China has been purchasing US soybeans as the trade discussions continue and that should support soybean demand in the country. Corn and wheat export inspections also improved on a weekly basis, though these do not show much improvement in the levels seen in 3Q19. Meanwhile, the weekly crop progress report from the USDA shows that soybean harvesting has been catching up fast, with 85% of the crop harvested to date, improving from 75% last week and only marginally down compared to 87% a year ago. Corn harvesting continues to be slow, with 66% of the crop harvested to date compared with 83% a year ago.

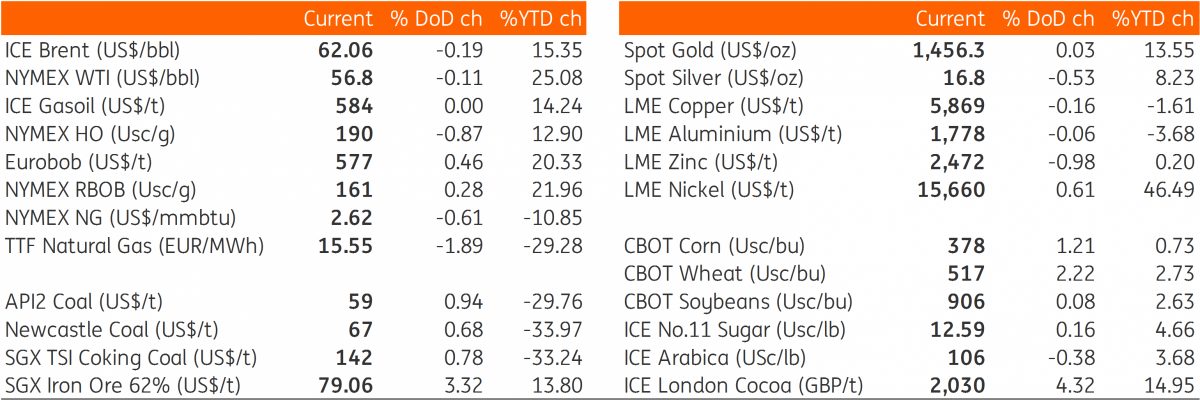

Daily price update

Download

Download snap